In brief:

- The shared services industry is transitioning beyond the back office to drive strategic value and core business support.

- 2025 shared services trends are focused on helping the industry reach a new level of maturity — spanning talent, technology, location strategies, and more.

- A shift toward hybrid models is boosting agility and resiliency — combining outsourcing and captives, nearshoring and offshoring, and remote and in-office workers.

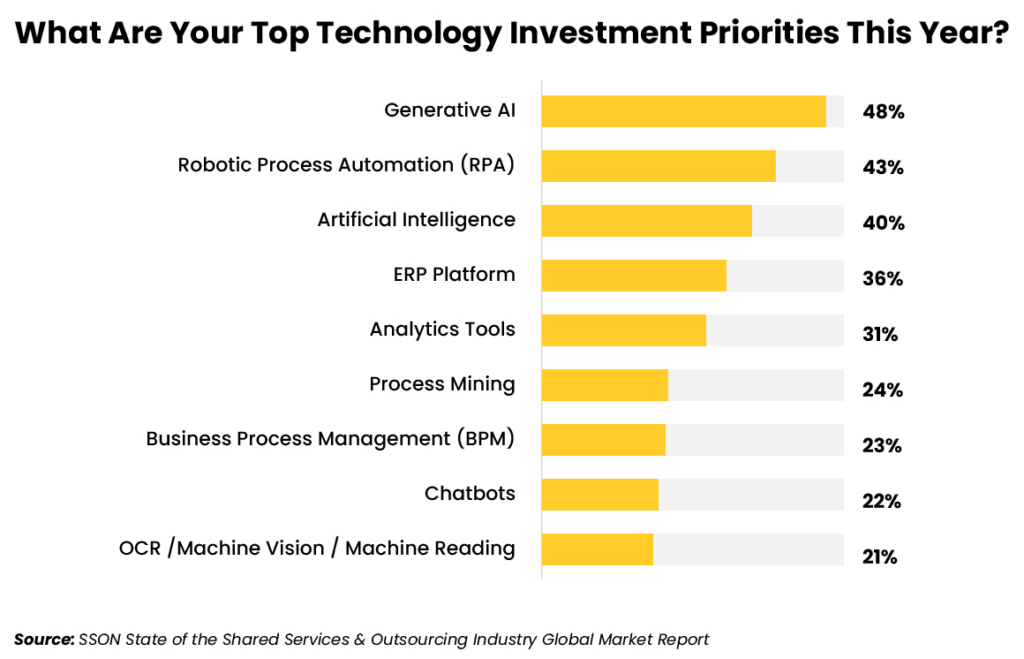

- Generative AI is the top tech investment priority, marking the first time a technology claimed the top spot after not appearing on the list at all the previous year.

Shared services, long a powerful solution for centralizing and standardizing transactional tasks, is being elevated as it navigates a new era defined by rapid advancements in AI and analytics, global interconnectedness, and shifting workforce dynamics. With a dual focus on delivering operational efficiency and strategic value now evident, shared services trends in 2025 are setting the stage for a new phase of maturity.

The future of shared services is not only designed to optimize costs but to support enterprise strategies, allowing organizations to pivot swiftly in response to a volatile and increasingly digital business landscape. Hybrid operating models are also taking center stage in multiple areas – boosting agility and resiliency by combining outsourcing and captives, nearshoring and offshoring, and remote and in-office workers.

But identifying the right opportunities isn’t easy – and challenges are inevitable as roadmaps to a new era are drawn.

Here’s everything you need to know about the key global business services (GBS) trends in 2025, leveraging findings from the latest State of the Shared Services & Outsourcing Industry Global Market Report by Shared Services & Outsourcing Network (SSON) Research & Analytics. From the role of AI to growing emphasis on nearshoring to the shift beyond the back office to true business enabler, these GBS trends will help you understand the transformational changes taking place – and emerge better positioned for sustainable success on the other side.

1. Cost reduction remains the #1 GBS driver, followed by service excellence

In today’s fast-changing business environment, establishing an agile, efficient, cost-effective back office is paramount. And as enterprises move to optimize productivity, operations, and overhead, the GBS industry is well-positioned to play an essential role – reaching 7,000+ captive centers and 3,000+ outsourced centers globally, according to SSON data.

But at the same time, a 2024 Boston Consulting Group (BCG) study found less than half (41%) of companies believe shared services creates value. And while just over half of shared services leaders believe their organization has advanced to a medium level of maturity, only a quarter believe they are at an advanced stage, the SSON industry report states.

“The leaders of these support functions must raise their game at a time when companies around the world face unprecedented challenges in how they operate,” the BCG report asserts. “Marginal adjustments to GBS strategy are no longer sufficient.”

