In brief:

- For organizations not yet leveraging nearshore delivery as an alternative to outsourced teams in Asia, the primary barrier for nearly half (48%) is a lack of knowledge about Latin America’s capabilities.

- The perception of nearshoring to Latin America is not in sync with the reality of those currently doing business in the region, our new survey with SSON Research & Analytics finds.

- From the availability of skilled talent to cost savings to competitive offerings in automation, data analytics, software development, and more, know the truths about nearshoring to Latin America.

As organizations explore alternatives to Asia outsourcing for real-time communication, solutions to cultural differences, and the ability to handle more complex tasks, a new trend is emerging for many North American companies: nearshoring to Latin America is gaining popularity as a viable alternative to cost-driven offshoring. Companies are looking for more value when it comes to outsourcing their operations – spanning finance, IT, HR, customer service, software development, and more – one that uplevels the benefits of both shared services and outsourcing models.

A new survey from Auxis and Shared Services & Outsourcing Network (SSON) Research & Analytics, “2024 State of the GBS & Outsourcing Industry in Latin America,” found that 90% of Global Business Services (GBS) and enterprise respondents either operate in Latin America (LATAM) or plan to open operations within the next three years. But for organizations not yet leveraging nearshore delivery, the primary barrier for nearly half (48%) is a lack of knowledge about Latin America’s capabilities – particularly for supporting North America.

This confirms that, despite the growth of the nearshore market over the past five to 10 years, many North American executives are still unaware of the value LATAM has to offer as a potential alternative to traditional Asia destinations such as India and the Philippines.

One thing that’s evident in the survey findings – for those companies that have not yet set up operations in Latin America, the reasons for hesitating don’t necessarily jibe with the experiences of those that have.

In this article, we explore top assumptions companies that are not leveraging shared services or outsourcing in LATAM have, with a comparison to the realities driving interest in the region for those currently nearshoring. It’s time to set the record straight on opportunities countries like Costa Rica, Colombia, and Mexico bring for outsourced business operations.

Outsourcing myths debunked: Perception vs. reality of outsourcing to Latin America

What are the overriding perceptions about nearshoring? Latin America exhibits different responses for those evaluating the region compared to those that already have established shared services operations in six key areas.

Myth #1: Quality talent is not readily available

A key concern for organizations evaluating Latin America is talent availability, with 78% citing this worry as one of the biggest risks of outsourcing in the Auxis/SSON report. However, only 45% of those already operating in LATAM share this concern – while talent availability stands as the top concern for 71% of enterprises with shared services organizations in Asia, Europe, and North America, the report found.

The reality is that Latin America’s high-quality talent has U.S. executives increasingly willing to delegate end-to-end, more complex processes to nearshore partners. Deep pools of highly educated resources in top nearshore markets alleviate U.S. labor shortages with the critical-thinking skills, cultural alignment, certifications, and strong English proficiency to deliver advanced tiers of business and IT work.

Advanced finance functions such as record-to-report (R2R) and financial planning & analysis (FP&A), for example, are increasingly being outsourced to leverage specialized expertise, improve efficiency, and focus on critical tasks, according to the “2024 ISG Provider LensTM for Finance and Accounting (FAO) Outsourcing Services.” Quality FAO providers in Latin America have a proven track record of success meeting this demand, bringing finance talent who also possess the digital literacy to unlock the full capabilities of emerging tech like advanced analytics and AI technologies.

Mexico ranked first in Latin America for skilled talent availability on the “2024 IMD World Talent Ranking,” a testament to the country’s education system which produces a large number of graduates in technology, engineering, and business fields – ensuring a steady stream of capable professionals ready to enter the workforce. Following on the heels of Mexico in the same report, Colombia ranks No. 2 in Latin America – standing out for its ability to offer scalable shared services operations in multiple cities with more than 1 million inhabitants.

Costa Rica rounds out LATAM’s top destinations as the most mature nearshore market, bringing deep experience supporting U.S. operations that places it among the 10 most preferred shared services destinations globally on Deloitte’s “2023 Global Shared Services & Outsourcing Survey.”

Myth #2: Cost savings can’t compare to Asia

Demand for nearshoring in Latin America is rising as talent shortages, accelerating digital transformation, and persistent geopolitical uncertainty prompt business leaders to look beyond the lowest cost to ensure the highest efficiency and performance. In Latin America, organizations can access substantially lower costs without compromising on quality.

While salaries in Asia tend to be lowest, the reality is countries in Latin America offer skilled labor at significantly lower rates compared to the U.S. and Europe – and with similar or greater value than Asia. Shared services leaders assess the value provided by Latin American markets as very similar to India – and ahead of other Asian locations like the Philippines, according to SSON’s “2023 The Future Location Report.”

Here’s why:

As shown above, the region hosts a wealth of well-educated professionals, particularly in the tech and business sectors, who deliver high-quality work. Additionally, Latin America’s proximity to North America means reduced travel expenses and real-time communication thanks to shared or similar time zones. This further adds to cost savings by reducing the need for overnight shifts or significant schedule adjustments that increase turnover and decrease performance in Asia-based locations.

