In brief:

- Asia-based outsourcing solutions can provide benefits for low-value transactional work, but these models bring challenges that can quickly offset cost savings.

- Interest in nearshore outsourcing is rising as talent shortages, advancing technology, and economic uncertainty prompt business leaders to look beyond the lowest cost to ensure the highest performance.

- As service complexity increases, Latin America offers strategic advantages like real-time collaboration, proven remote work models, and top talent that can be hard to achieve in Asia.

Asia is a leading destination for outsourcing low-value transactional work at bottom-of-the-barrel prices. But it’s no secret that Asia-based outsourcing models are rife with challenges that can quickly offset cost savings.

Demand for nearshore outsourcing is rising as talent shortages, accelerating digital transformation, and persistent geopolitical uncertainty prompt business leaders to look beyond the lowest cost to ensure the highest efficiency and performance.

“Change is coming,” Deloitte asserts in its 2022 Global Outsourcing Survey – calling Latin America “the up-and-coming region today.” As service demand becomes more complex, Latin America offers top-tier business and technology talent, real-time collaboration, cultural alignment, strong English proficiency, robust infrastructure, and lower turnover that can be difficult to achieve at the other end of the world – and are fundamental to delivering business and IT processes across the value chain.

Geopolitical risk and serious infrastructure issues spotlighted by the pandemic are also raising concerns about over-reliance on outsourcing models in India and the Philippines. A growing number of enterprises are diversifying their outsourcing locations to mitigate risk, expanding into top markets closer to home where highly skilled talent with strong English proficiency and proven remote work models are readily available.

Download our report, “Nearshore vs. Offshore: Navigating the Hidden Hassles of Outsourcing to Asia,” for a deep dive into the challenges and benefits of nearshore vs. offshore outsourcing.

6 reasons U.S. companies are rethinking outsourcing to Asia

Consider these key factors driving the emergence of Latin America as a heavyweight contender on the global outsourcing stage:

Nearshore vs. Offshore: Navigating the Hidden Hassles of Outsourcing to Asia

1. The real burden of the faraway time zone

10 hours and 30 minutes. That’s how many hours India sits ahead of New York. And it can make a tremendous difference when urgency or collaboration matters, with Asia-based offshore teams sometimes taking more than 24 hours to fix an issue or respond to business requests via choppy, prolonged email exchanges.

