In brief:

- The “2024 State of the GBS & Outsourcing Industry in Latin America” report released by SSON Research & Analytics and Auxis fills the information void about the strengths, challenges, and opportunities of the LATAM shared services market.

- High satisfaction levels with Latin American SSOs stem from factors including real-time communication, talent quality, and continuous improvement and innovation.

- Latin America is increasingly being leveraged as an extension to offshore – boosting access to talent in a similar time zone, performing complex processes that require real-time collaboration, and mitigating risk.

- Learn why companies of all sizes are realizing greater value as they perform the same functions as Asia, but with greater scale in Latin America.

The challenges of outsourcing to Asia – saturated labor markets, faraway time zones, infrastructure challenges, and cultural and language barriers – have only been exacerbated as a result of today’s geopolitical climate. As a result, Latin America has emerged as a preferred shared services destination for North American companies over the past five to 10 years.

Ninety percent of global business services (GBS) leaders said they either operate in LATAM or plan to within the next three years, according to a new survey from Auxis and Shared Services Outsourcing Network (SSON) Research & Analytics. And 96% of Latin American shared services organizations (SSOs) plan to expand or maintain their level of service – significantly more than other regions.

But for companies looking to explore outsourcing in the region, there is not a lot of information about the opportunities Costa Rica, Colombia, Mexico, and other top markets present. Until now.

This new report, “2024 State of the GBS & Outsourcing Industry in Latin America,” was developed to fill the information void about the LATAM market for any organization experiencing cost escalation, talent challenges, and the need for more customer-centric solutions to improve productivity and efficiency in their operations. It updates the Latin America study Auxis conducted in 2016, offering new and important insights into the region’s strengths, challenges, and opportunities.

We’ve highlighted some of the key results, based on data gathered from 150 global service delivery executives across industries and geographies, to help you understand what the region offers and why more companies are starting or complementing existing outsourcing operations in Latin America.

To read the full report, download here.

Here is an overview of 10 key findings from the report:

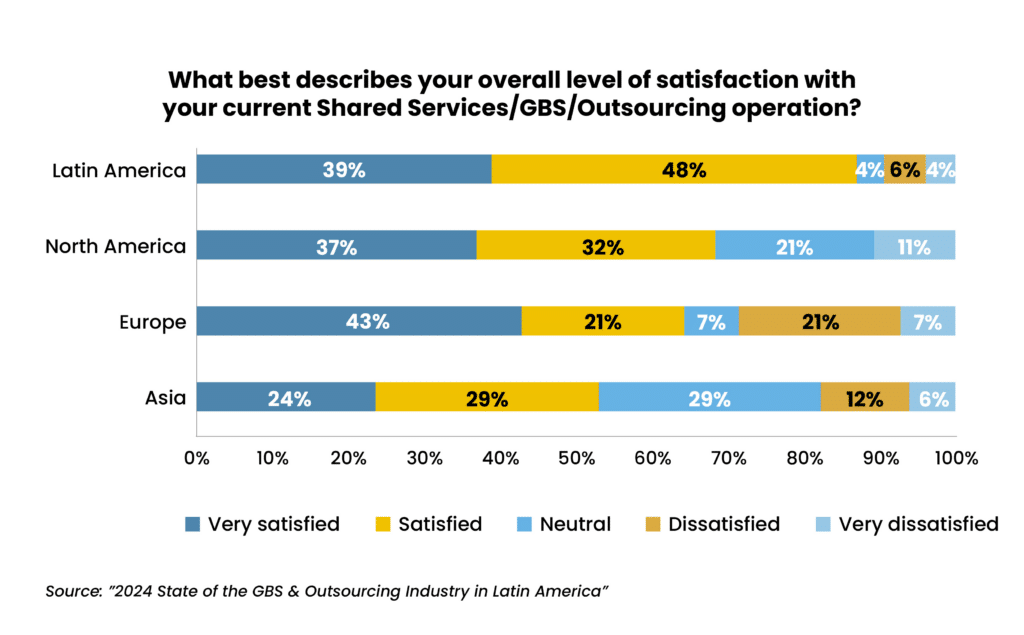

1. LATAM brings highest satisfaction levels vs. other regions

Eighty-seven percent of survey respondents are either “satisfied” or “very satisfied” with their shared services operation in Latin America, compared to 69% for North America, 64% for Europe, and 53% for Asia.

This represents an 18% increase from the 74% of respondents who reported being “satisfied” or “extremely satisfied” with their decision to move towards LATAM shared services in 2016.

The latest survey also probed beyond overall satisfaction, with more than 60% of respondents expressing high satisfaction with their LATAM SSOs across key evaluating factors: service quality (85%), talent (83%), cost (70%), and innovation (62%). Clearly, as more companies are heading to the region to set up shared services operations, they are realizing the benefits they expect to achieve and more in Latin America.

