In brief:

- CFOs are shouldering new responsibilities in 2025, expected to drive digital transformation enterprise-wide, strengthen cybersecurity, help shape the overall direction of the organization, and more.

- Finding the right talent to help manage these new CFO priorities remains a “significant” and “extensive” challenge amid ongoing finance labor shortages and rising labor costs.

- AI adoption is a top priority, but 86% of CFOs have failed to achieve significant value from their investments.

- “Metrics, analytics, and reporting” ranks as the #1 CFO priority as pressure intensifies to react nimbly to fast-changing market conditions.

The C-suite’s optimistic start to 2025 was tempered in March, amid the potential for new tariffs, rising geopolitical uncertainty, and overall unpredictability for what comes next. But while most organizations say they still are moving forward with measured growth strategies — with technology initiatives at center stage — CFO priorities are focused on preparing their organizations to withstand potential headwinds from policy shifts, continued economic uncertainty, increased cyberthreats, and ongoing skills shortages.

The role of the chief financial officer is expanding faster than ever before, with over 70% now shouldering responsibilities beyond finance, according to Gartner’s Top 5 Priorities for CFOs in 2025 report. Today’s CFO is increasingly expected to act as a strategic partner to the business – leveraging advances in AI, automation, and analytics to drive innovation, support digital transformation enterprise-wide, enhance cybersecurity, and help shape the overall direction of the organization.

Nearly 60% of CFOs say they’re dedicating more time to business performance and financial planning & analysis compared to a year ago (PwC CFO Pulse Survey 2024). The same percentage said they are dedicating more time to technology investment and implementation, striving to combine cost savings with greater efficiency and performance while also accessing data that helps them run their business better amid fast-changing market conditions.

Careful evaluation of the finance function and seeking ways to improve it will be a continued focus of finance leadership in 2025. A heightened focus on risk management is further reshaping how CFOs ensure resilience and long-term organizational success as they confront surging cyberthreats and potential regulatory and policy changes like tariffs and the expiration of major tax policies in 2025.

One constant runs through it all: Finding the right talent to handle emerging needs remains a challenge — and outsourcing is increasingly a key strategy for filling organizational gaps.

Shifting roles mean shifting CFO strategies for 2025

So, what are the priorities finance leaders are focused on this year to help them meet these increasing demands? Here, we discuss new and changing CFO priorities – and the solutions driving success.