Nearshore vs. Offshore: Navigating the Hidden Hassles of Outsourcing to Asia

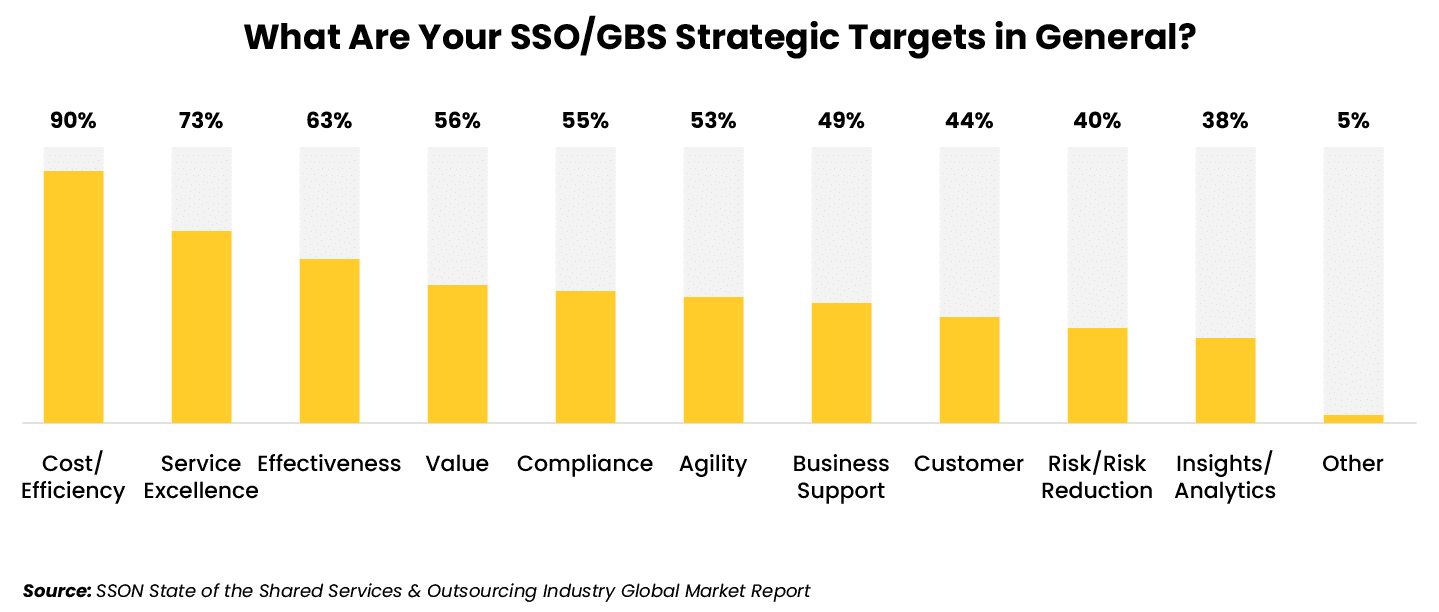

In this environment, streamlining operations to reduce costs remains the #1 shared services driver, cited by 90% of organizations in the SSON report. Enhancing service quality and delivery (73%) and ensuring processes and workflows drive measurable outcomes (63%) are also top of mind as enterprises realize that centralization doesn’t automatically equate to service excellence and better customer experiences.

But what’s most notable this year is that “value” (56%) edged out “compliance” (55%) to complete the top four targets, underscoring shared services’ new focus on driving operational efficiency and strategic value.

Enterprises are increasingly looking to shared services organizations (SSOs) to function as true business partners – boosting efficiency, agility, and performance by creating a customer-centric approach, optimizing operations, automating processes, and providing real-time strategic insights that drive ongoing success.

2. Emphasis on value drives shift toward more complex and front-facing processes

“Creating value” also ranks highest among customer priorities, with 54% of shared services leaders overwhelmingly agreeing that the ability to drive value realization earns the greatest show of appreciation from their customers, the SSON report found.

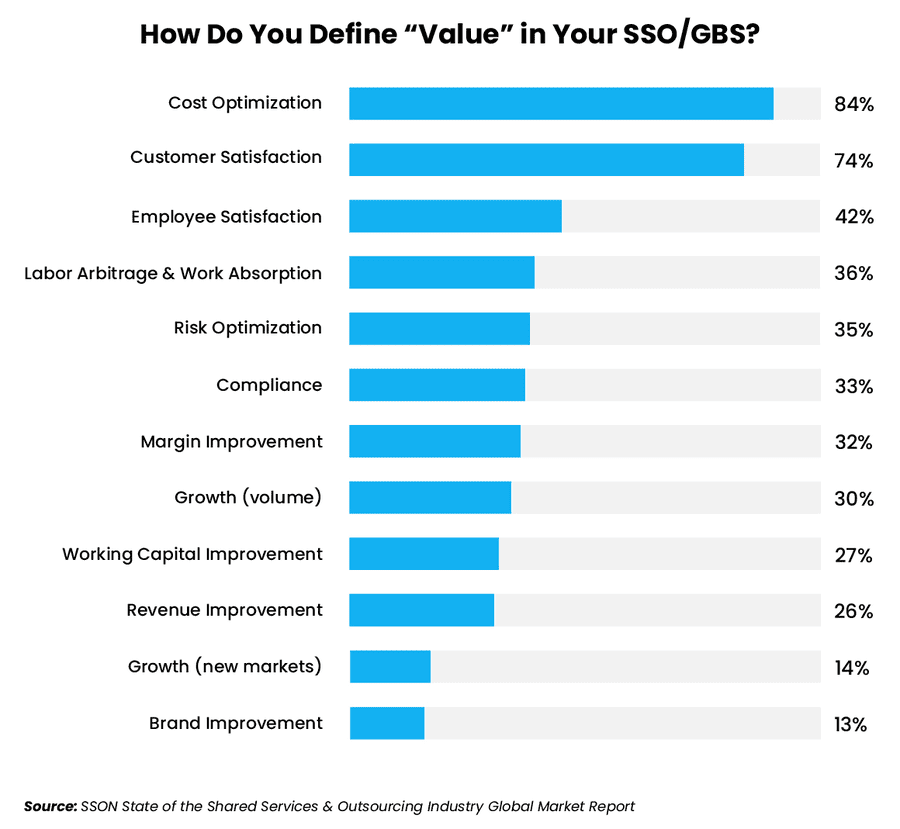

But while value is often touted as the key differentiator between advanced global business services and the rest of the shared services industry, what does creating value really mean?

For most SSOs, cost optimization ranks supreme – a natural fit, given the long-held enterprise view of shared services as a cost-cutting tool. However, 74% of shared services leaders point to customer satisfaction and 42% cite employee satisfaction – including two of their core stakeholders in their meaning of value.

More than a third defined value by labor arbitrage and work absorption, which is also expected — emphasizing the core shared services driver of removing and optimizing costly operations. A similar segment recognized risk optimization, speaking to benefits like new talent pipelines and diversified location strategies.

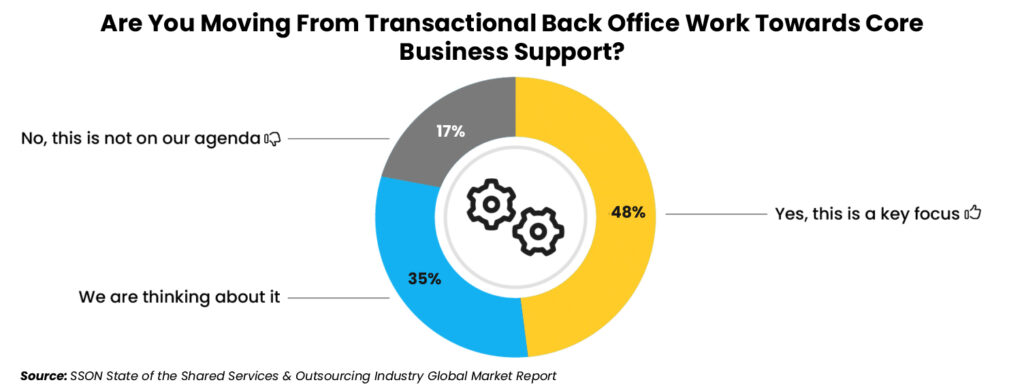

This greater emphasis on value supports shared services’ expansion from traditional back-office work to core business support, with nearly 50% of shared services leaders committed to delivering more decision support, research, and end-customer-facing activity in their operations.

Another 35% are considering moving in this direction, up from 29% last year. Only 17% are not planning to change, down from 22% last year.

Changing reporting structures also indicate the higher level of value placed on SSOs. More than half now report directly to the CFO, reflecting a heightened emphasis on financial alignment and strategic oversight, the SSON report states. Overall, 76% of SSOs now report to the C-suite, up from 65% last year.

