In brief:

- Nearshore outsourcing involves working with providers in nearby countries — like Latin America for U.S. businesses — combining real-time collaboration, cultural alignment, and easier communication with significant cost savings.

- Tholons predicts 50% of companies will have adopted a hybrid sourcing model that includes nearshoring by 2026, driven by the need for greater agility and resilience.

- Companies doing business in Latin America zero in on five powerful factors as the biggest nearshoring benefits, with three related to talent quality.

With no end to talent shortages and economic uncertainty in sight, demand for efficient and cost-effective outsourcing solutions is rising – driving businesses to seek alternatives to the challenges of sending business processes to the other end of the world. But hard data on the advantages of nearshoring have been scarce – leaving many North American organizations unaware of the value Latin America’s shared services and outsourcing industry offers or unsure about its effectiveness.

Tholons 2025 Top 10 GCC/GCBS Trends Report predicts 50% of companies will have adopted a hybrid sourcing model by 2026 that includes nearshoring, driven by the need for greater agility and resilience. New research reflects this rapid growth, with 90% of enterprise and global business services (GBS) leaders already operating in Latin America or planning to open operations there in the next three years, according to the 2024 State of the GBS & Outsourcing Industry in Latin America report by Shared Services & Outsourcing Network (SSON) Research & Analytics and Auxis.

Eighty-four percent of LATAM GBS service North America, making it the #1 region supported, the report found. In 2016, that number was 44% – underscoring the market shift.

More than 120 enterprise leaders recently gathered for Auxis’ webinar, “Latin America’s Shared Services & Outsourcing Industry Revealed: Key Findings from the SSON/Auxis Report,” to bridge the information gap about LATAM. Leveraging exclusive data shared in the webinar and the report, this blog explores five key benefits of nearshoring for North American companies.

Read on to find out why shared services satisfaction levels are higher in Latin America (87%) than other regions (53% in Asia, 64% in Europe, and 69% in North America) – translating to confidence that has LATAM successfully delivering business processes across the value chain on a greater scale than other markets in finance, IT, HR, software development, supply chain operations, and more.

“When Auxis started, we were a lone voice in the wilderness talking about nearshore. When most people thought about moving operations outside of the U.S., they were always considering Asia-based models,” Eric Liebross, Auxis Senior Managing Director Business Transformation, said in the webinar. “Over the past couple of years in particular, we are seeing that changing and nearshoring has become much more of a trend.”