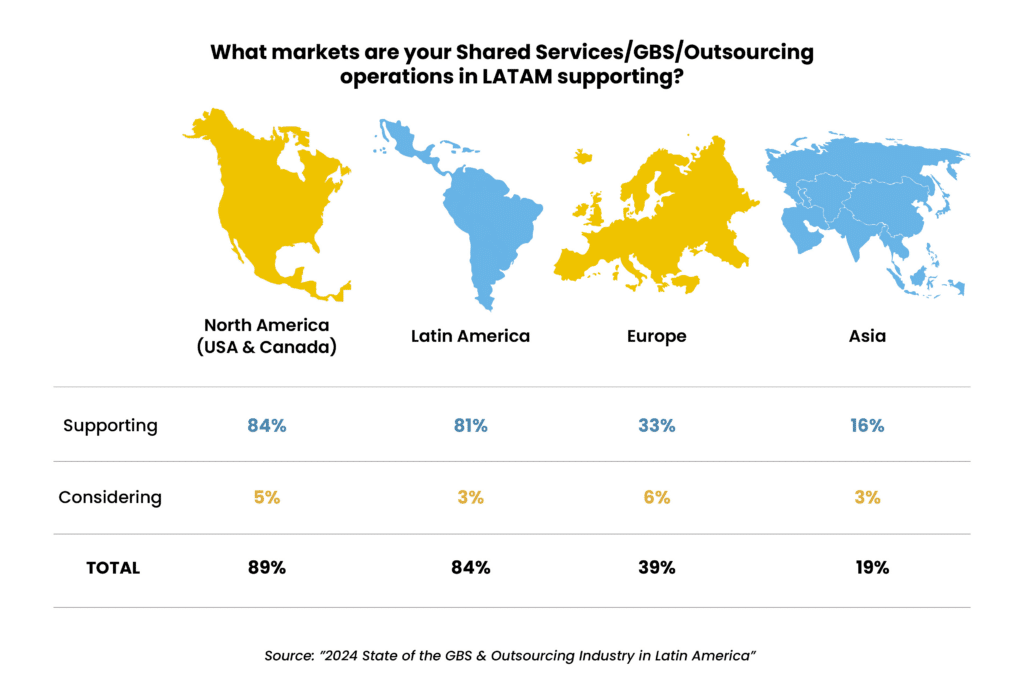

2. North America is the #1 market supported

It’s no surprise then that Latin America is one of the fastest-growing regions for shared services and outsourcing today. Compared to 2016, when 44% of LATAM SSOs serviced North America, 84% of operations currently support North America – nearly doubling in less than a decade to make it the #1 region Latin America supports.

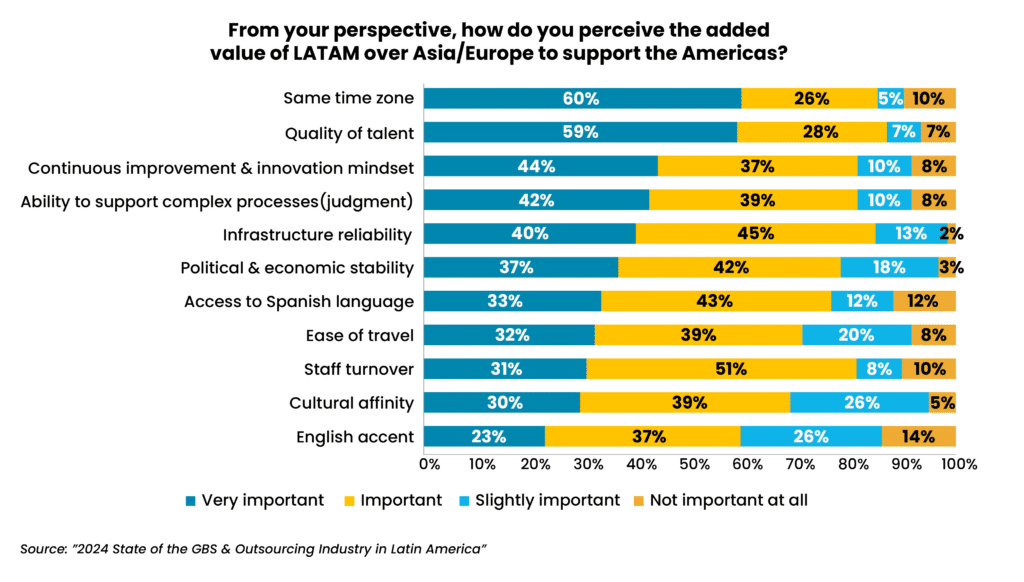

But why has Latin America become North America’s preferred destination for shared services and outsourcing? When considering what organizations ranked “very important,” in terms of the added value LATAM brings them over Asia and Europe, the top five factors include:

- Same time zone (60%)

- Quality of talent (59%)

- Continuous improvement & innovation mindset (44%)

- Ability to support more complex processes (42%)

- Infrastructure reliability (40%)

Three of these five reasons highlight LATAM’s top-tier talent. Latin America’s shared services industry evolved rapidly from purely transactional activities to a broad range of higher value-add services that include performance of judgment-intensive processes and acceleration of strategic tech adoption.