“GBS risk becoming obsolete if they remain solely focused on back-office functions,” the SSON report asserts in an executive perspective. “To become even more relevant, it will be essential for our people to leverage technology effectively and seamlessly integrate into core business operations to provide strategic value.”

3. Global Business Services is the preferred operating model

A global business services approach fosters innovation through shared expertise, cross-functional data, and advanced technologies — positioning businesses for sustainable growth in an increasingly connected world. With centralized leadership and a global scope, GBS provides a more comprehensive solution for managing business operations – supporting more functions, performing higher-value services, and serving a greater geography than traditional shared service centers (SSCs).

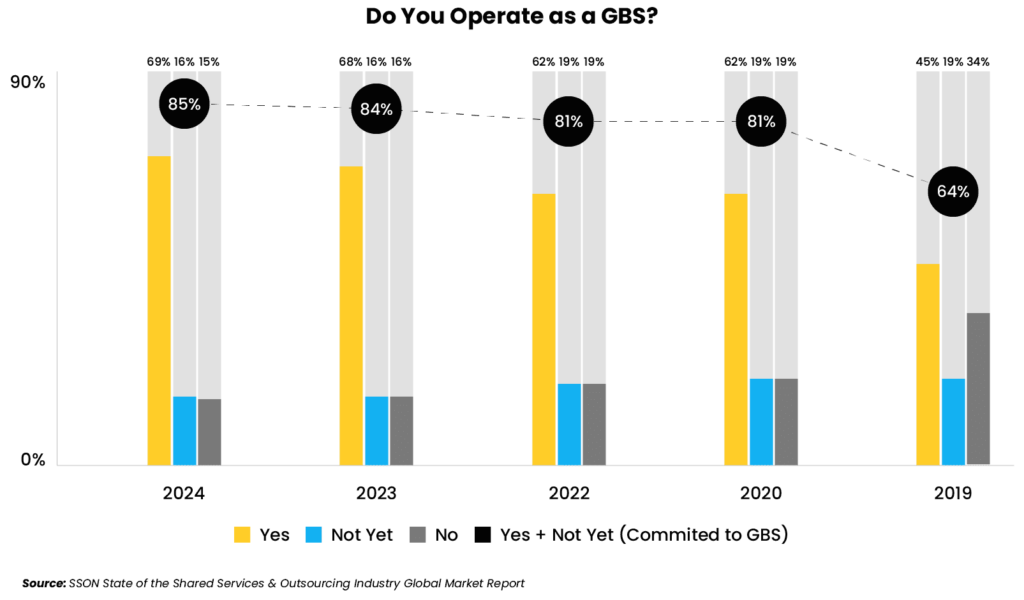

The SSON report highlights the continued shift up the maturity curve toward GBS as the preferred operating model, with 69% of SSOs either operating as GBS or actively working toward it. Another 16% plan to adopt a global shared services model within the next five years.

Put simply, 85% of SSOs are embracing the GBS model, demonstrating a resounding preference for integrated and enterprise-wide approaches to service delivery.

This shift is underscored by changing naming conventions, which show a growing trend toward monikers that speak to global reach, greater value, and alignment with business goals.

Forty-three percent of SSOs now use the term “Global Business Services” or “Global Business Solutions,” communicating their evolving capabilities to internal and external stakeholders. Just over 30% prefer “Shared Services,” reflecting the traditional role of consolidating functions for efficiency and cost reduction.

4. Scope expansion tops agendas

Scope expansion ranks high on the list of GBS trends, with 77% of SSOs planning to increase their services and 45% planning to widen their geographic reach in 2025, SSON reports.

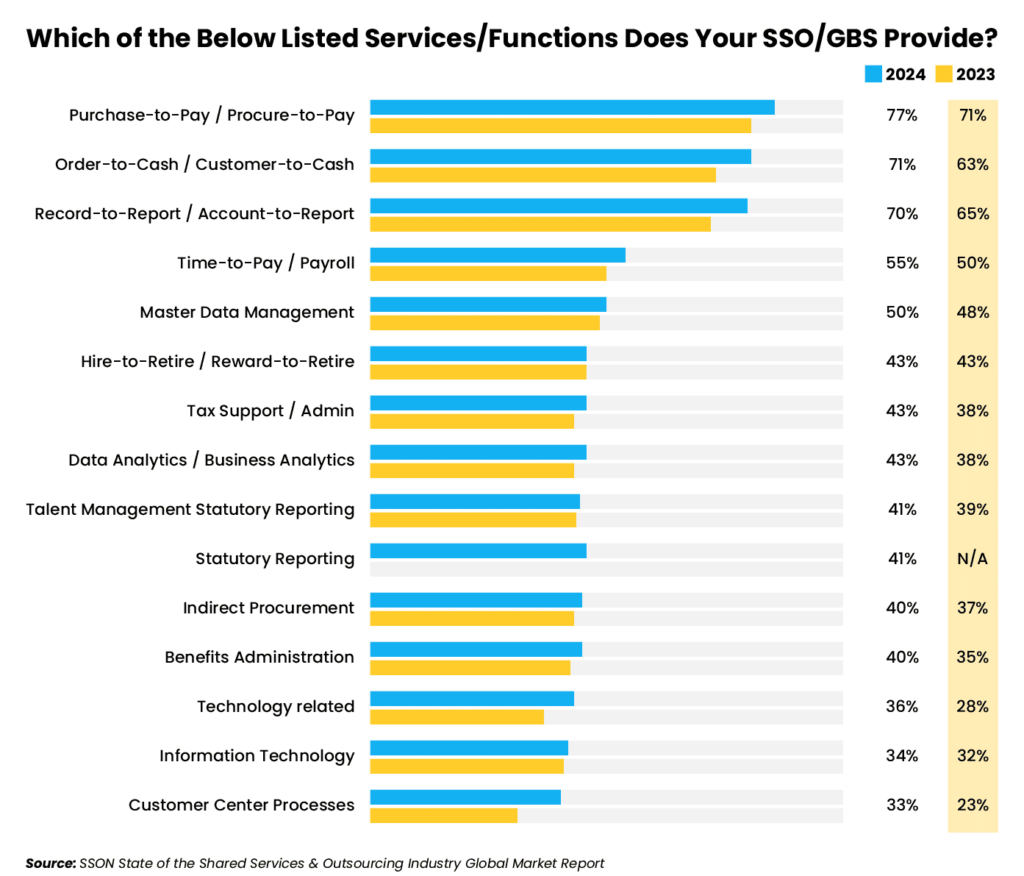

The shared services “Big Three” – Finance, HR, and IT – remain foundational, with procure-to-pay (offered by 77% of respondents), order-to-cash (71%) and record-to-report (70%) continuing to form the backbone of most shared services operations.