Key benefits of nearshoring to Latin America

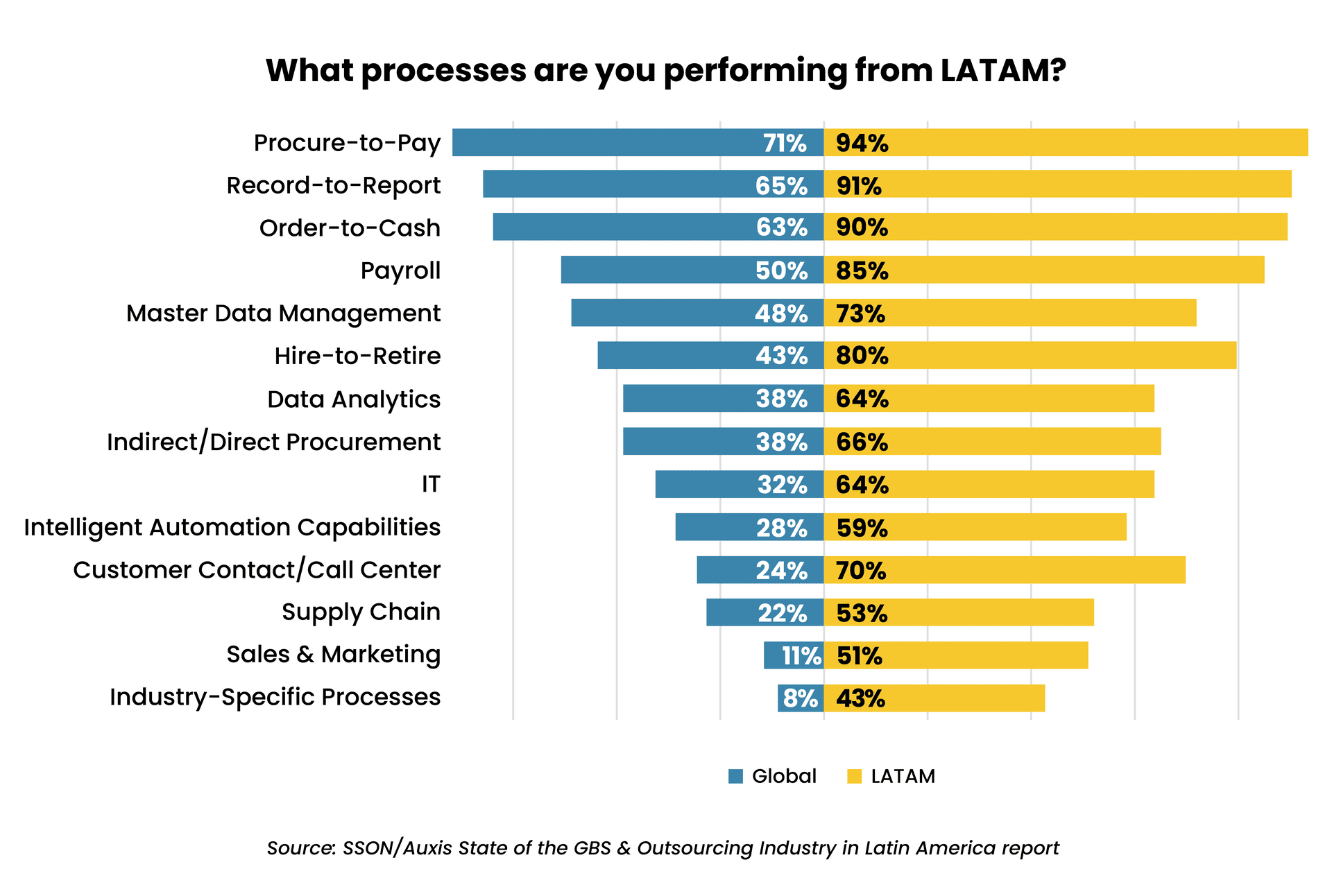

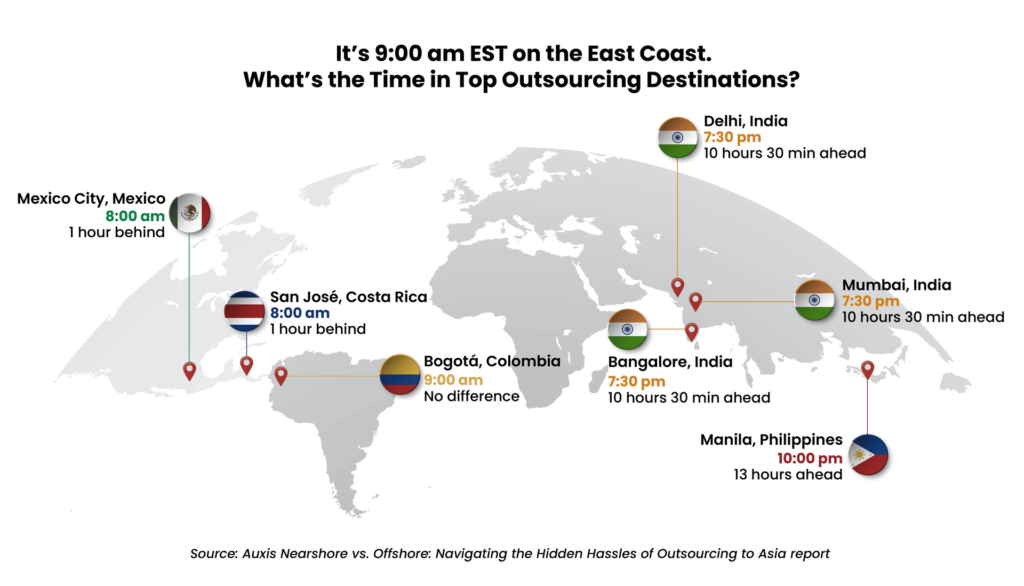

Companies already operating in Latin America deem multiple factors as “important” or “very important” when assessing the region’s greatest value over Asia and Europe for supporting the Americas. At least 60% prioritized each category in the chart below on the SSON/Auxis report:

When the list is narrowed to what survey respondents consider “very important,” however, five factors stand out as the biggest benefits of nearshore outsourcing in LATAM:

1. Real-time communication

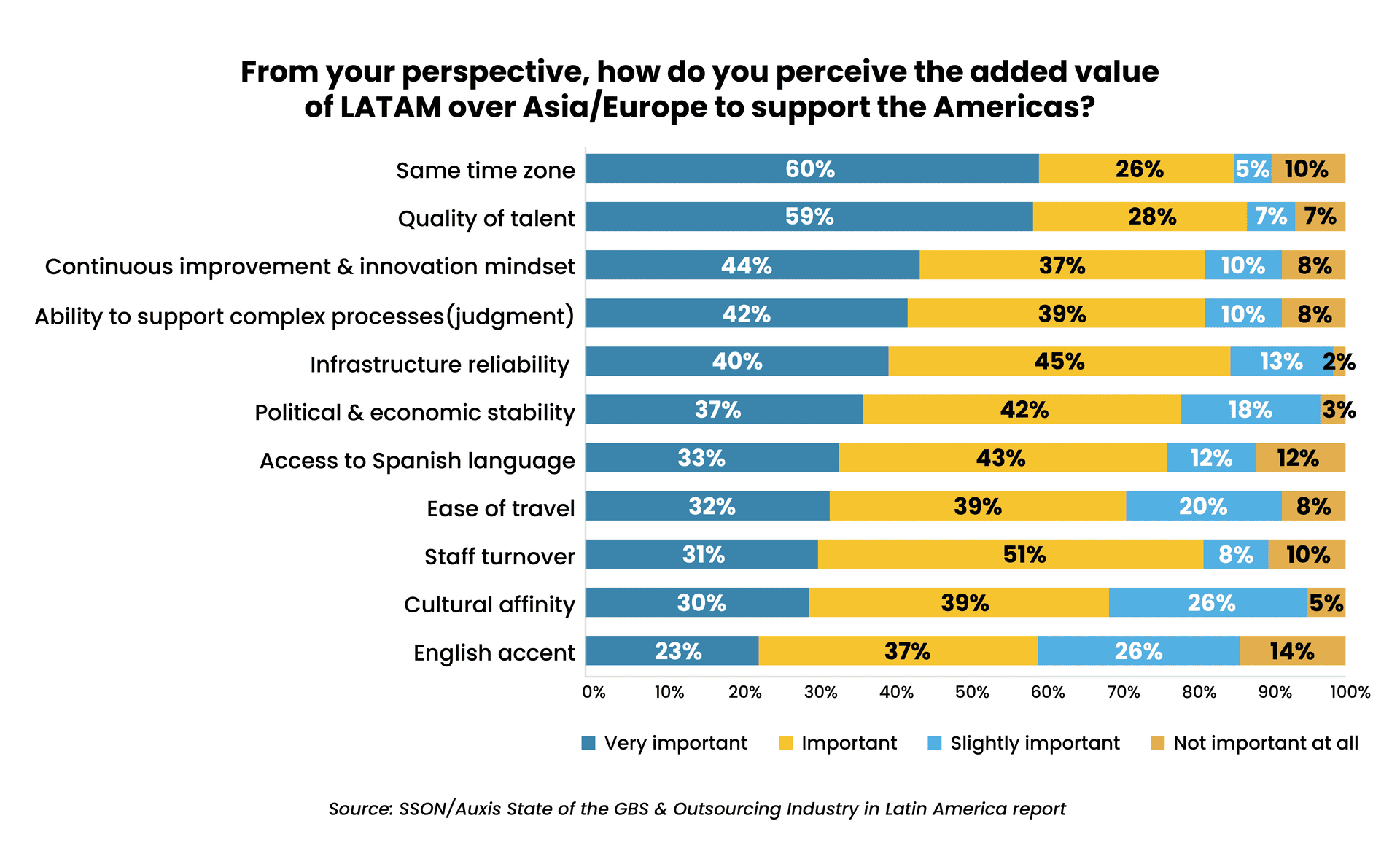

When evaluating your outsourcing options, the impact of time zone differences is a critical factor to consider – ranked “very important” by the most enterprise and GBS leaders (60%) on the SSON/Auxis survey.

Asia-based outsourcing solutions can offer cost advantages and smooth operations for transactional work that does not require frequent communication. But for more complex processes or functions requiring interaction, the large time zone gap can be a significant drawback, with India’s main outsourcing destinations sitting 10 hours and 30 minutes ahead of New York and the Philippines sitting 13 hours ahead.

Working with teams in Asia often requires early-morning or late-night meetings, leading to less-efficient collaboration and slower turnaround times. Even if your outsourcing provider aligns with U.S. business hours, the resulting overnight shifts in Asia tend to bring high turnover and less-experienced talent that can impact consistency and performance.

Nearshore outsourcing in Latin America offers businesses the advantage of operating in shared or similar time zones to the U.S., enabling real-time communication and a seamless extension of your team. The result: faster decision-making and more effective collaboration, which enhances productivity. Time zone affinity also makes it easier to address urgent issues quickly.

Travel time and costs decrease with a nearshore partner as well, supporting more face-to-face meetings and shorter business trips. Not surprisingly, physical proximity ranked as the #1 factor for choosing an outsourcing provider on the latest IT Outsourcing Statistics report by Computer Economics.

IT leaders said reduced operational challenges made them most likely to select outsourcing partners in the same geographical region – even if a lower cost could be realized in a more distant location.