While more than 60% of survey respondents deemed all the factors listed in the chart above as “important” or “very important” for choosing LATAM over Asia and Europe, other critical reasons include cultural affinity (69%), lower turnover (82%), ease of travel (71%), and English accent (60%).

These findings are underscored by the “2023 IT Outsourcing Statistics” report by Computer Economics. It found physical proximity is the #1 reason for choosing an outsourcing provider due to reduced operational challenges – and cost is the lowest factor.

What’s more, English proficiency ranked as the #3 factor in the same report. While India boasts an estimated 140 million English speakers – roughly 10% of its sizable population – its level of proficiency has been slowly declining over several years, especially among young people, according to the “2023 EF English Proficiency Index (EPI)”.

By comparison, 13 Latin American countries outperformed India for English proficiency on the 2023 EPI – emphasizing LATAM’s ability to support North American business operations successfully.

3. Companies turn to LATAM for first-time ventures outside the U.S. and to complement offshore operations

The reasons organizations are turning to LATAM are also expanding. Most companies already established in Latin America – the “early adopters” of nearshoring – leveraged the region to move processes outside the U.S. for the first time (57%).

2024 State of the GBS and Outsourcing Industry in Latin America

But for those not operating in LATAM but evaluating doing so, 65% want to complement and expand existing offshore operations; 24% plan to reduce Asia-based operations by shifting work to Latin America; and the remaining 29% are considering moving processes outside the U.S. for the first time.

The takeaway: Latin America is increasingly being leveraged as an extension to offshore. It boosts access to talent ranging from finance to HR to software development outsourcing. It also supports more complex processes that require real-time collaboration and communication, and mitigates risk by diversifying shared services locations.

With increased geopolitical and location risk considered a top five enterprise challenge in Everest Group’s “Evolution of Finance Organizations in 2024” report, finance leaders ranked “business proximity” and “a well-balanced shoring mix” as top areas of strength and must-have capabilities for outsourcing companies.

4. LATAM’s substantial value offers an alternative to Asia’s hidden costs

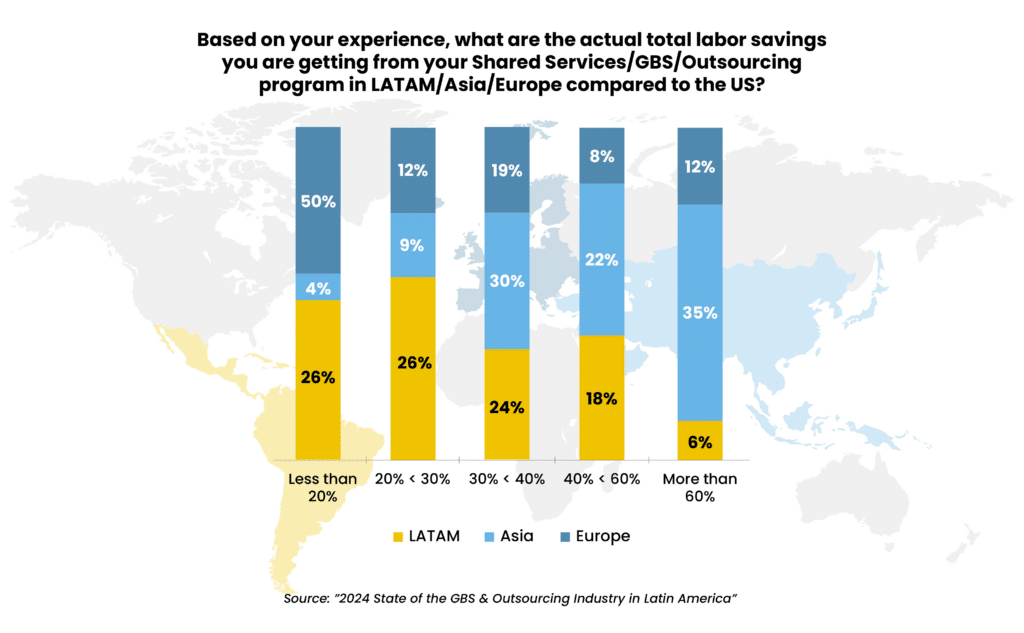

Cost savings continue to be one of the main business drivers for shared services and outsourcing programs. But while Asia traditionally offers the lowest costs, LATAM’s savings are still significant for U.S. enterprises.