But the SSON report also shows significant growth in more strategic and complex areas like data analytics (performed by 43% of SSOs) and master data management (50%) as SSOs look to generate greater value. There is also continued expansion in services like tax admin support (43%), statutory reporting (41%), tech-related services (36%), and call center/front office support (33%).

U.S. labor shortages and greater comfort levels with remote work are further prompting service demand to move beyond well-understood, standardized processes toward non-traditional, interaction-heavy, center-of-expertise functions like engineering and research & development. Combined, these new initiatives reinforce the model’s shift from labor arbitrage-focused back office to strategic business partner.

The chart below shows the top shared services functions performed by SSON survey respondents, with the complete list available in the SSON report:

5. The search for best-available talent continues to drive multi-location models

Shared services leaders continue to refine their global footprint, with the trend toward multiple locations considered a key strategy for overcoming labor challenges and accessing the best talent based on the strengths of different regions — or even cities within the same country. A multi-location approach keeps organizations globally resilient, allowing GBS leaders to rebalance workloads as needed based on geopolitical climate and other market conditions.

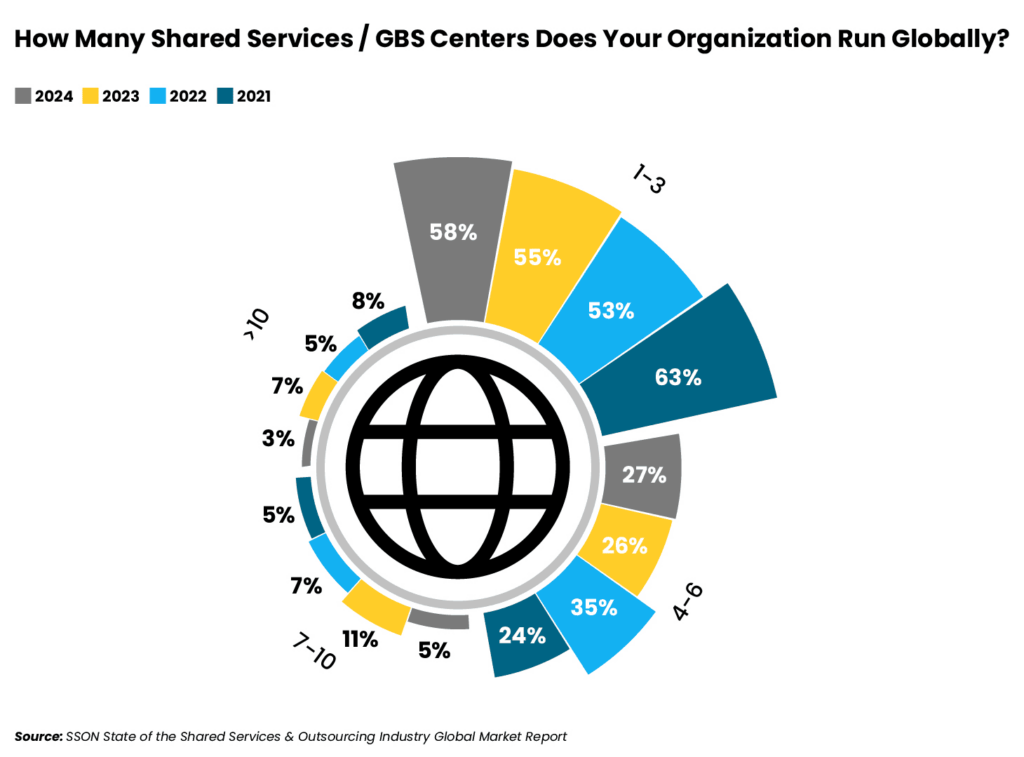

Nearly 60% of SSOs operate 1–3 centers globally, while 35% operate at least four, the SSON report found. Nearly 30% say they have increased their number in the past two years, and 25% plan to expand further in 2025.

Staffing levels vary widely, with some global business services examples employing less than 250 FTEs across their entire organization and others maintaining 10,000+, the SSON report found.

This trend toward multi-locations coincides with what we are seeing with our clients at Auxis. Many organizations that used to support the Americas from one Latin American country (e.g., in Costa Rica), are now opening hubs in multiple countries within the region (e.g., Mexico, Colombia) to access a lower-cost market or tap into a larger pool of talent or specialized skills.

On the 2024 State of the GBS & Outsourcing Industry in Latin America report conducted by SSON Research & Analytics and Auxis, 39% of organizations said they currently operate in two LATAM countries or more – and 50% of organizations evaluating the region plan to set up operations in two or more countries.

6. Outsourcing demand increases, with talent trumping cost as the #1 driver

A steady 50% of SSOs rely on outsourcing to meet their targets every year, with about a quarter planning to increase their outsourcing volume in 2025.

Hybrid models combining captive (in-house) and outsourced teams are the most common shared services operating approach, utilized by 58% of organizations, the SSON/Auxis report found. Less than 40% of SSOs are fully captive, while 5% are fully outsourced to third-party shared services companies.

But the reasons for outsourcing are changing.