2. Access to top-tier talent

“Access to talent” trumped “spend optimization” for the first time since the pandemic as the #1 outsourcing driver on the 2024 Deloitte Global Outsourcing Survey. Only 34% of organizations ranked cost reduction as their biggest outsourcing goal, compared to 70% in 2020, the survey found.

Latin America offers significant cost savings, averaging 30-50% labor arbitrage compared to hiring the same resources in the U.S. But as U.S. organizations seek new talent pipelines to combat ongoing labor shortages, LATAM’s deep pool of high-quality talent is its biggest draw.

A whopping 87% of enterprise and shared services leaders ranked LATAM’s talent quality as “very important” or “important” to its value proposition over Asia and Europe on the SSON/Auxis report – ranking first overall. In fact, three out of the top five factors chosen as LATAM’s greatest value are related to talent, including a continuous improvement/innovation mindset and ability to support complex processes.

Deep pools of highly educated resources in top nearshore markets like Costa Rica, Colombia, and Mexico alleviate U.S. labor shortages with the critical-thinking skills, certifications, and strong English proficiency to deliver advanced tiers of business and IT work. Heavy government expenditures on key educational areas like accounting and IT ensure a steady talent pipeline, while the region’s less-saturated labor markets keep attrition from spiraling.

Cultural affinity between the U.S. and LATAM is another significant factor, with seemingly minor discrepancies in approaches to completing tasks, communication styles, attitudes toward conflict, and decision-making creating the potential for miscommunication and frustration between U.S.- and Asia-based teams.

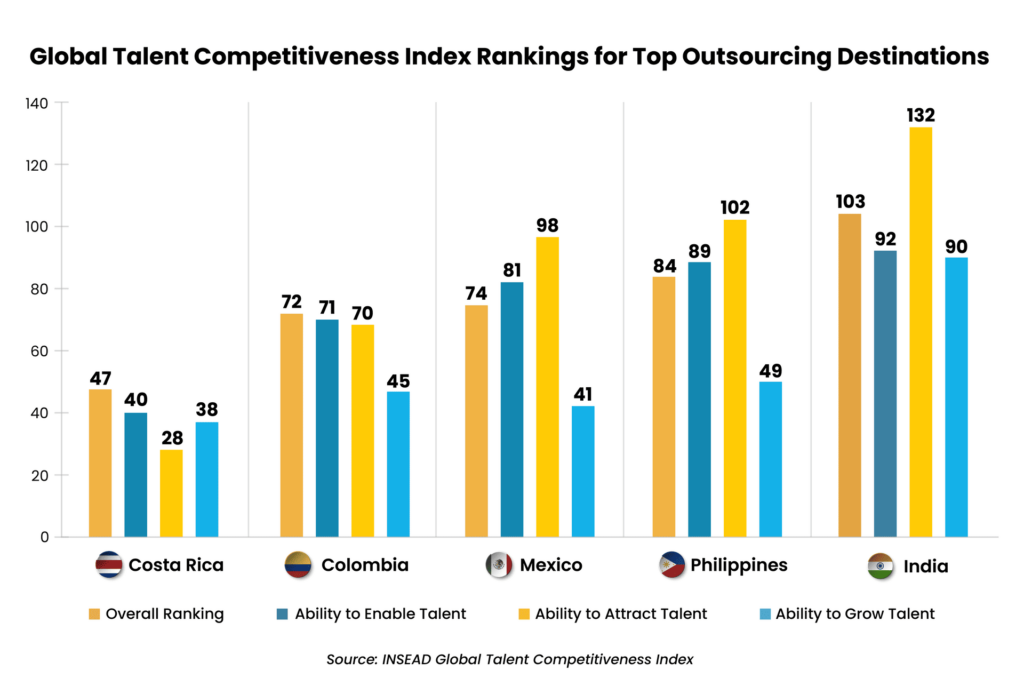

INSEAD’s latest Global Talent Competitiveness Index (GTCI) underscores the talent quality in LATAM’s top destinations. The “Big Three” nearshore markets of Costa Rica, Colombia, and Mexico scored 47th, 72nd, and 74th respectively out of 134 countries on the World Economic Forum-endorsed GTCI report, while India ranked 103rd and the Philippines 84th.

India’s talent competitiveness has decreased every year since 2020 on the GTCI as growing difficulty attracting top talent in a highly competitive labor market creates an increased skills mismatch for employers, the report states. In fact, talent availability is cited as the biggest concern for 71% of enterprise and shared services leaders doing business in regions outside LATAM.

In the webinar, Auxis Commercial Managing Director Keith Sayewitz showed how a Fortune 50 retailer found success shifting HR functions to Auxis’ Costa Rica delivery center after it struggled to find talent familiar with the nuances and complexities of U.S. HR practices in India. The retailer also struggled with common offshore challenges such as faraway time zones, thick accents, and high turnover affecting communication and service quality.