Eighteen percent of organizations operating in LATAM report labor savings of at least 40% compared to the U.S., while half report savings in the range of 20-40%.

There’s also more to consider.

Nearshore salaries may start slightly higher than some offshore locations, but the total cost of nearshoring can be lower once you consider the additional value of LATAM’s advantages that drive greater efficiency and performance – as well as Asia’s hidden costs like travel expenses, lower productivity, quality control, and high turnover.

The reality is costs across the ocean are rising. India’s business process outsourcing (BPO) industry averaged 10% median salary increases in 2023 to combat alarmingly high attrition, according to WTW’s 2023 Salary Budget Planning report. Asia’s saturated job markets leave offshore providers struggling to hire and retain high-level, “A team” resources for overnight shifts that match U.S. business hours, leading to quality concerns and increased labor costs.

Latin America’s shared or similar time zones, however, enable top-tier outsourced teams to connect seamlessly with North American enterprises. Naturally aligned work schedules foster in-sync communication, fewer delays, and effective, real-time collaboration on IT projects and business processes.

Additionally, while Asian locations rank highest for financial attractiveness on Kearney’s “2023 Global Services Location Index,” Latin America’s labor arbitrage is not far behind. For example, Colombia’s financial attractiveness score was only about a tenth of a point different from the Philippines.

Further, shared services leaders assess the value provided by Latin American markets as very similar to India – and ahead of other Asian locations like the Philippines, according to SSON’s “2023 The Future Location Report.”

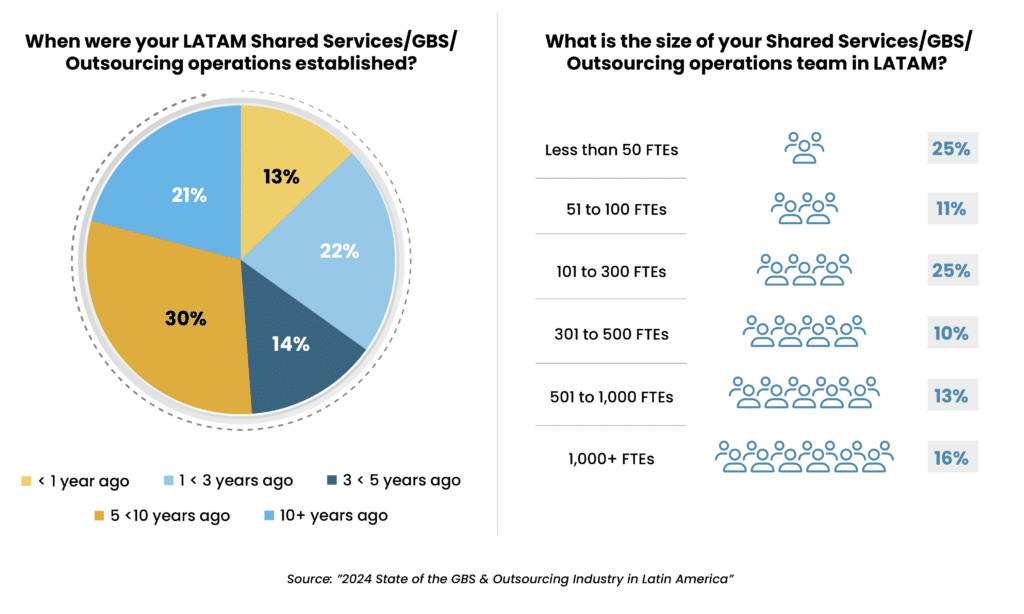

5. Latin America appeals to SSOs of all sizes and scale

In terms of headcount, the SSON/Auxis research shows LATAM centers of all sizes, from less than 100 FTEs (36%) to 100-500 FTEs (35%), and more than 500 FTEs (29%). This confirms that organizations across all revenue ranges, including small to mid-market, could be leveraging the power of nearshoring regardless of their scale.

Even large, multi-billion-dollar companies are starting GBS pilots in the region with small footprints and growing over time.

Over half of shared services operations in Latin America have been established for more than five years (30% for five to 10 years and 21% for more than a decade), which is testament to the sustainability and success of the nearshore model. At the same time, the region is still growing, with 35% of shared services having been established less than three years ago, and 14% between three and five years.