1. Drive digital transformation

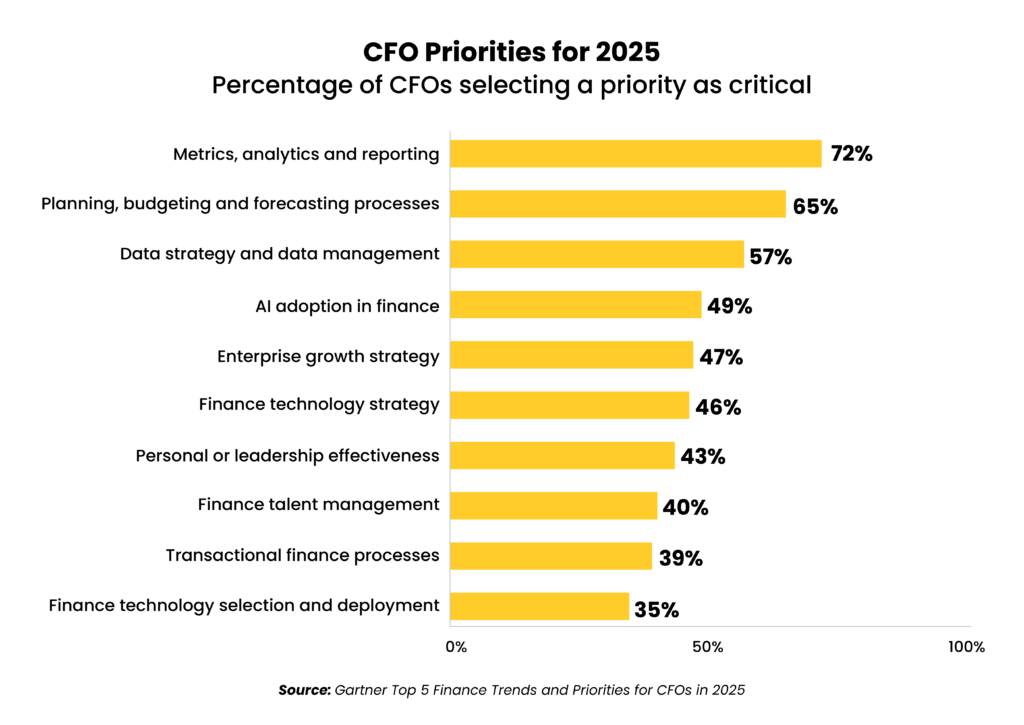

“Leading transformation efforts” was the No. 1 priority for CFOs in 2024, cited by almost 80% of respondents in Gartner’s priorities survey. And it remains a top priority in 2025, with “AI adoption” and “finance technology strategy” continuing to rank fourth and sixth, respectively, on the 2025 Gartner list.

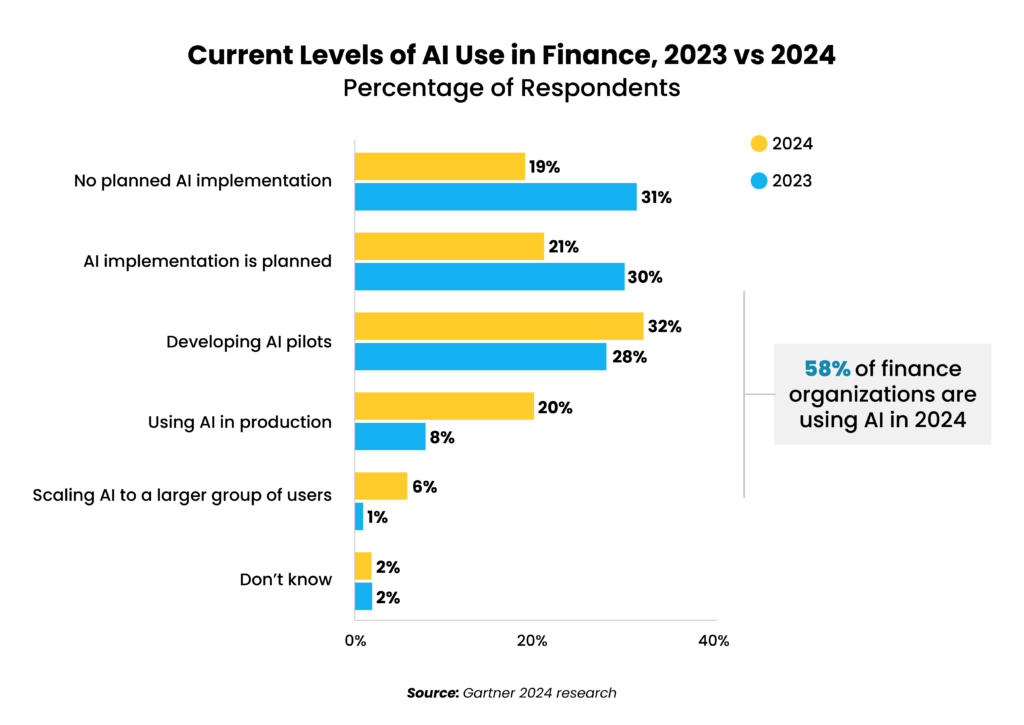

Some 58% of finance organizations started using AI in 2024, a 57% increase over 2023, Gartner research found. Long considered a laggard in AI adoption, finance is catching up with other functions such as HR, legal, and procurement as CFOs look to forecast trends, improve risk management, optimize operations, and automate end-to-end processes.

However, usage remains in early stages, with most centered around developing pilots and another 21% still in planning. These numbers will no doubt rise in 2025 as companies grow more comfortable with the technology.

About 45% of CFOs say increasing the use of technology to reduce costs is very important to fund in the next 12 months (PwC CFO Pulse Survey 2024). Leveraging technology to drive efficiency and performance is another priority on every CFO’s to-do list, alleviating some of the burden of talent shortages by helping teams do more with less and elevating staff to higher-value work.

Investments in risk monitoring and intelligence tools are also high on CFO agendas as 42% rank inadequate tech as a top risk management challenge amid exploding cyber-risk and an increasingly complex business landscape (2025 BDO CFO Outlook Survey).