“While companies may initially go to Costa Rica for cost, they find this treasure trove of talent in key areas like finance and accounting, HR, and IT and start expanding from there,” Sayewitz said. “Another factor is that back-office jobs in the U.S. trend toward a younger workforce that is not satisfied with this type of work, while in Latin America, these are considered amazing jobs. When companies see they’re getting access to strong talent who is motivated and has a better ability to collaborate, you end up with a higher customer satisfaction rating.”

3. Continuous improvement and innovation mindset

A high-level shift is happening in shared services and outsourcing that has many business leaders rethinking their operating models.

Long a powerful solution for standardizing transactional tasks and lowering costs, enterprises are now looking to shared services to provide strategic value. Deloitte’s 2024 outsourcing survey reports that 67% of enterprise leaders have adopted strategic outsourcing solutions that combine lower costs with the ability to design and execute digital strategies, provide actionable insights, deliver more advanced process tiers, and structure an outcome-driven approach. Only 29% opted for traditional, transactional solutions solely focused on cost reduction.

Webinar Recap

Latin America’s Shared Services & Outsourcing Industry Revealed: Insights from the SSON/Auxis Market Report

Here’s the thing: offshore solutions typically offer a value proposition based on labor arbitrage, requiring high-volume, standardized solutions to work. While nearshore providers offer significant cost savings, their greatest value stems from driving operational excellence – bringing the flexibility to tailor solutions to business needs, optimize operations, and drive continuous improvement.

Boosting efficiency and innovation through technology is also a top priority, with tech adoption averaging 9% higher at LATAM shared services than other regions across critical tech like analytics, Robotic Process Automation (RPA), and Intelligent Document Processing (IDP), the SSON/Auxis report found. Emerging technologies like Generative AI (GenAI) are another key focus – being evaluated, piloted, or implemented by nearly 80% of LATAM SSOs.

In fact, while availability of automation/AI skills is a top 2 concern for other regions, with 60% of GBS and enterprise leaders saying they are “very concerned” or “concerned” on the SSON/Auxis survey, it ranked as the lowest concern in LATAM – cited by 29% of survey respondents.