6. Outsourcing is on the rise – and hybrid is the most popular shared services model

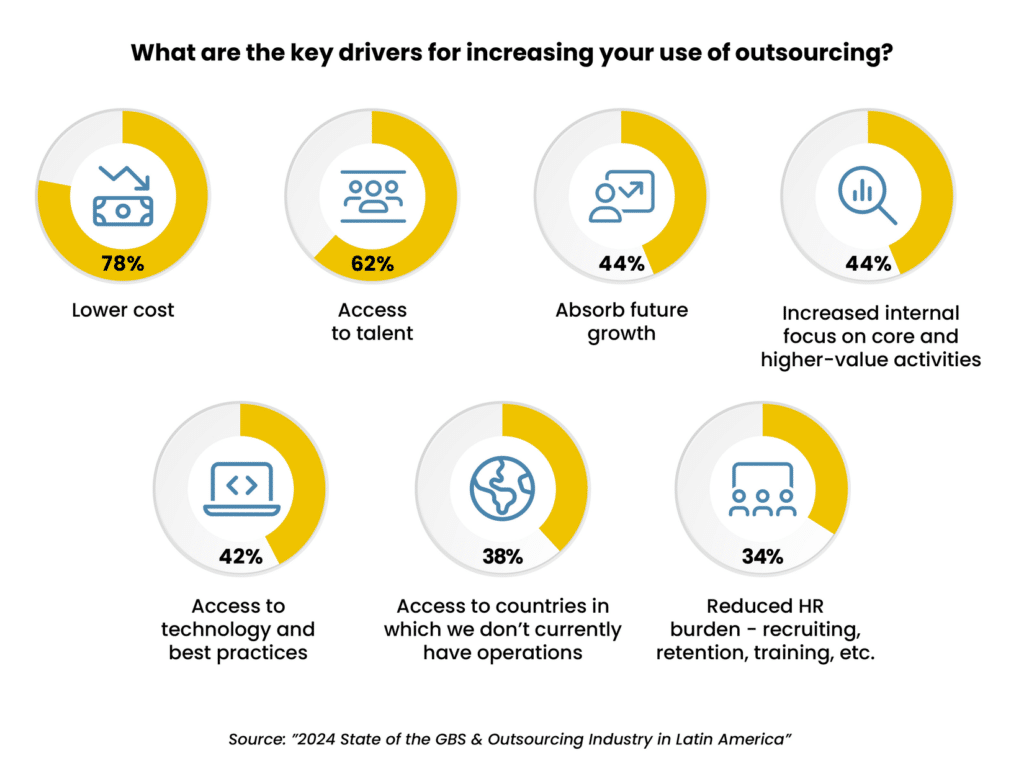

Demand for outsourcing continues to increase – from those new to outsourcing as well as those already outsourcing. Fifty-two percent of GBS plan to increase their use of outsourcing mainly to reduce costs, expand access to talent, and absorb growth.

As a result, the most common shared services sourcing model is the “hybrid” approach, with 58% of organizations combining captive (in-house) and outsourcing strategies into their operations. Of the remaining respondents, 37% operate fully captive models, and 5% have adopted a fully outsourced approach.

7. Nearshore enables greater process scale

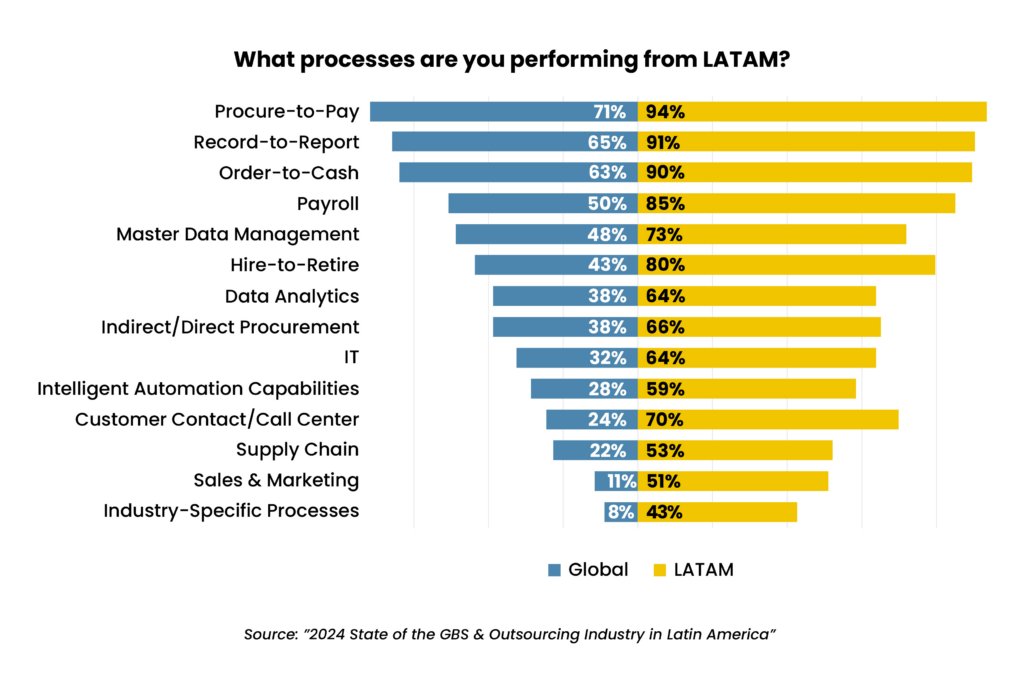

LATAM GBS are performing the same functions as Asian locations like India, but on a greater scale. This holds true for common processes such as Procure-to-Pay (performed by 94% of LATAM shared services organizations vs. 71% of global shared services), and Order-to-Cash (90% LATAM vs. 63% globally).