Half of organizations operating in LATAM report labor savings of between 20-40% compared to the U.S., and nearly 20% report savings of at least 40%, according to the Auxis/SSON report.

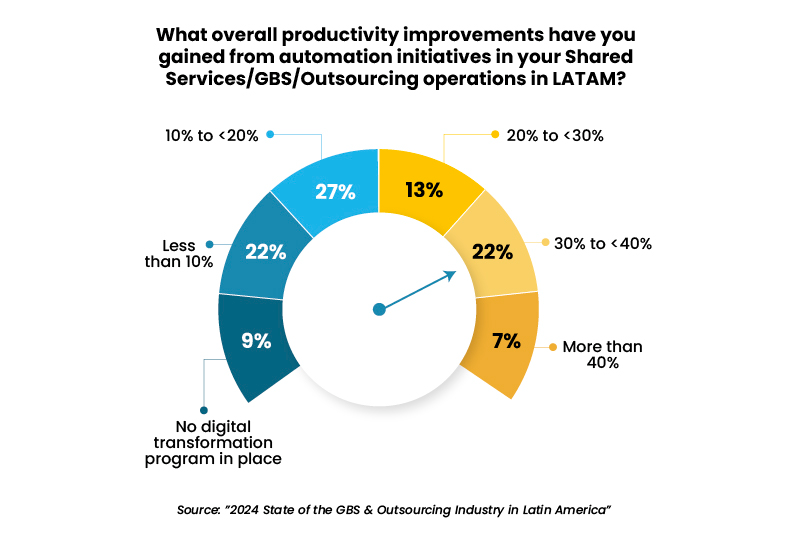

Businesses with LATAM operations also report substantial efficiency gains in addition to labor savings. When asked about productivity improvements from automation in the Auxis/SSON survey, 69% of respondents report gains of more than 10% and 42% report improvements of 20%-plus.

Further, many Latin American governments offer incentives such as tax breaks and investment in technological infrastructure to attract foreign businesses, enhancing the overall cost-effectiveness of outsourcing to the region.

Additionally, while Asian locations rank highest for financial attractiveness on Kearney’s “2023 Global Services Location Index,” Latin America’s labor arbitrage is not far behind. For example, Colombia’s financial attractiveness score was only about a tenth of a point different from the Philippines.

And salaries in India’s outsourcing industry are on the rise – chipping away at cost savings with 10% median increases across the board in 2023 to combat alarmingly high attrition, states WTW’s Salary Budget Planning report.

The takeaway: While nearshore salaries may start slightly higher than some Asia-based locations, the total cost of nearshoring can be lower once you consider the additional value of LATAM’s advantages that drive greater efficiency and performance – as well as Asia’s hidden costs like travel expenses, lower productivity, quality control, and high turnover.

Myth #3: English proficiency is not strong enough

Sixty-seven percent of respondents who were evaluating a nearshore Latin America solution cited availability of English as a top concern, whereas only 37% shared this concern.

The reality is English proficiency scores in top nearshore markets are strong and continuously improving – with 13 LATAM countries ranking ahead of India on the latest EF English Proficiency Index (EPI) report. Driven by a wealth of government programs focused on strengthening bilingual capabilities, Central America’s fluency levels improved more than any other region in the world over the past decade and South America has also shown a steady increase.

What’s more, heavy Indian accents with different intonations and word stresses than Americans are used to can trigger miscommunications and prove frustrating to North American business audiences. India ranks 60th globally on the EPI report, down from 21st globally in 2013, and ranks 9th in Asia.

More than 60% of SSON/Auxis survey respondents ranked “English accent” as a key reason for choosing LATAM over Asia and Europe.

Myth #4: Data security is a concern

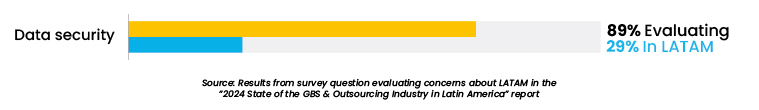

Data security is a growing concern among all companies, and it’s not surprising it would rank highly among organizations looking to outsource their operations. However, when it comes to LATAM outsourcing, security for sensitive data is a concern for 89% of potential entrants, yet only 29% of those operating in the region consider it an issue.

The reality is countries within the region have been actively enhancing their data protection laws and mechanisms to align with global standards, thereby providing a secure environment for successful outsourcing and shared services operations. Several Latin American nations have implemented comprehensive data protection regulations like the GDPR (General Data Protection Regulation), which aim to safeguard sensitive information while promoting transparency and accountability.

Moreover, these countries are investing in cybersecurity infrastructure and training to resist potential threats and vulnerabilities.

As a trusted nearshoring Latin America service provider, Auxis takes a stringent approach to security concerns and compliance at our LATAM operations, offering instant access to best-in-class security governance, best business practices, products, and partnerships with leading security technology providers. Auxis also uses custom AI and automation solutions to enhance security; for example, innovating an AI automation that detects phishing emails, and others that can assess and even respond to infrastructure monitoring alerts.