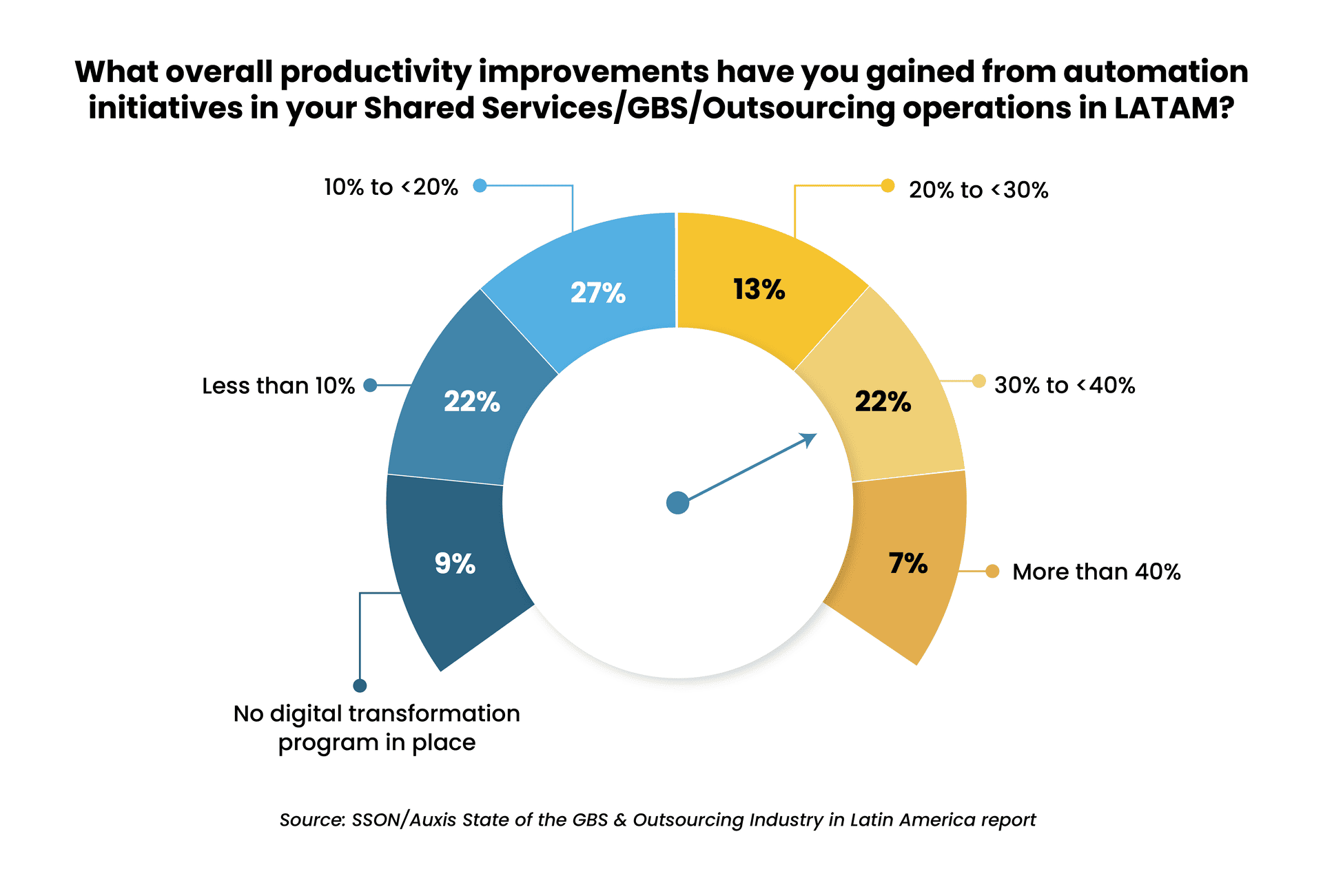

Organizations with nearshore shared services are reaping the benefits: 42% report productivity gains of 20%-plus from automation in addition to labor savings. Many times, companies use the labor savings from outsourcing to self-fund their innovation programs.

In the webinar, Sayewitz explains how Auxis helped a leading restaurant operator innovate, implement, and deliver a revolutionary virtual approach to brand audits that triggered a revenue lift of 8.5-12.5% at participating stores, overall customer satisfaction scores increasing to 98%, and store touches jumping from 126 to 7,000 per year.

“This program, started over three years ago, really highlights the out-of-the-box thinking and capability model you can deploy when you have the ability to collaborate on a daily basis with your team,” Sayewitz said.

4. Ability to support more complex processes

As comfort levels with remote work continue to increase, businesses have started outsourcing more complex processes that require critical-thinking skills.

With technology changing faster than possible adoption timelines, enterprises also realize that the traditional approach of outsourcing a single, fragmented slice of a process often fails to create the right impact. Instead, they are increasingly turning to partners with the sophistication to own and drive excellence across end-to-end processes.

Amid this market shift, Latin America has emerged as a leading solution for North American companies, with the ability to support more complex processes cited as a top advantage over Asia and Europe by 81% of enterprise and GBS leaders on the SSON/Auxis report. The location and business culture of nearshore markets are more conducive to delivering judgment-intensive work for U.S. enterprises, empowering real-time collaboration, decision-making at every level, and more flexible service delivery that reduces reliance on internal teams.