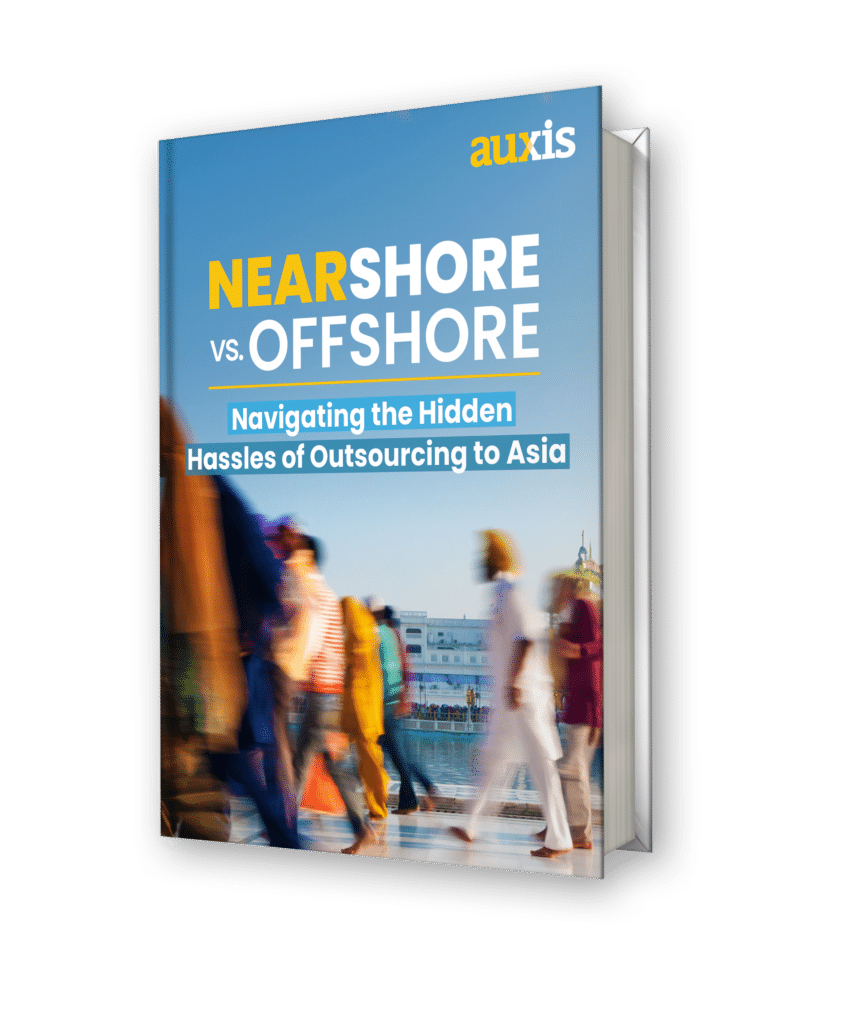

- Physical proximity ranked as the #1 factor for choosing an IT outsourcing provider on the 2023 IT Outsourcing Statistics report by Computer Economics – even if a lower cost could be realized in a more distant location.

- Demanding real-time communication from Asia-based outsourcers doesn’t necessarily fix the problem. Asia’s saturated job markets leave offshore providers struggling to hire and retain high-level, “A team” resources for overnight shifts that match U.S. business hours, leading to quality concerns and increased labor costs.

- With day-long flight durations, most executives fly business class to visit Asian outsourced teams – averaging $10,000+ per ticket. With the significantly shorter flight duration falling outside most company requirements for business class fares, organizations can fly 20 people to Costa Rica for that price.

Why does LATAM offer a better alternative?

Learn more about why enterprises are increasingly turning to geographically close outsourcing – and key benefits for your business – by downloading our report: “Nearshore vs. Offshore: Navigating the Hidden Hassles of Outsourcing to Asia.”

2. Cultural differences can affect outsourcing results

Cultural differences contribute to the failure of more than 70% of international ventures, according to a Business Standard report. Seemingly minor discrepancies in approaches to completing tasks, communication styles, attitudes toward conflict, and decision-making can create major pain points between USA- and Asia-based teams – sparking miscommunication and misunderstandings.

- Indian business culture is typically hierarchical, with decision-making top-down, states a UK India Business Council report. Unfortunately, that approach can impact an organization’s ability to achieve expected benefits from outsourcing, with a Global Business Culture consultancy report noting that U.S. executives often complain that Indian teams don’t take enough initiative or venture outside their box.

- Latin America’s geographic proximity and common European roots drive close alignment with U.S. culture, work ethics, and business approach – helping nearshore outsourcers integrate seamlessly into internal teams.

- Kearney’s 2023 Global Services Location Index (GSLI) scores top LATAM markets like Costa Rica, Colombia, and Mexico above India and the Philippines for business environment, measuring cultural, political, economic, and regulatory factors that impact the ease of doing business.

Learn more about how cultural differences can impact an outsourcing partnership – and how Latin America enables seamless integration of outsourced teams – by downloading our report: “Nearshore vs. Offshore: Navigating the Hidden Challenges of Outsourcing to Asia.”

3. LATAM’s top-tier talent supports complex process delivery

A high-level shift is happening in outsourcing that’s swinging the pendulum toward nearshore providers. While Deloitte’s outsourcing survey reported that 32% of enterprise leaders plan to increase their budget for traditional, transactional solutions solely focused on cost reduction, 67% said they are increasing budgets for next-gen, strategic outsourcing partnerships that combine lower costs with the ability to design and execute digital strategies, provide actionable insights, deliver more advanced process tiers, and structure an outcome-driven approach.