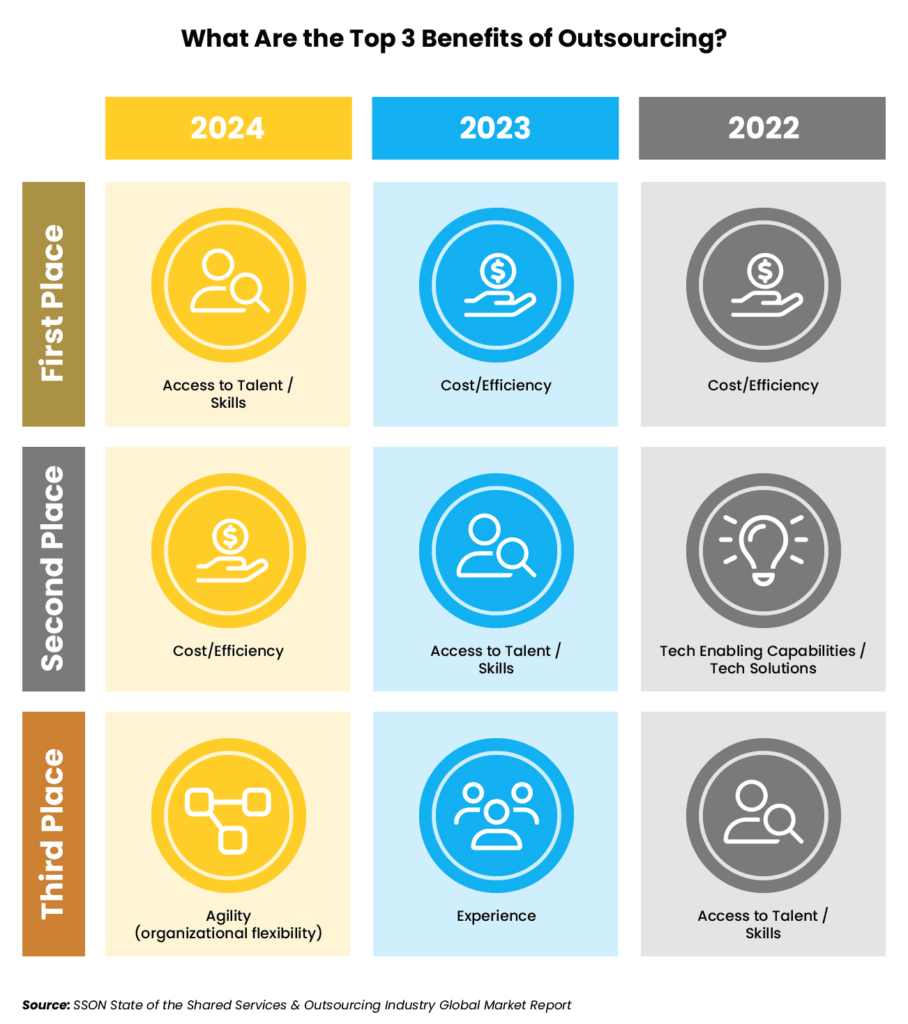

Amid ongoing labor shortages, “access to talent/skills” trumped “cost/efficiency” for the first time since the pandemic as the #1 outsourcing driver, cited by 63% of shared services leaders on the SSON global report.

Emphasizing these findings, “spend optimization” also fell to third place on the list of outsourcing drivers cited on Deloitte’s 2024 Global Outsourcing Survey. “Improved access to talent” claimed the top spot, followed by “increasing customer demands.” Only 34% of organizations identified “cost reduction” as a primary outsourcing driver in 2024, compared to 70% in 2020, the Deloitte report found.

Other top outsourcing benefits identified on the SSON report by more than half of shared services leaders included agility (56%), focus on service excellence (55%), greater value (54%), and more automation/tech-enabling capabilities (53%).

So, what’s the takeaway?

While spend optimization will always be a key outsourcing driver — especially for first-time outsourcers — finding opportunities to drive value and optimize performance are greater strategic priorities. That’s left SSOs looking beyond the lowest cost to choose partners who can help them build a robust pipeline of skilled talent, leverage AI and automation, enhance core capabilities, and boost their ability to quickly respond to changing market dynamics.

7. Nearshoring surges in popularity

Tholons’ 2025 Top 10 GCC/GBS Trends Report predicts 50% of companies will have adopted a hybrid sourcing model by 2026 that includes nearshoring, driven by the need for greater agility and resilience. That trend is supported by the Auxis/SSON report, which found 90% of GBS leaders either operate in Latin America or plan to within the next three years.

While traditional Asia-based locations remain a leading destination for low-value, transactional work at bottom-of-the-barrel prices, interest in nearshoring has accelerated in recent years as organizations look to mitigate risk by diversifying locations, navigate the headaches of Asia-based models, and leverage regional advantages such as time zone and cultural alignment with North American markets.

While salaries in Latin America are generally positioned between Asia and Europe, LATAM’s cost savings are still substantial, averaging 30-50%. And the ability of top nearshore markets like Costa Rica, Colombia, and Mexico to offer highly skilled talent capable of successfully delivering judgment-intensive processes that have proven difficult to support in Asia provides a compelling value proposition.

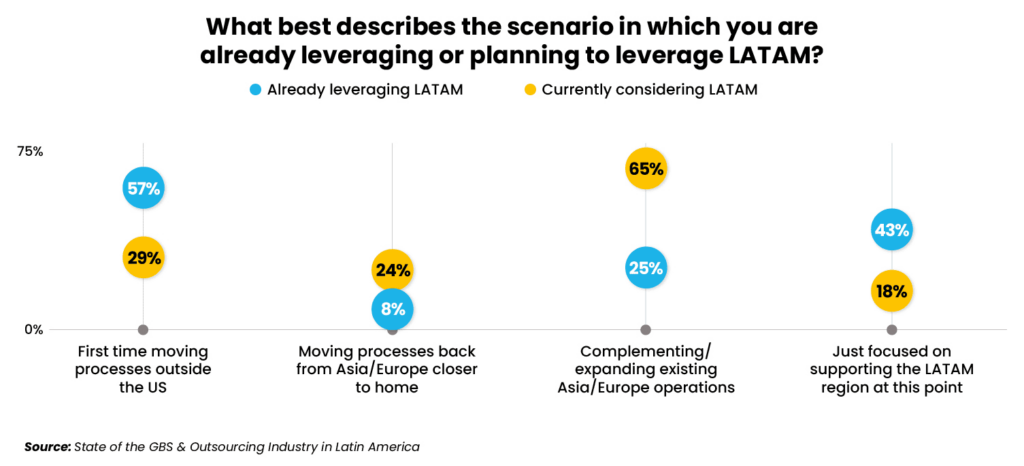

While most organizations (57%) already operating in LATAM were first-time outsourcers, 65% of those evaluating the region today are looking to complement or expand their existing operations in Asia or Europe, the SSON/Auxis report found.

Asia’s saturated job markets and notoriously high turnover are also chipping away at its cost savings and performance. India’s business process outsourcing (BPO) industry is expected to average 9.7% salary increases to combat alarmingly high attrition in 2025 – after rising 9.5% in 2024, according to WTW’s 2025 Salary Budget Planning India report.

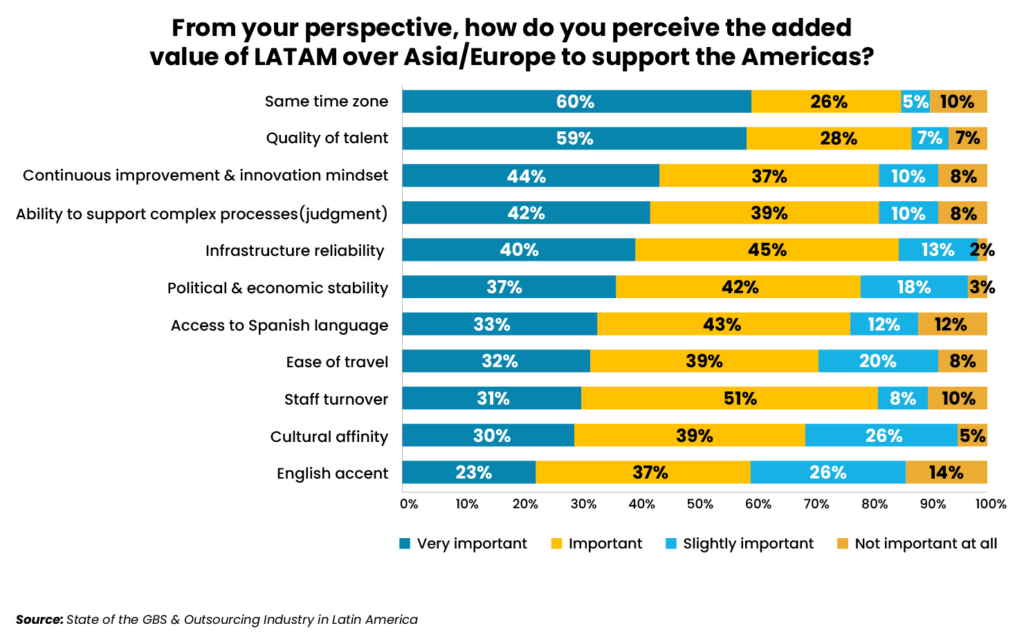

More than 60% of respondents to the Auxis/SSON survey ranked all the factors on the chart below as important or very important to LATAM’s value-add over Asia and Europe:

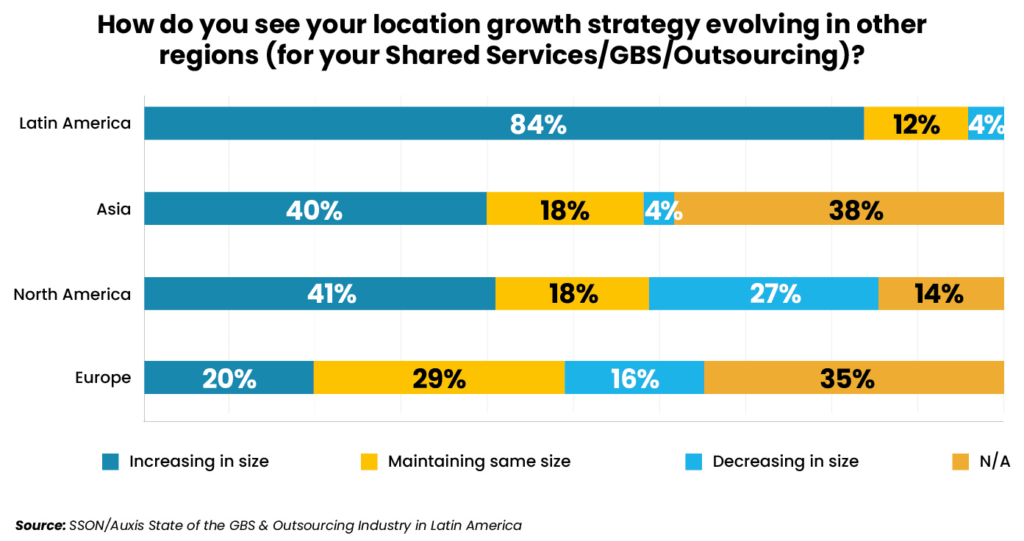

As a result, LATAM’s shared services and outsourcing industry is growing significantly faster than other regions, with 96% of its SSOs planning to expand or maintain its level of service, compared to 58% in Asia, 59% in North America, and 49% in Europe, the SSON/Auxis report found.

8. GenAI jumps to the top of digital to-do lists — after not even appearing last year

Digital innovation is transforming shared services organizations, with 90% acting as a core component of their company’s digital agenda, according to the SSON report. Most showcase their strategic value by participating in broader enterprise initiatives or serving as digital proofs of concept, with only 20% driving the agenda.

While Generative AI (GenAI) adoption previously lagged among SSOs, it is now the top investment priority – the first time a technology has gone from not appearing on the previous year’s list to ranking at the top.

As of Q4 2024, nearly 80% were using GenAI tools and more than half had rolled out strategic AI-driven process enhancements, the SSON report found. In 2023, only 10% of SSOs had deployed GenAI use cases.

More than a decade after it started appearing in SSOs, Robotic Process Automation (RPA) also remains a top investment priority, claiming the No. 2 spot. But while half of SSOs say they have reached a medium level of automation investment, only 20% consider themselves advanced and nearly a third rank their automation level as low – surprising statistics considering the long timeline.

Nearly all SSOs have also implemented some level of intelligent automation, but only about a third have reached an advanced stage that includes scaling, digitizing data, and deploying advanced capabilities.

Overall, SSOs are prioritizing investments in tools that promise impact on performance and can deliver measurable outcomes. Below are the biggest investment areas, with the complete list available in the SSON report:

The biggest automation wins have occurred in procure-to-pay and order-to-cash, which tend to be heavily standardized, the SSON report found. GenAI applications are emerging in areas like AI chatbots for customer support and intelligent document processing, with early adopters reporting faster service delivery (54%) and improved output quality (51%).

AI is also enabling shared services staff to better focus on strategic tasks, with 80% of shared services leaders noting enhanced employee experience due to reduced workloads and skill augmentation.

Organizations are further leveraging advanced technologies like process mining to identify bottlenecks, promote workflow, and drive faster decision-making. With an emphasis on expanding the scope of work in the year ahead, successful process optimization is key to quality service.

But while the transformative potential of GenAI for SSOs lies in automating processes, enhancing decision-making, and achieving deeper personalization, data management and skills gaps remain challenges for nearly 60% of shared services leaders.

As a result, organizations are increasingly turning to outsourcing to support their digital transformation journeys – with 60% leveraging existing partners to kickstart AI adoption and 57% developing new relationships based on AI-powered outsourcing, Deloitte’s report found.