Further, the region’s capabilities extend to less-common processes that are more complex and require a higher level of judgment, such as data analytics (64% LATAM vs. 34% globally), IT (64% LATAM vs. 32% globally), HR (80% LATAM vs. 43% globally) and intelligent automation capabilities (59% LATAM vs. 28% globally).

This greater scale supports quality service delivery, creating deep pools of experienced talent. It also speaks to confidence in nearshore talent and real-time collaboration – a driving factor in why North American organizations are shifting their focus to LATAM.

8. Reality beats perception when it comes to LATAM concerns

What’s keeping companies from outsourcing to Latin America?

For organizations not yet leveraging nearshore delivery, the primary barrier for nearly half (48%) is a lack of knowledge about Latin America’s capabilities, particularly for supporting North America. Despite the growth of the nearshore outsourcing market in recent years, many North American executives are still unaware of the value LATAM has to offer as a potential alternative to traditional Asia destinations such as India and the Philippines.

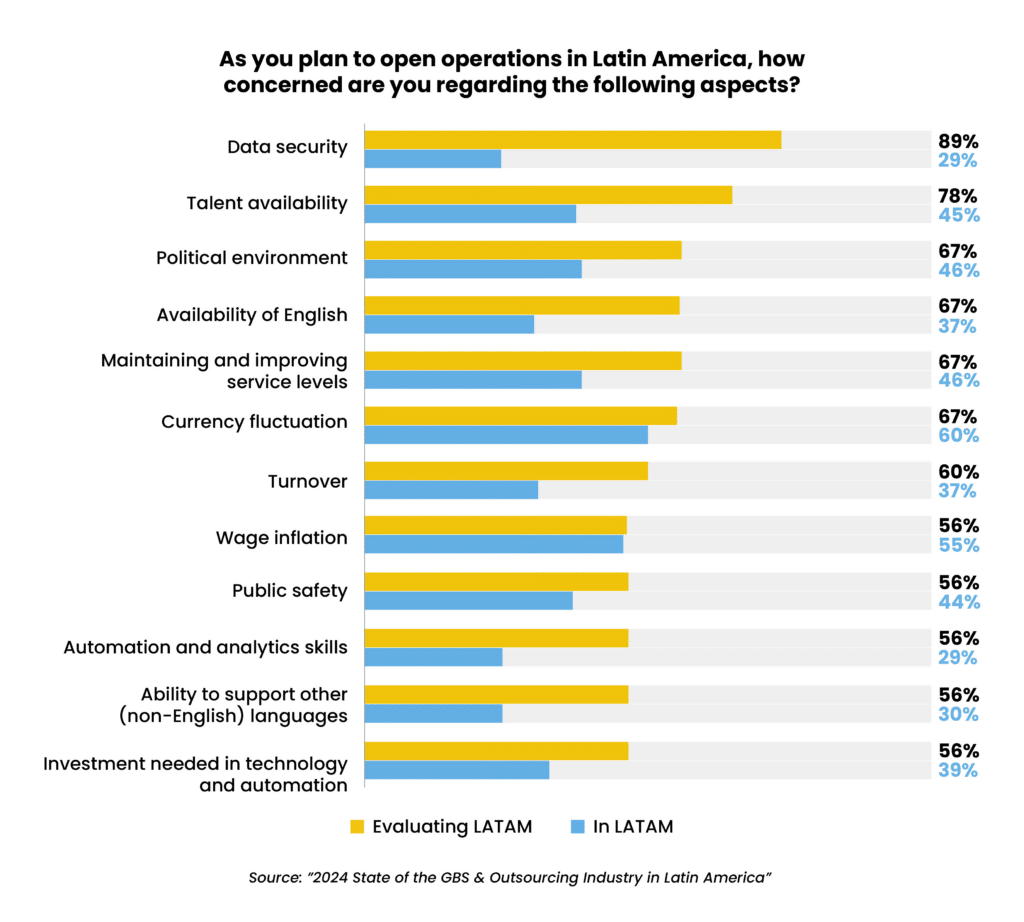

What’s more, for organizations planning to set up operations in Latin America, concerns about the region don’t measure up to the true experience. For example, while 78% of organizations evaluating Latin America cite talent availability as a top concern, less than half of those already operating there share this worry. Similarly, data security is a concern for 89% of potential entrants, yet only 29% of those operating in the region consider it an issue.