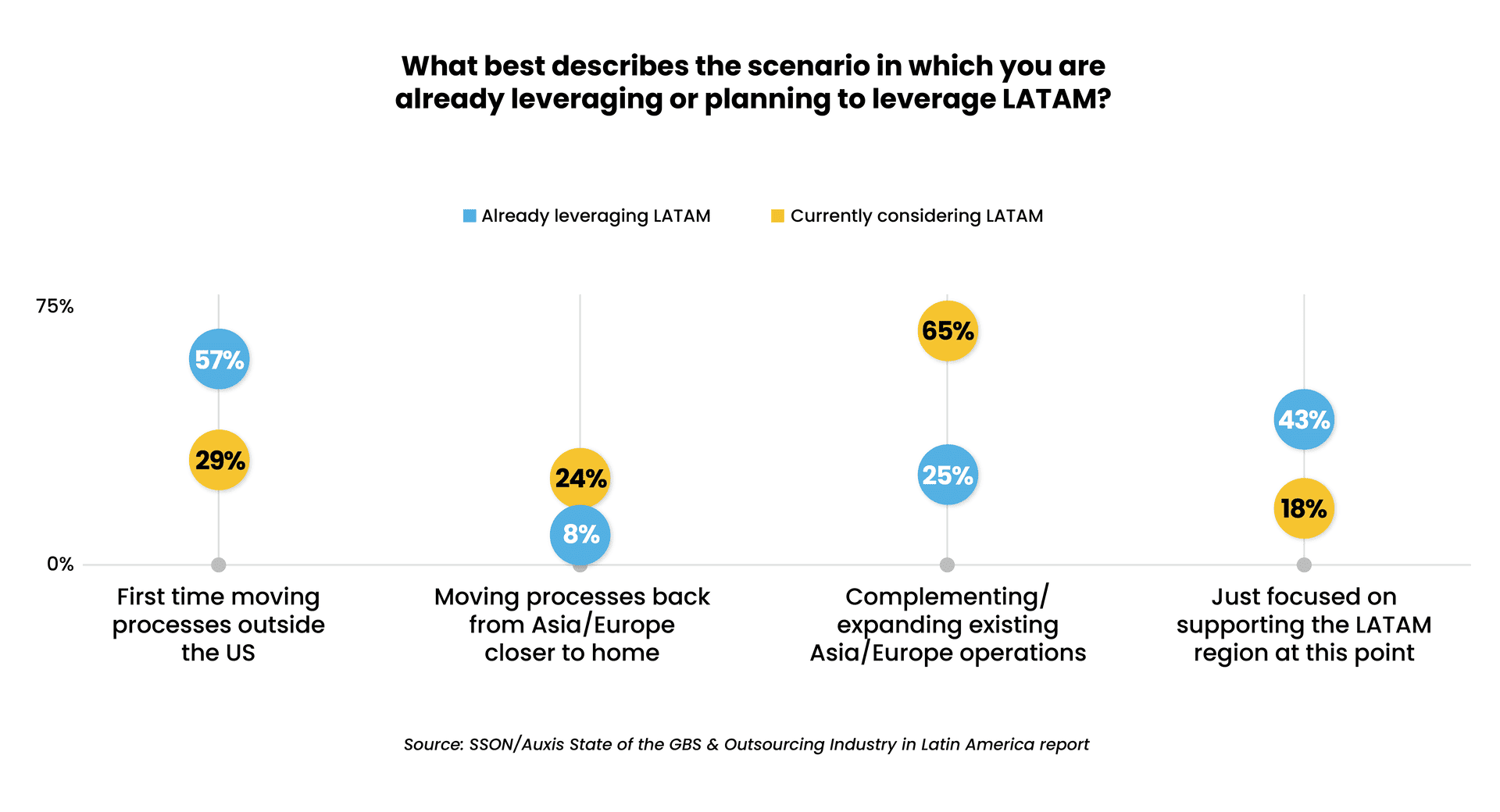

While 57% of organizations currently operating in Latin America moved processes outside the U.S. for the first time, LATAM’s ability to support more complex work is creating a new value proposition. Today, 65% of those evaluating the region are looking to complement or expand existing operations in Asia or Europe, the SSON/Auxis report found – whether that means accessing nearshore advantages for higher-value processes or diversifying their portfolio to mitigate risk.

At the Auxis webinar, Liebross detailed how a leading healthcare provider had successfully outsourced transactional, back-office work to Asia. But its leadership team was concerned that its Asia-based solution lacked the right skillsets, geographic proximity, communication, and cultural alignment to successfully deliver a more advanced, judgment-intensive tier of processes.

By leveraging Auxis’ nearshore platform to tap into a top Latin American market with a highly educated population, the client was able to access the critical-thinking skills, outstanding English proficiency, and real-time communication needed to deliver complex, time-sensitive processes without constant support from its internal teams. With operations in both India and Latin America, this client found that the productivity of 1 LATAM team member was equal to 1.4 FTEs in India.

“Some processes in Asia can run as smooth as silk, but for the type of activities where you really need immediate, direct communication or collaboration and the ability to not just do the same thing over and over, but to think more broadly about a transaction – our nearshore platform was able to be much more productive and effective,” Liebross said. “The value spoke for itself because of that productivity the client saw.”

5. Reliable infrastructure supports seamless remote teams

In today’s digital world, infrastructure reliability is critical to the success of shared services solutions, cited as another key factor for choosing LATAM by 85% of shared services and enterprise leaders in the SSON/Auxis report.

While Asian governments have worked to improve the country’s digital connectivity since service issues grabbed headlines during the pandemic – and the infrastructure within corporate parks is adequate – India and the Philippines present critical challenges to working remotely, states the latest Global Remote Work Index (GRWI) published annually by NordLayer.

Unfortunately, seamless remote work capabilities are essential to attracting top talent in the shared services and outsourcing industry – with hybrid work models cited as the #1 job priority for Gen Z, according to the 2025 State of the Shared Services & Outsourcing Industry Global Market Report by SSON Research & Analytics. More than 70% of shared services leaders globally report that 50+% of their workforce is hybrid.

India dropped 15 places to score 64th on the GRWI and the Philippines scored 68th, with internet speeds and infrastructure lagging behind most of the destinations evaluated. Meanwhile, Latin America’s top destinations have improved their GRWI rankings, with eight countries appearing as more attractive remote work destinations due to better policies, digital infrastructure, and living conditions that support hybrid work models successfully.

Besides enabling high-quality service delivery, LATAM’s stable infrastructure supports the shared services industry’s shift toward multi-location models as organizations look to mitigate risk and overcome labor challenges by combining top talent from different areas into a seamless nearshore team.