Nearshore markets have emerged as a top choice for cost-effective IT and BPO solutions that lower costs without sacrificing quality:

- Deep pools of highly educated resources in LATAM alleviate U.S. labor shortages with the critical-thinking skills, certifications, and strong English proficiency to deliver advanced tiers of business and IT work.

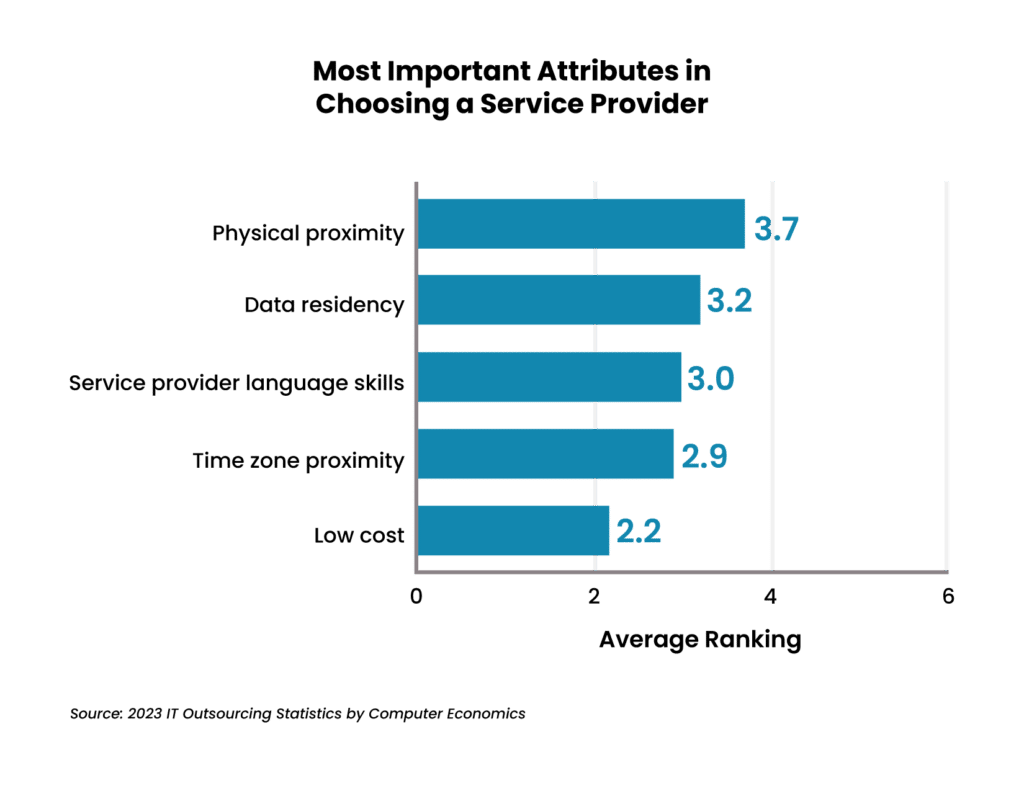

- India’s talent competitiveness has decreased every year since 2020 on the World Economic Forum-endorsed Global Talent Competitiveness Index. The chart below shows how Latin America’s talent competitiveness outpaces Central and Southern Asia in every area:

- Latin America emerged as the hottest region for global companies looking to add resources across industries in 2022, with Colombia among the most-targeted countries, according to Deel’s State of Global Hiring Report.

Discover what’s fueling the widening talent gap between Asia and Latin America – and specific country rankings for talent competitiveness – by downloading our report: “Nearshore vs. Offshore: Navigating the Hidden Hassles of Outsourcing to Asia.”

4. Asia’s notoriously high turnover impacts savings and performance

Finding and keeping top-tier talent at bottom-of-the-barrel prices is a tall order in Asia’s saturated job markets – and the region’s notoriously high turnover is chipping away at cost savings and performance. The bottom line: While nearshore salaries may start slightly higher than some offshore locations, the total cost of nearshoring can be lower once you consider Asia’s hidden costs like travel expenses, lower productivity, quality control, and high turnover.