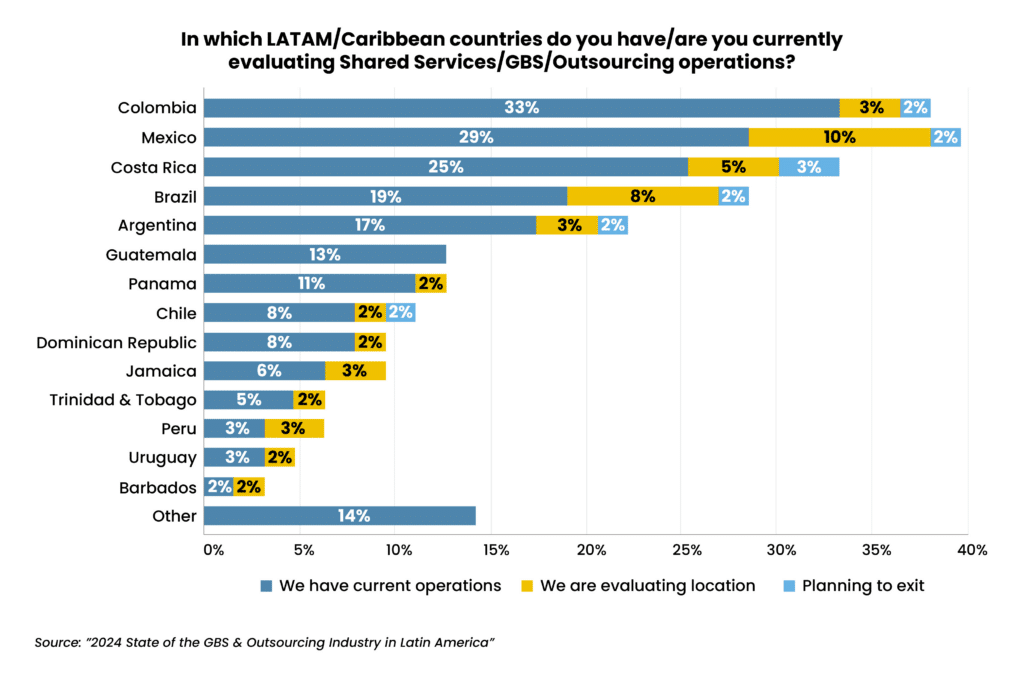

9. Colombia, Mexico, and Costa Rica rank as top nearshore markets

Colombia, Mexico, and Costa Rica have emerged as the top LATAM markets for nearshoring, according to the survey. In fact, 350 multinational organizations have already established operations in Costa Rica and 200 have set up shop in Colombia. These outsourced workforces are very familiar with North American work culture and regulations – adding to the benefits of nearshoring.

These countries are also among the top countries being evaluated by organizations considering operations in LATAM, with 44% evaluating Mexico, 37% Colombia, and 22% considering Costa Rica, the SSON/Auxis survey found.

The reasons are not difficult to decipher. Costa Rica’s high-level talent boasts the latest technologies and best practices for driving automation, optimizing operations, and achieving peak performance. Trained by one of the top educational systems in LATAM with the second-highest English proficiency, the Costa Rica workforce delivers the critical-thinking skills and easy communication that’s needed as companies start to outsource more complex activities.

Costa Rica and Mexico rank among the 10 most preferred shared services destinations globally on Deloitte’s “2023 Global Shared Services & Outsourcing Survey.”

Mexico further joins Colombia on the “2024 IMD World Talent Ranking,” ranking first and second, respectively, among Latin America’s top markets for availability of skilled talent. With the third-largest workforce in Latin America, Colombia offers potential for scalable operations in six cities with more than 1 million inhabitants and 15 with 500,000+. Mexico recently replaced Brazil as the largest market for digital talent in LATAM on the CBRE “Scoring Tech Talent 2024” report.

Colombia and Mexico rank high on the “Kearney Global Services Location Index” as well – recently edging out the Philippines.