Nearly 40% of organizations said they currently operate in two LATAM countries or more in the SSON/Auxis report – and 50% of those evaluating the region plan to set up operations in two or more nearshore countries. For example, benefitting from the highly educated and mature talent market in Costa Rica for complex work and accessing the lower-cost, extensive, highly skilled workforce in Colombia for more transactional tasks.

“We’re seeing a big multi-country trend over the last few years, but it’s not just because companies are more open to remote workforce models than in the past,” said Fabiana Corredor, Auxis VP of Marketing & Growth. “It’s also because of the need to access larger pools of talent and tap into the strengths and skills of each market at the best possible price.”

Why Auxis: Capture nearshoring benefits with the nearshore pioneer

When cost savings is the top priority, shared services and outsourcing operations in Asia can provide value for transactional work. But what enterprises need from shared services is changing – and executives are increasingly looking beyond the lowest cost to drive the greatest value, efficiency, productivity, and performance in their business operations.

Auxis is a nearshore outsourcing pioneer recognized for a decade as a top outsourcing company globally on IAOP’s elite Global Outsourcing 100 list and by respected research analysts like Everest Group and ISG. Its multi-location platform has made it a top nearshore outsourcing company – leveraging the strengths of Costa Rica, Colombia, and Mexico to match customer demand.

Named the Foundational Partner of the Year for the Americas by the leading intelligent automation platform, UiPath, Auxis further supports its nearshore services with an exceptional ability to make AI and automation the cornerstone of business innovation and success.

Bringing more than a quarter-century of business transformation experience, large enterprise and middle-market companies rely on Auxis for the end-to-end capabilities and innovative solutions they need to achieve operational excellence.

Ready to learn more about nearshore outsourcing benefits? Schedule a consultation with our nearshore experts today! You can also download our reports, Nearshore vs. Offshore: Navigating the Hidden Hassles of Outsourcing to Asia and 2024 State of the GBS & Outsourcing Industry in Latin America to learn more about the opportunities and challenges of nearshore and offshore markets.

Frequently Asked Questions

What is the difference between offshore and nearshore outsourcing?

+Offshore outsourcing involves delegating business processes to distant countries like India or the Philippines, offering lower operational costs but creating potential challenges with time zones, communication, and cultural differences. Nearshore outsourcing involves working with providers in nearby countries, such as Latin America for U.S. businesses, enabling real-time collaboration, cultural alignment, and easier communication while still delivering cost savings. The choice between the two depends on factors like cost, efficiency, and operational needs.

How do nearshore and offshore outsourcing compare in terms of cost?

+Offshore outsourcing typically offers the lowest labor costs, as providers in regions like Asia often have lower wage structures. However, hidden costs such as time zone challenges, communication barriers, and extended turnaround times can impact efficiency – while high attrition is causing labor costs to rise in popular Asian locations like India. Nearshore outsourcing, while slightly more expensive, provides better alignment in time zones, cultural similarities, and real-time collaboration, often leading to higher productivity and fewer operational disruptions — which can ultimately deliver better long-term value.

What are the key nearshore outsourcing benefits vs. offshore outsourcing?

+Nearshore outsourcing offers several advantages over offshore outsourcing, including closer time zone alignment that enables real-time collaboration and faster issue resolution. Cultural and language similarities improve communication and reduce misinterpretations. Additionally, nearshore locations often provide easier travel access for on-site visits and strong data security regulations aligned with North American and European standards. While offshore outsourcing can offer lower labor costs, nearshore outsourcing delivers higher efficiency, greater flexibility, and higher satisfaction ratings — making it a strategic choice for many businesses.

How does the talent pool differ between nearshore and offshore outsourcing?

+The talent pool in nearshore outsourcing often provides greater cultural and language alignment, making communication and collaboration smoother compared to offshore locations. Nearshore regions, such as Latin America for North American businesses, offer a growing base of highly skilled professionals in finance, IT, and HR, with education systems aligned to Western business practices. Business practices are also more closely aligned with the U.S., supporting successful delivery of judgment-intensive processes. Offshore outsourcing, while sometimes offering a larger talent pool at lower costs, may come with challenges like time zone differences, cultural gaps, and language barriers that can impact productivity and service quality.

What factors should I consider when choosing between nearshore and offshore outsourcing?

+When choosing between nearshore and offshore outsourcing, consider factors such as cost, communication, language and cultural compatibility, talent availability, and service quality. Nearshore outsourcing offers better real-time collaboration, cultural affinity, and easier travel, while offshore outsourcing may reduce costs but can come with operational challenges. Also, evaluate your specific business needs, industry regulations, and the complexity of tasks being outsourced to determine which outsourcing model best supports your strategic goals.