- More than 60% of Indian workers say they are likely to change employers within the next 12 months – higher than any other country (PwC’s India Workforce Hopes and Fears Survey 2023).

- EY’s latest shared services center (SSC) survey on Colombia stated that 41% of the country’s SSCs experienced turnover below 5% – and 70% had turnover below 10%.

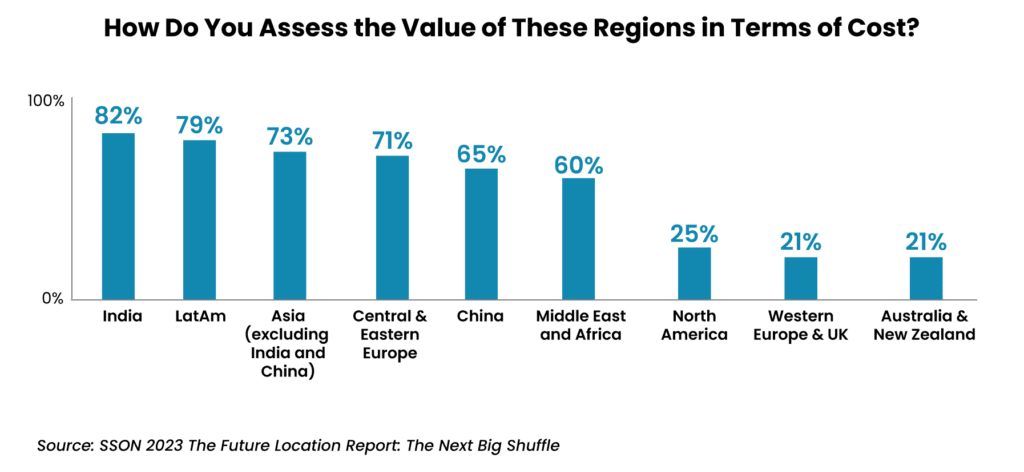

- Shared services leaders assess the value provided by Latin American markets as very similar to India – and ahead of other Asian locations like the Philippines, states the Shared Services & Outsourcing Network (SSON)’s 2023 The Future Location Report: The Next Big Shuffle.

Take a deeper dive into nearshore vs. offshore turnover and cost savings – and the factors behind each region’s market conditions – by downloading our report: “Nearshore vs. Offshore: Navigating the Hidden Hassles of Outsourcing to Asia.”