Here’s the challenge: 86% of finance teams say they have achieved no significant value from their AI investments, states Gartner’s 2025 Leadership Vision for CFOs report. More than 85% of enterprises also say they are not prepared to handle the risks necessary to achieve the higher-order rewards of the technology, Everest Group’s priorities survey found.

The reasons? Everest Group points to uncertainty as to where or how to begin, unpreparedness (both skills and quality data), and unaffordability. Gartner’s priorities survey adds lack of talent: 77% of CFOs report that a lack of technical skills within finance is a critical reason their function has not yet adopted AI.

Finding trusted talent to work with technology will be a key driver of real transformation in 2025. Not surprisingly, a whopping 81% of finance functions are adopting or planning to adopt AI as part of their outsourced services, looking to quality providers to offer instant access to the talent and tools they need to achieve sustainable success (Deloitte Global Outsourcing Survey 2024).

2. Restructure the role of finance teams to drive growth

“Growth” stood as the No. 1 priority across the C-suite in 2024 — above technology, workforce, and even financials, Gartner found. And “enterprise growth strategy” remains a top 5 priority for CFOs in 2025, cited by 47% of finance leaders as they scramble to help the business navigate an increasingly disruptive environment through financially sound decision-making, Gartner’s CFO priorities survey found.

CFOs are focused on scaling up the business partnership between the C-suite and finance teams in 2025, ensuring decision-makers throughout the enterprise are armed with finance insights. CFO insights are crucial in evaluating risks, estimating ROI, and securing the necessary funding to fuel business development.

Finance support is equally vital for day-to-day operating decisions, with Gartner’s CFO Leadership Vision asserting profits lost due to financially unsound operating decisions are currently equal to 3% of EBITDA.

As CFOs take on more strategic responsibilities focused on growth, so too will they be moving to drive digital transformation and foster innovation across the organization. This shift requires a redefined skill set for finance leadership overall, placing greater emphasis on data analytics, technological expertise, and leadership capabilities.

To meet these new responsibilities, CFOs are heavily investing in technology like intelligent automation to streamline the back-office work that consumes about 80% of the finance department’s time – freeing up teams to double down on strategic business insight and services (Deloitte Finance 2025: Digital Transformation in Finance).

As a result, new job roles will be created that specifically address emerging priorities such as AI financial analyst, AI auditor, and AI compliance analyst. Expanding digital finance skills is a critical priority for 2025, Gartner’s CFO Leadership Vision report states, adding talent with backgrounds in key areas like analytics that offer a new ability to transform data into strategic recommendations, identify growth opportunities, and recommend improvements for business health.

CFOs are also embracing hybrid operating models as a new normal, with 54% of finance organizations expanding their teams’ capacity to perform higher-value work by outsourcing back-office processes to a third-party provider (Deloitte Global Outsourcing Survey 2024).

3. Develop new talent sources

A severe shortage of skilled accountants is putting immense strain on CFOs and finance teams. The deficit, estimated to potentially reach 3.5 million this year, threatens to disrupt financial reporting and compliance processes across sectors.

The challenge isn’t only limited to accounting: about half of finance teams say they also struggle to hire skilled talent in critical areas like accounts receivable, accounts payable, and financial planning & analysis, states Robert Half’s 2025 Finance and Accounting Salary Guide. Further adding to hiring headaches, the future of finance calls for finding new ways to identify tech-savvy finance professionals who can unlock the full capabilities and value of emerging tech for the organization.

More than half of CFOs say retaining and attracting talent is either an “extensive” or “significant” struggle (EY 2024 Tax and Finance Operations Survey). More than half of finance and accounting managers say hiring quickly enough to land top talent is a top recruiting struggle, Robert Half found, and another 50% rank meeting candidate’s salary expectations as a top challenge.

The result: 89% of finance leaders say talent-related barriers are preventing them from delivering on their purpose and vision, the EY survey states.