9. Analytics holds the key to higher-value services

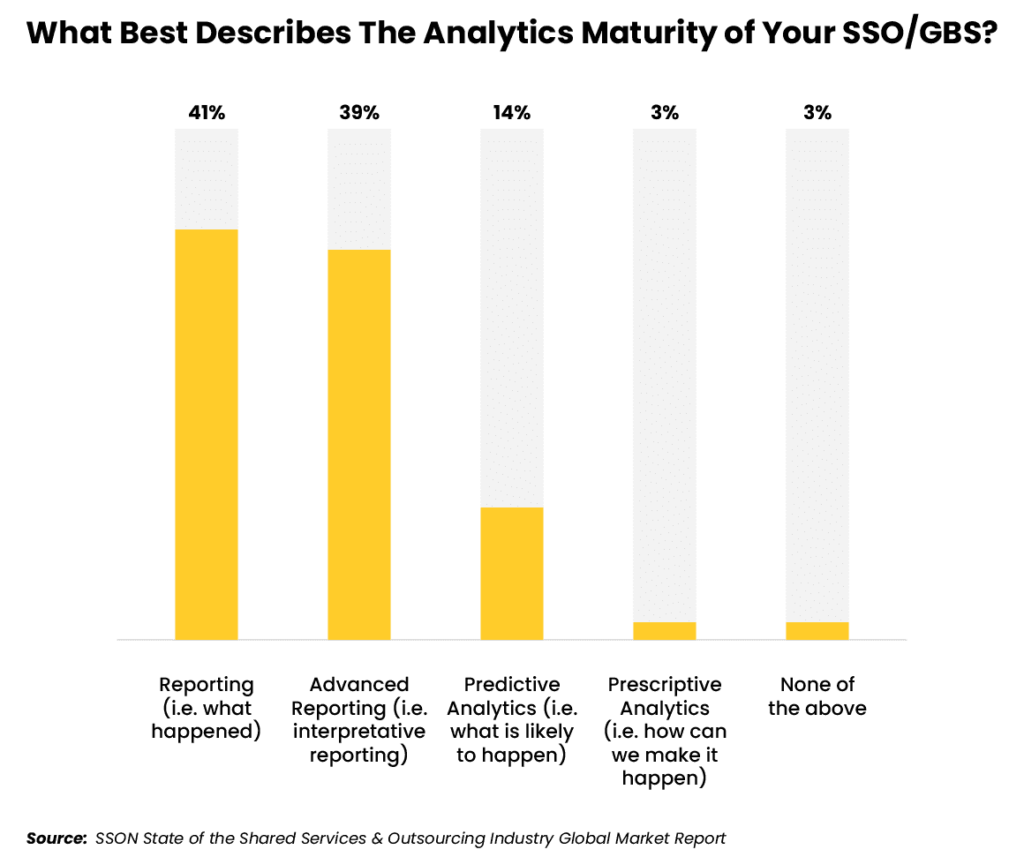

Mastering data and advanced analytical solutions is critical to creating new, higher-value shared services offerings. With the right capabilities, SSOs can quickly harvest actionable insights from the immense amount of enterprise data they handle – replacing gut-based actions with clear-eyed, agile decision-making that drives business success in today’s fast-moving environments.

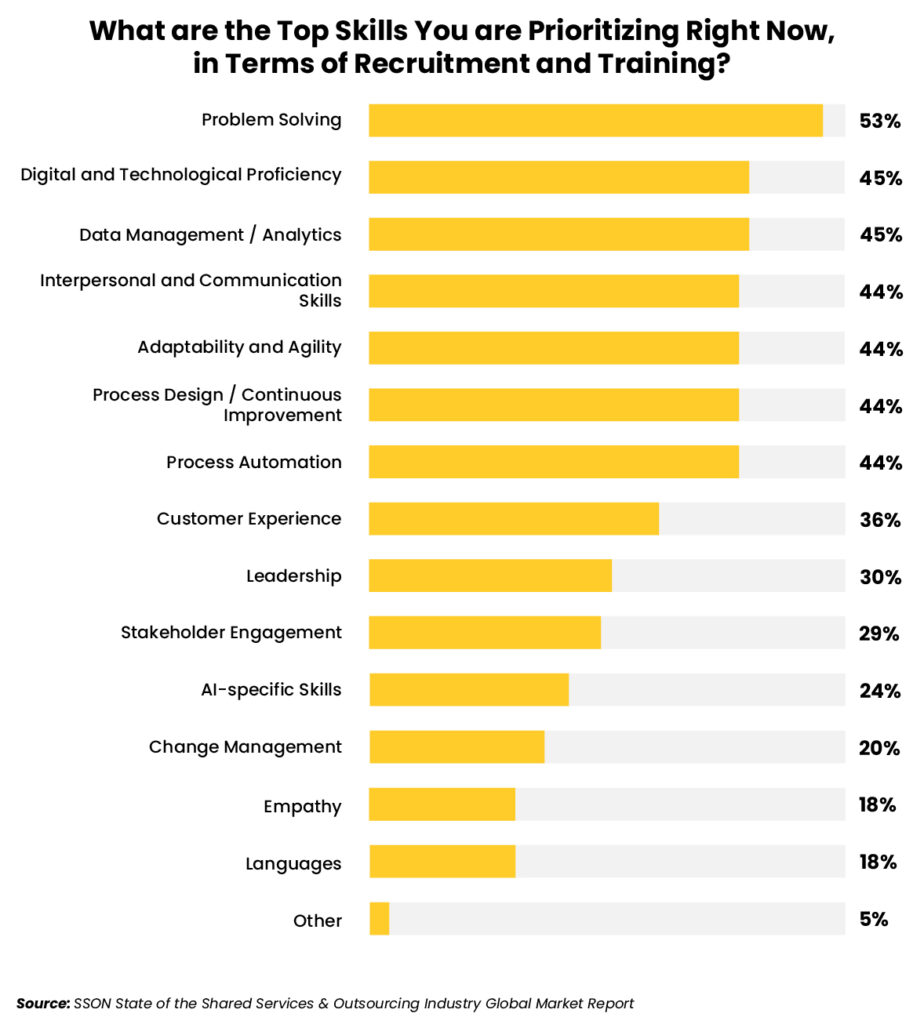

Analytics tools stood as the top digital investment priority for SSOs in 2024 and remain in the top five in 2025. SSO leaders also ranked data management and analytics skills as a top three priority for recruitment and training this year, the SSON report found.

As a result, 56% of SSOs have moved past historical reporting to reach advanced stages of data analytics: either interpreting, predicting, or prescribing what could or should be done to improve decision-making and performance.

Conventional areas that served as early proofs of concepts like procure-to-pay and order-to-cash are reaping the biggest benefits. Talent-related analytics such as identifying and upskilling are also delivering strategic value, as well as workforce analytics capable of optimizing employee productivity within shared services through data-driven insights used to streamline workflows, allocate resources effectively, and benchmark performance against industry standards.

10. Talent challenges lead to new recruiting strategies

Of course, tools and innovation can’t make an impact unless employees embrace the change and have the skills to leverage the technology. Sixty-three percent of shared service leaders ranked talent skills and capabilities over technology tools and solutions (60%) as the most critical factor to optimizing process performance, the SSON report found.

Problem-solving stands as the most in-demand skill for SSO staff in 2025 as enterprises increasingly shift judgment-intensive activities and AI-powered automation manages more transactional tasks – leaving SSO staff to focus on exceptions. Other prioritized skills span digital proficiency, data analytics, process design/continuous improvement, communication, and adaptability – driving value by identifying inefficiencies, streamlining workflows, implementing continuous improvement initiatives, and providing positive customer experiences.

However, finding and retaining the right skills at the right cost often remains out of reach in today’s red-hot labor market. An alarming 84% of shared services leaders believe Gen Z recruits will leave their positions within three years.

That’s made finding stable talent pipelines through alternative solutions like outsourcing more important than ever, as well as solving pain points like limited career progression, lack of flexibility, and inadequate compensation within SSOs.