5. 13 LATAM countries outperform India for English proficiency

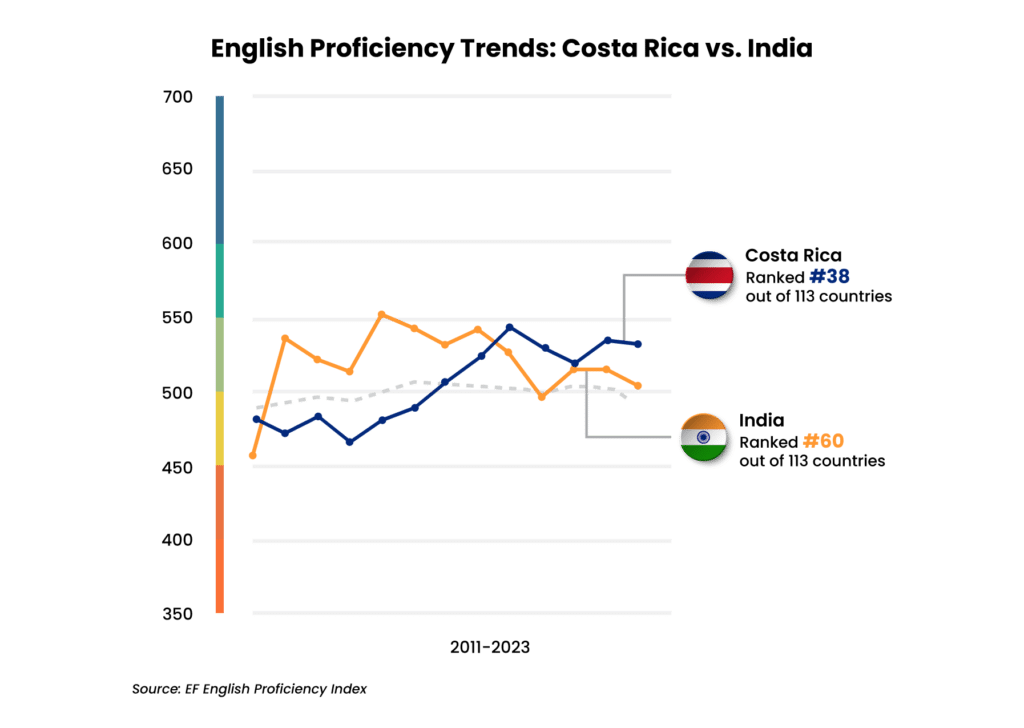

There’s a common misperception among western countries that most Indians speak fluent English. Here’s the reality: While India boasts an estimated 140 million English speakers – roughly 10% of its sizable population – its level of proficiency has been slowly declining over several years, especially among young people, states the 2023 EF English Proficiency Index (EPI).

- India ranks 60th globally on the 2023 English Proficiency Index, down from 21st globally in 2013.

- English proficiency scores across Latin America are on the upswing, with 13 LATAM countries outperforming India. Central America’s fluency levels improved more than any other region in the world over the past decade and South America’s proficiency is also steadily improving.

- Even Latin American countries with lower EPI scores overall still showed strong proficiency within major cities. For instance, Medellín, Colombia earned an EPI score of 500, outpacing the proficiency score of 451 in Delhi, one of India’s top outsourcing destinations.

Learn more about the realities of English proficiency in Latin America and India – and what’s driving the shift – by downloading our report: “Nearshore vs. Offshore: Navigating the Hidden Hassles of Outsourcing to Asia .”

6. Asia’s sub-par infrastructure hinders remote work

The pandemic underscored the sub-par infrastructure that exists outside corporate parks in offshore markets like India. But while Asian governments have worked to improve their infrastructure since 2020, India and the Philippines still rank among the worst countries to work remotely, according to the World Economic Forum-endorsed 2023 Global Remote Work Index (GRWI) published annually by NordLayer.

- India dropped 15 places to score 64th on the 2023 Global Remote Work Index and the Philippines ranked 68th.

- In an analysis of the GRWI, India’s Economic Times newspaper wrote: “The internet connection in India is neither affordable nor good quality.”

- Eight Latin American countries rank as more attractive remote work destinations than India and the Philippines on the 2023 GRWI.

Learn more about infrastructure reliability in Latin America vs. Asia and discover internet speeds by city by downloading our report: “Nearshore vs. Offshore: Navigating the Hidden Challenges of Outsourcing to Asia.”

Download our nearshore vs. offshore report!

Outsourcing is a major transformation initiative – especially for businesses starting a journey. Learn everything you need to know to make an informed decision about nearshore vs offshore outsourcing by downloading our “Nearshore vs. Offshore: Navigating the Hidden Challenges of Outsourcing to Asia” report.

You will discover:

- Challenges and benefits of top outsourcing locations

- Time differences and travel times between top destinations and the U.S.

- Real-world case studies

- Why seemingly minor cultural differences can have big impact on outsourcing partnerships

- The widening talent gap between Asia and Latin America

- The reality of attrition and cost savings in nearshore vs. offshore markets

- English proficiency levels in India vs. LATAM – including a city-by-city breakdown

- The world’s best and worst locations for remote work – including internet speeds by city

- What to look for in a strategic outsourcing partner

Want to learn more about the benefits of nearshore outsourcing to Latin America? Schedule a consultation with our nearshore experts today! You can also download a complimentary copy of Everest’s 2023 PEAK Matrix for Finance and Accounting Outsourcing to discover why Auxis is a Major Contender and Nearshore Leader. Or, visit our resource center for nearshore outsourcing tips, strategies, and success stories.