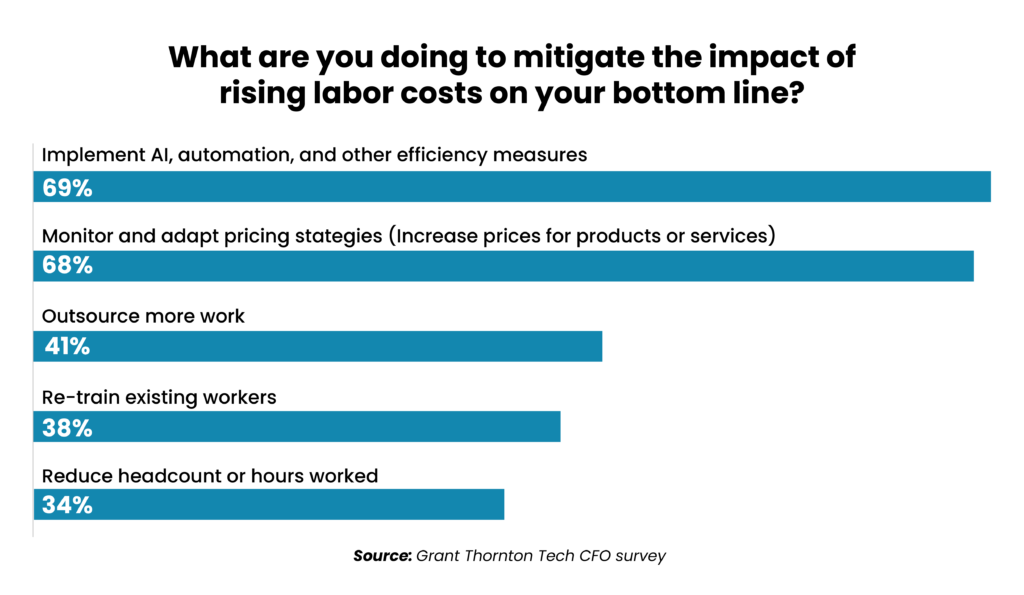

As a result, even businesses that never considered outsourcing before are now exploring opportunities to find new talent sources, access digital talent, meet the challenges of the continued labor shortage, and improve job satisfaction for internal teams by alleviating the burden of transactional tasks. More than 40% of CFOs surveyed by Grant Thornton indicated “outsource more work” as a key organizational strategy.

In fact, “improved access to talent” trumped “spend optimization” as the biggest outsourcing driver for the first time since the pandemic on the 2024 Deloitte Global Outsourcing Survey.

4. Improve data analytics

With more than 75% of CFOs now responsible for data and analytics enterprise-wide, finance executives ranked “metrics, analytics, and reporting” as their top focus area on Gartner’s 2025 CFO priorities report. The potential for abrupt business disruption from policy shifts like tariffs has upped the ante even more as pressure intensifies for CFOs to quickly access and analyze good data to assess and offset risk.

CFOs are looking to improve business performance by digging deeper into financial datasets to identify patterns and insights that were previously unattainable. Advancing data analytics tools hold the potential to transform the finance and accounting industry, enhancing decision-making and fostering the more strategic roles previously discussed.

Predictive analytics, powered by AI and machine learning, offer an unprecedented ability to forecast trends and potential risks with greater accuracy. The industry is shifting from reporting on what happened in the past to real-time analytics that allow companies to not only react to what is happening right now but also look ahead to what’s coming – leveraging advancing tech to enhance fraud detection, streamline operations, anticipate customer behaviors and market fluctuations, and drive profitability.

But while nearly 95% of business leaders expect data and analytics to play a pivotal role in their organization’s success, finding the right talent is challenging, states Gartner’s 2024 Data and Analytics Priorities and Challenges report.

Not surprisingly, finance leaders are turning to shared services/outsourcing to fill the gap. Shared services leaders ranked analytics tools as their biggest tech priority in 2024, according to SSON’s State of the Shared Services & Outsourcing Industry Global Market Report, with finance typically the first function supported.

Data & Analytics is now the fourth-largest outsourced business function, with 72% of organizations outsourcing analytics processes to a third-party provider (Deloitte Global Outsourcing Survey 2024).

Nearshoring emerges as a top solution for meeting CFO priorities in 2025

CFOs are increasingly leveraging outsourcing as a critical strategy to address their 2025 priorities. With the right partner, this approach not only facilitates investment in emerging technologies such as AI, but also grants access to expert knowledge, best practices, and turnkey, high-performing operations that give internal teams the bandwidth to focus on strategic goals while lowering operating costs.

But as CFO priorities change, so are the reasons for outsourcing.