Auxis further can implement a “clean room” in its service delivery centers for clients in heavily regulated industries like healthcare and financial services, creating a secure, segregated space with controlled access, video surveillance monitoring, and other robust security measures. These same controls are applied to remote teams, with high-performing security software managing connection and control of devices to ensure sensitive client information remains safe and uncompromised throughout the outsourcing process.

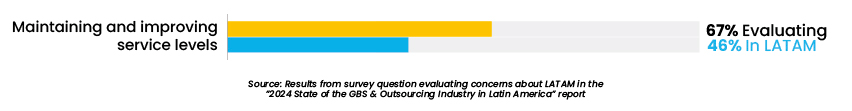

Myth #5: Maintaining and improving GBS service levels can be challenging

It’s one thing to set up operations outside of North America; it’s another to ensure those operations continue to deliver to expectations over time. This is another concern among those evaluating Latin America as a nearshoring destination, with 67% citing maintaining and improving service levels as a concern compared to those already established in the region (46%).

The reality is Latin America receives favorable attention for maintaining and improving service levels, with satisfaction levels reported for LATAM GBS (87%) significantly higher than those in Asia (53%), Europe (64%), and even North America (69%).

Factors like top-tier talent, geographical proximity to North America, time zone alignment, and cultural affinities enhance communication and collaboration, allowing for quicker turnaround times, seamless interaction with global clients, and successful delivery across the value chain.

Nearshore models further enable greater flexibility and customization than offshore outsourcing models solely driven by labor arbitrage, which require high volumes of cookie-cutter operations to work. With a focus on providing value beyond cost savings, nearshore models can tailor solutions to the client’s specific needs and maintain a continuous improvement mindset. Robust service level agreements also ensure nearshore outsourcing companies continually improve their offerings.

In terms of service quality, LATAM countries like Mexico, Colombia, and Costa Rica have developed more reliable infrastructure than Asia-based locations and offer competitive costs, making the region an appealing choice for businesses looking to outsource services while keeping high standards. Continuous improvements in service levels are supported by ongoing investments in education and technology training, thereby equipping the workforce with the necessary skills to meet evolving client demands.

Myth #6: Automation and analytics skills are not the same as the U.S.

Keeping pace with advancing technologies has always been a goal of outsourcing, but with the rise of AI in recent years, it’s become an essential factor in choosing an outsourcing relationship. Similarly, organizations have outsourced data entry and operations for decades, but modern expectations and requirements have grown to include analytics and insight generation, according to Deloitte’s latest Global Outsourcing Survey.

Fifty-six percent of respondents evaluating LATAM as an outsourcing destination in the Auxis/SSON survey cited automation and analytics skills as a concern, whereas only 29% of those currently operating there had this worry.

The reality is Latin America offers deep pools of automation and analytics skills, thanks to the region’s focus on technology education and skill development. Tech adoption rates across critical technologies ranging from automation to analytics to AI range 9% higher at shared services operations in LATAM compared to other regions.

Sixty-seven percent of respondents with LATAM operations in the Auxis/SSON survey feel confident or very confident in their ability to drive automation and digital transformation with the current skills and resources available.

LATAM nations are spearheading efforts to cultivate tech talent proficient in automation tools and analytics, essential in meeting the demands of modern businesses. The growing emphasis on STEM education and collaborative partnerships with tech industries is fostering a workforce capable of handling complex data and deploying automation efficiently.

Enhanced investment in training programs and infrastructure development will continue to cement Latin America as a prominent hub for nearshoring needs while keeping pace with technological evolution. The efforts are paying off as the number of foreign companies looking to Latin America for tech resources surged by 156%, the most of any world region, according to a Bloomberg report.

Why Auxis: A nearshoring pioneer with deep roots in Latin America

The past decade has seen Latin America emerge as a leading destination for supporting North America with shared services and outsourcing – and continue to strengthen its status as a contender on the global stage. With close to 30 years of experience doing business in Latin America, Auxis is a pioneer in the region redefining how the most modern organizations navigate modern business needs.

Recognized for being one of the only true nearshore-centric delivery models in leading rankings of outsourcers by analysts like Everest Group and ISG, Auxis brings deep industry knowledge and unmatched customer experience in serving U.S. companies. Going beyond cost savings, our delivery centers in Costa Rica and Colombia and supporting hubs in Mexico and Guatemala offer highly skilled talent, cultural alignment, accelerated digital capabilities, and operational standardization for long-term value.

An exceptional shared services partner like Auxis is key to navigating your organization through the unique challenges and complexities of transformation. From turnkey IT and business process outsourcing solutions to clear strategies for improving sub-optimal operations to robust digital transformation capabilities, Auxis delivers the people, processes, knowledge, and tools you need to confront the industry’s crossroads and determine the best path forward.

Download the full report, “2024 State of the GBS & Outsourcing Industry in Latin America” to learn why shared services operations in Latin America report the highest satisfaction levels worldwide.

Want to learn more about shared services consulting and nearshore outsourcing solutions? Schedule a consultation with our shared services leaders today! Or, visit our resource center to learn more shared services trends, strategies, and success stories.