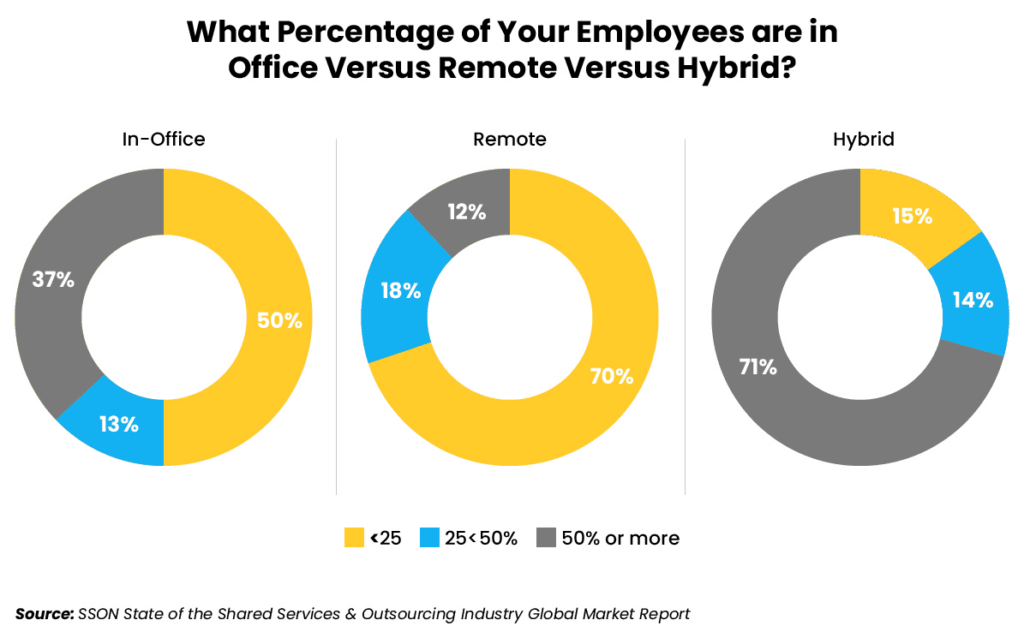

Hybrid work models remain the #1 priority for Gen Z talent, the SSON report found. And SSOs are responding in kind, with 71% indicating more than 50% of their workforce is hybrid. Similarly, 50% say less than 25% of their workforce is entirely in-office.

Changing recruitment strategies reflect this dynamic, with nearly half of SSOs adopting location-agnostic recruitment practices that provide access to a wider talent pool, and less than a quarter sticking with traditional, commuter-distance hiring models.

To attract Gen Z, companies are also broadening their talent acquisition channels to include social media, leveraging their company brand, and revising their employee value proposition to appeal to a more remote-based workforce that has also recently begun to place greater emphasis on jobs that offer skills training and certifications, career paths, and a tech-enabled environment.

Interestingly, less than 40% of SSOs view increased compensation and benefits as a key recruitment strategy as they balance finding the best talent with operating at the lowest cost.

The future of shared services combines value and efficiency

Despite recent buzz questioning its sustainability, 93% of organizations believe shared services works – and 61% think it will continue to increase in scope and impact, SSON reports. Only 1% plan to pull back their investment.

But there is no doubt the model must evolve – and as shared services leaders define what’s next, value creation and operational efficiency are the themes that weave through their top objectives.

“Customers come for the price but stay for the value,” the SSON report explains in an executive perspective. “Cost efficiency may be the entry point, but long-term, trust-based partnerships depend on the broader value GBS delivers.”

Technology and talent continue to top agendas as operators look to upskill staff and provide the right tools and solutions to reach their organization’s full potential. Shared services leaders are also realizing they must rethink jobs as automation and AI offer the potential to elevate the roles of human staff.

And as technology and talent evolves, they are adapting their operating models to better support modern capabilities – embracing new locations, more functions, and outsourcing solutions that help them transition from siloed, transaction-processing units to strategic business partners.

The widespread disruption the shared services industry has faced shows no signs of slowing down in the coming year. 2025 shared services trends reflect the resiliency and innovation that have allowed organizations to make their mark as a source of efficiency – and are now driving the shift toward true business enabler.

Why Auxis: Choosing the best path to sustainable success

The traditional global shared services model has reached a pivotal juncture as enterprises demand value beyond legacy contributions.

Efficiency and cost-effectiveness remain best practices. But global business services trends are also calling upon organizations to leverage the power of advanced technologies and modernized operating models to deliver higher-value insights, capabilities, and service delivery.

An exceptional shared services partner like Auxis is key to navigating your organization through the unique challenges and complexities of transformation. From turnkey outsourcing solutions to clear strategies for improving sub-optimal operations to robust digital transformation capabilities, Auxis delivers the people, processes, knowledge, and tools you need to confront the shared services industry’s crossroads and determine the best path forward.

Want to learn more about shared services consulting and nearshore outsourcing solutions? Schedule a consultation with our shared services leaders today! Or, visit our resource center to learn more shared services trends, strategies, and success stories.

Frequently Asked Questions

What are the top trends shaping the shared services and GBS industry in 2025?

+The top shared services trends for 2025 include a greater focus on creating strategic value; outsourcing for talent over cost; strides in automation, GenAI, and data analytics; and an increased reliance on nearshoring to prioritize regional proximity for real-time collaboration and reduced operational challenges. These trends highlight how shared services are evolving to meet growing demands while balancing technology adoption, workforce challenges, and operational efficiency.

How is the role of shared services changing?

+Shared services are increasingly shifting from back-office functions to strategic business enablers. Nearly 50% of organizations are expanding their scope to include decision support, research, and direct customer engagement. Additionally, 76% of shared services now report directly to the CFO, highlighting their growing strategic importance within organizations.

What is the difference between Global Business Services and Shared Services?

+Shared services focus on centralizing specific business functions such as HR, finance, or IT within a single organization to drive efficiency and cost savings. Global Business Services (GBS), which is now the preferred operating model, expands on this model by integrating multiple functions across different regions and business units under a unified governance structure - leveraging advanced technology, automation, and data analytics to enhance scalability, innovation, and strategic value. GBS operates as an end-to-end service delivery model with a broader, more global scope, while shared services typically focus on specific processes within a region or business segment.

What are the key benefits of nearshoring for shared services organizations?

+While offshore locations like India and the Philippines offer the lowest costs, nearshoring offers advantages like time zone, cultural, and language compatibility that make it easier to deliver processes that require higher communication or complexity. Countries like Colombia, Costa Rica, and Mexico are gaining traction due to their strong talent pools, competitive labor costs, and digital capabilities. These factors contribute to increased productivity and significant cost savings.

How is the talent landscape changing for shared services organizations?

+Shared services are prioritizing skills such as problem-solving, process design, digital proficiency, and data analytics. To attract and retain talent, many are revising their employee value propositions, conducting location-agnostic searches, leveraging organizational branding, and expanding talent acquisition channels to include digital platforms.