To meet modern challenges, businesses are looking for finance and accounting outsourcing (FAO) partners that act not just as service executors but as advisors and collaborators. These providers understand and align with long-term business objectives, offering the business knowledge and skills to design and execute digital strategies, drive process excellence, provide actionable insights, mitigate risk, and execute more complex process tiers.

Increasingly, CFOs are realizing traditional outsourcing solutions in India and the Philippines struggle to meet this emerging standard, bringing challenges such as distant time zones, language nuances, and cultural barriers that can hinder seamless collaboration, productivity, and the ability to support judgment-intensive activities. Traditional outsourcing models in Asia with a value proposition solely focused on labor arbitrage also require a cookie-cutter approach that negate opportunities for flexibility or customization.

As a result, nearshoring is emerging as a compelling strategy for meeting CFO priorities in 2025. In a market overview, Everest Group predicts FAO demand in Latin America will surge by 17% through 2026, as demand shifts from pure transactional support to strategic outsourcing partnerships.

Tholons goes a step further, predicting 50% of companies will have adopted a hybrid sourcing model by 2026 that includes nearshoring, driven by the need for greater agility and resilience.

Latin America offers an ample supply of finance professionals trained to U.S. GAAP and IFRS accounting standards working in the same time zone, who are culturally aligned, have strong English proficiency, and significantly lower labor costs. Robust government-led educational programs further ensure steady talent pipelines.