10. LATAM offers greater tech adoption and productivity gains

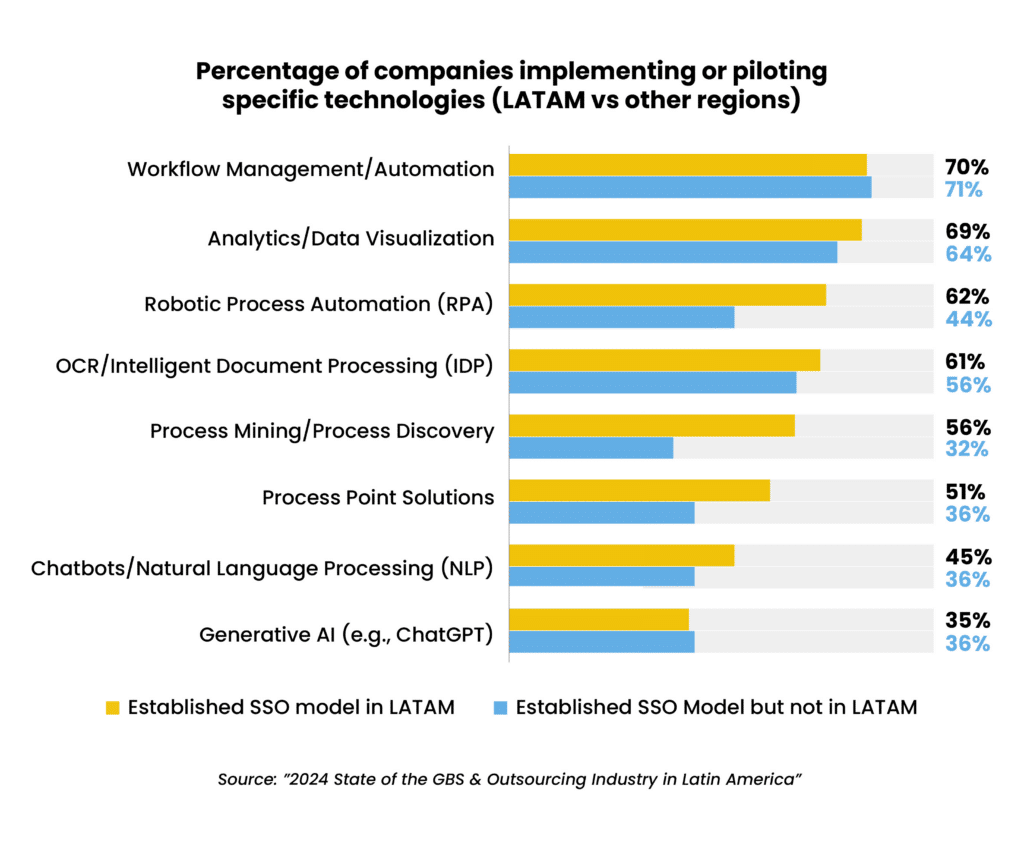

Tech adoption averages 9% higher at LATAM GBS across critical technology, including analytics, robotic process automation (RPA), and Intelligent Document Processing (IDP).

The four most mature technologies in LATAM include workflow automation, Intelligent Document Processing (IDP), robotic process automation (RPA), and analytics. More than 62% of the region’s SSOs have either implemented these technologies or started to pilot them. Emerging technologies like Generative AI are also a priority – being evaluated, piloted, or implemented by nearly 80% of LATAM SSOs.

And organizations with shared services in LATAM are reaping the benefits: 42% report productivity gains of 20%-plus from automation in addition to labor savings.

The maturity of LATAM’s technology landscape was reaffirmed by the “2023 Global Remote Work Index” (GRWI). Eight top LATAM destinations significantly outperformed the Philippines and India in the GRWI, emphasizing LATAM’s ability to support cloud-based shared services and outsourced operations successfully.

India and the Philippines ranked among the lowest globally for infrastructure quality (i.e., poor internet speeds that make remote work difficult) in the 2023 GRWI, with India’s own Economic Times newspaper writing, “The internet connection in India is neither affordable nor good quality.”

Why Auxis: Pioneering the nearshore outsourcing model

Establishing shared services operations in Asia may fill the bill when cost savings are paramount and the type of work needed is largely transactional. But what enterprises need from their SSOs and outsourcing partners is changing – and business leaders are increasingly looking beyond the lowest cost for strategic partners who can drive the greatest value, efficiency, productivity, and performance in their operations.

Auxis is a nearshore outsourcing pioneer recognized annually on IAOP’s elite Global Outsourcing 100 list, and is also named a top finance and accounting outsourcing provider by leading research analysts like Everest Group and ISG. Its multi-location platform stands as one of the most robust in Latin America – leveraging the strengths of Costa Rica, Colombia, and Mexico to match customer demand. Named the Foundational Partner of the Year for the Americas by the leading intelligent automation platform, UiPath, Auxis further supports its outsourcing services with an exceptional ability to make AI and automation the cornerstone of business innovation and success.

With a unique perspective as shared services operators, industry veterans, and experienced advisors – and more than a quarter-century of business transformation experience – Fortune 1000 companies rely on Auxis for the end-to-end capabilities, innovative solutions, and high-touch delivery model they need to futureproof operations and set the stage for long-term growth.

There’s still much more to unlock about the Latin American market in the “2024 State of the GBS & Outsourcing Industry in Latin America” report. Download the complete version here!

To learn more about the benefits nearshoring can bring to your business, schedule a consultation with our shared services and outsourcing experts today! Or visit our resource center to learn more shared services trends, strategies, and success stories.