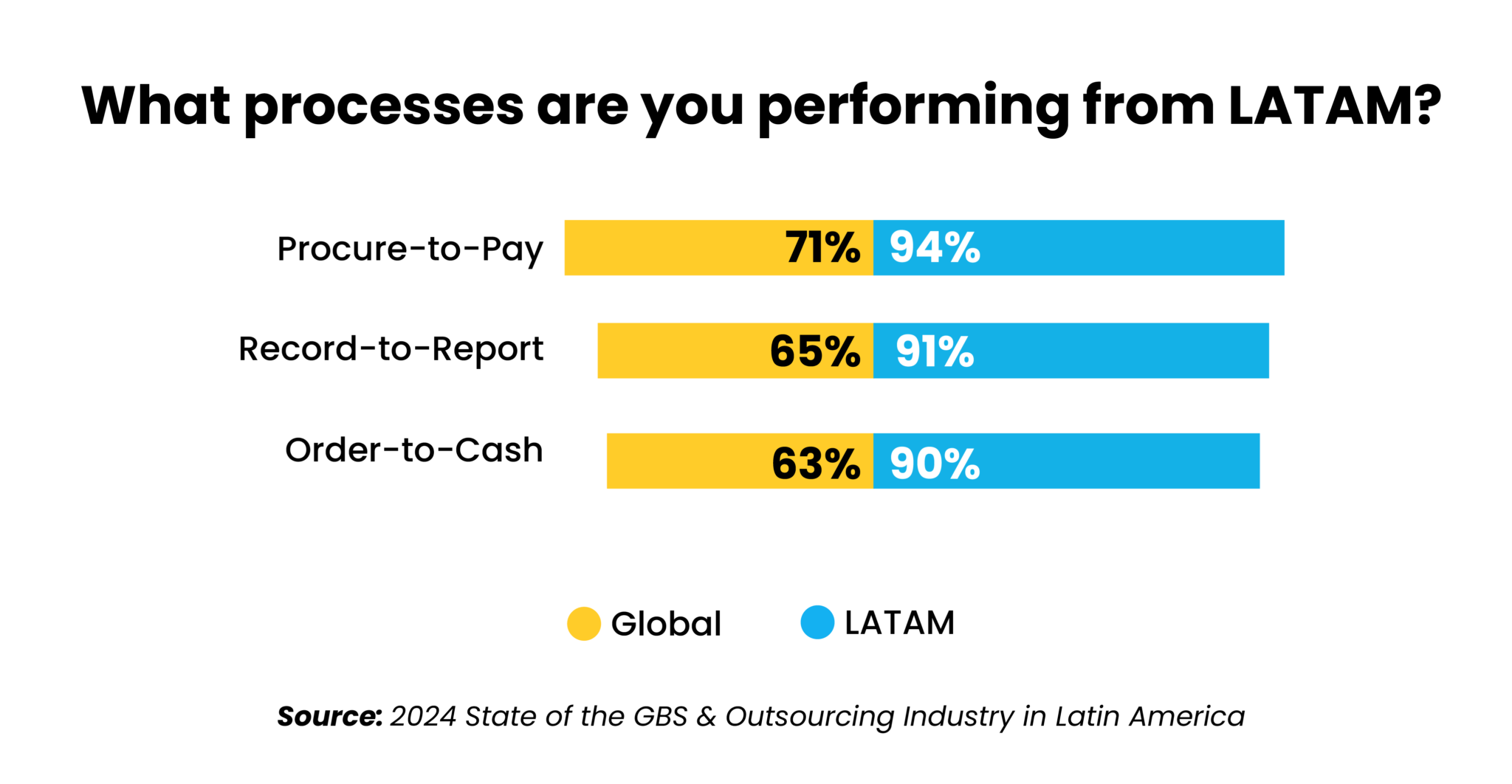

Finance functions represent the top processes performed in LATAM, with more than 90% of regional shared services supporting order-to-cash (O2C), procure-to-pay (P2P), and record-to-report (R2R), according to the 2024 State of the GBS & Outsourcing Industry in Latin America report by SSON Research & Analytics and Auxis. Those numbers are significantly lower across global regions, the report found.

Satisfaction levels with Latin America shared services also outpace Asia, at 87% vs. 53%, respectively, the SSON/Auxis report found. In Latin America, CFOs are finding the talent, agility, and financial expertise to meet the demands of their changing role – and those of their teams.

Why Auxis: A pioneer of finance nearshoring

CFOs face mounting pressure in 2025 from fast-changing market conditions, expanding roles, talent shortages, cost pressures, and advancing tech. Fortunately, there are strategic solutions to help them navigate.

Asia-based outsourcing solutions focused solely on lowering the cost of highly transactional work will always have a role. But as Auxis’ clients have come to realize, when the need is for increased collaboration, judgment, and flexibility, nearshoring to a quality partner brings the right combination of competency, communication, and digital capabilities to meet the expanding needs of CFOs in today’s fast-changing environment.

Want to learn more about the benefits of outsourcing finance and accounting services to Latin America? Schedule a consultation with our nearshore experts today! You can also learn why Auxis was chosen as a top FAO company by Everest Group and ISG, or visit our resource center for more CFO insights, tips, strategies, and FAO success stories.

Frequently Asked Questions

Why is finding the right talent one of the biggest challenges CFOs face in 2025?

+Finding the right talent remains a significant challenge. There are simply not enough accountants entering the workforce. Ongoing labor shortages and rising costs make outsourcing a key strategy for filling organizational gaps. CFOs are turning to outsourcing to access skilled talent, particularly in areas like AI-driven financial analysis, accounting, and compliance.

Why is AI adoption a priority for CFOs in 2025?

+CFOs are leveraging AI and automation to streamline transactional work, freeing up teams for higher-value strategic activities and improving efficiency. AI further helps CFOs forecast trends, improve risk management, optimize operations, and automate end-to-end financial processes. However, 86% of CFOs have yet to achieve significant value from AI investments due to lack of talent, data quality, and implementation challenges.

How is the role of the CFO evolving beyond traditional finance responsibilities?

+Over 70% of CFOs now handle responsibilities beyond finance, including digital transformation, cybersecurity, data analytics, and strategic planning. CFOs are also dedicating more time to technology investment and implementation to drive efficiency and address labor shortages.

Why is data analytics a top CFO priority in 2025?

+With over 75% of CFOs responsible for enterprise-wide data and analytics, improving metrics, reporting, and predictive analytics is crucial for better decision-making and business growth. CFOs are looking to improve business performance by digging deeper into financial datasets to identify patterns and insights that were previously unattainable. Advancing data analytics tools hold the potential to transform the finance and accounting industry, enhancing decision-making and fostering more strategic roles for finance teams.

How is outsourcing changing to meet evolving CFO priorities?

+Businesses are seeking outsourcing providers that act as strategic partners rather than just service executors, offering insights, digital strategies, and risk mitigation. CFOs are increasingly finding advantages in nearshoring as Latin America provides finance professionals trained in U.S. GAAP and IFRS standards, operates in the same time zone, offers strong English proficiency, and has lower labor costs.