Many companies implement AP automation solutions but they’re not getting the full benefit:

Invoice processing is a huge pain point; it’s the number one thing AP teams spend their time on. But it’s far from the only challenge, with AP teams universally confronting manual processes that waste time and drive errors, staffing shortages, lack of standardization that leads to high exception rates, and poor operational visibility that makes upgrading performance a challenge.

Combined, these pain points lead to late payments that impact cash flow and erode vendor goodwill — at the same time unpredictable supply chains make strong relationships critical to keeping goods and services flowing.

It’s no surprise AP stands as the top automation priority within finance departments. But not all AP automation solutions are the same.

Auxis is recognized as a world leader in AI and automation, earning status as an elite Platinum Partner and Americas Partner of the Year for UiPath, the world’s leading intelligent automation platform. But unlike providers who are just technical experts, we also come to the table with nearly 30 years of accounts payable experience as trusted advisors, finance shared services operators, and industry veterans. We bring the business and technical knowledge to identify your underlying challenges and optimize the way you work – improving your processes and enhancing or replacing your existing automation capabilities with innovative solutions that help your teams not only work faster, but smarter.

Leveraging UiPath’s cutting-edge platform, our AP automation team erases the limitations of off-the-shelf solutions with AI-powered automation customized to meet the unique challenges and opportunities of your end-to-end P2P process. Combining best-in-breed automation talent with UiPath’s top-rated Intelligent Document Processing (IDP) solution, we help you address your biggest pain point – averaging 80+% touchless invoice processing across industries and even reaching 95%.

But we also go beyond invoice processing – effectively optimizing your entire accounts payable process lifecycle with insights, modeling, management, and integrations that support seamless workflows across your systems, all in a single platform. From AI-powered Intelligent Document Processing (IDP) to automated processing workflows to the unprecedented power of Agentic AI, Auxis AP Automation Services is the ideal partner for your AP automation journey – helping you build a streamlined, digital department that shifts your focus from transactional tasks to strategic work.

AP remains the #1 automation priority for CFOs for the fourth consecutive year, but less than 2 in 5 say the capabilities they are currently using completely meet their needs.

2024 State of AP Report by MineralTree

AP teams who have optimized RPA require 2.5 fewer FTEs per $1 billion revenue at the median level and process over 10,000 more invoices per AP FTE.

APQC 2024 RPA and Accounts Payable Research

As AP automation adoption increases, 20% of AP teams are spending less than 5 hours per week processing invoices. However, 64% say poorly designed processes remain a challenge.

IFOL Accounts Payable Automation Trends 2024

Auxis provides the full suite of AP automation support needed to quickly realize cost savings and ROI: consulting services, certified UiPath resources and experienced AP talent, proven processes, and industry-leading technologies. Four common AP automation areas we provide include:

AP fraud is a serious concern – and messy master vendor data files make it impossible to keep your records accurate, complete, and fraud-free. Auxis AP automation solutions implement controls that ensure vendor files are properly set up and maintained, deploying IDP and sophisticated algorithms to identify irregularities in vendor documents like W9 forms that can signal vendor impersonation, phony vendors, and other fraudulent behavior that often slips through manual oversight.

Invoice management stands as the #1 automation priority for AP leaders, with 52% still spending 10+ hours per week processing invoices, according to IFOL’s Accounts Payable Automation Trends 2024 report. But most automation solutions focus on invoice data extraction, requiring other tools to upload and process information.

Leveraging the combination of UiPath’s market-leading IDP solution, AI-powered Document Understanding, and its automated User Interface (UI) and Application Programming Interface (API) capabilities, Auxis brings the ability to automate the end-to-end extraction, interpretation, and processing of structured and unstructured invoices and documents for AP teams. With AI capabilities seamlessly integrated into enterprise-level automation, we support your AP staff with a digital workforce that can help you achieve mostly automated invoice processing, while directing exceptions to the proper place as effectively as a human user. Humans only need to step in to validate information and handle exceptions.

50% of AP teams spend six hours or more every month fielding vendor inquires, a pain point that has been steadily increasing every year (2024 State of AP Report). Introducing: the game-changing power of agentic automation to ease the burden on your AP team and let them focus on higher-value work.

Agentic AI opens the door to automating complex business processes that were previously beyond the reach of automation by powering advanced bots known as agents with an unprecedented ability to act independently, adapt to changes, and make informed decisions. A key use case for agentic automation is managing vendor inquiries: assessing queries from unstructured communications like email and identifying and orchestrating subsequent workflows to solve an issue.

For example, an agentic agent can direct RPA to collect needed information to answer a query about payment and even process a waiting invoice. It can then leverage GenAI to create a response updating the vendor on when payment can be expected based on the information it receives.

We understand 100% payment process automation might not be your goal, preferring to optimize cash flow by continuously strategizing when payments are made within vendor terms. But payments are still a challenging pain point – and AP leaders want to speed and streamline the process. Auxis infuses efficiency into the payment process by automating data extraction for pending payments and creating automated payment proposals. The automated application allows managers to remove proposed payments and approve others – ensuring you retain complete control over payment decisions while benefiting from the expediency of automation.

AP fraud is a serious concern – and messy master vendor data files make it impossible to keep your records accurate, complete, and fraud-free. Auxis AP automation solutions implement controls that ensure vendor files are properly set up and maintained, deploying IDP and sophisticated algorithms to identify irregularities in vendor documents like W9 forms that can signal vendor impersonation, phony vendors, and other fraudulent behavior that often slips through manual oversight.

Invoice management stands as the #1 automation priority for AP leaders, with 52% still spending 10+ hours per week processing invoices, according to IFOL’s Accounts Payable Automation Trends 2024 report. But most automation solutions focus on invoice data extraction, requiring other tools to upload and process information.

Leveraging the combination of UiPath’s market-leading IDP solution, AI-powered Document Understanding, and its automated User Interface (UI) and Application Programming Interface (API) capabilities, Auxis brings the ability to automate the end-to-end extraction, interpretation, and processing of structured and unstructured invoices and documents for AP teams. With AI capabilities seamlessly integrated into enterprise-level automation, we support your AP staff with a digital workforce that can help you achieve mostly automated invoice processing, while directing exceptions to the proper place as effectively as a human user. Humans only need to step in to validate information and handle exceptions.

50% of AP teams spend six hours or more every month fielding vendor inquires, a pain point that has been steadily increasing every year (2024 State of AP Report). Introducing: the game-changing power of agentic automation to ease the burden on your AP team and let them focus on higher-value work.

Agentic AI opens the door to automating complex business processes that were previously beyond the reach of automation by powering advanced bots known as agents with an unprecedented ability to act independently, adapt to changes, and make informed decisions. A key use case for agentic automation is managing vendor inquiries: assessing queries from unstructured communications like email and identifying and orchestrating subsequent workflows to solve an issue.

For example, an agentic agent can direct RPA to collect needed information to answer a query about payment and even process a waiting invoice. It can then leverage GenAI to create a response updating the vendor on when payment can be expected based on the information it receives.

We understand 100% payment process automation might not be your goal, preferring to optimize cash flow by continuously strategizing when payments are made within vendor terms. But payments are still a challenging pain point – and AP leaders want to speed and streamline the process. Auxis infuses efficiency into the payment process by automating data extraction for pending payments and creating automated payment proposals. The automated application allows managers to remove proposed payments and approve others – ensuring you retain complete control over payment decisions while benefiting from the expediency of automation.

We want to learn more about your organization to help you achieve your finance transformation goals

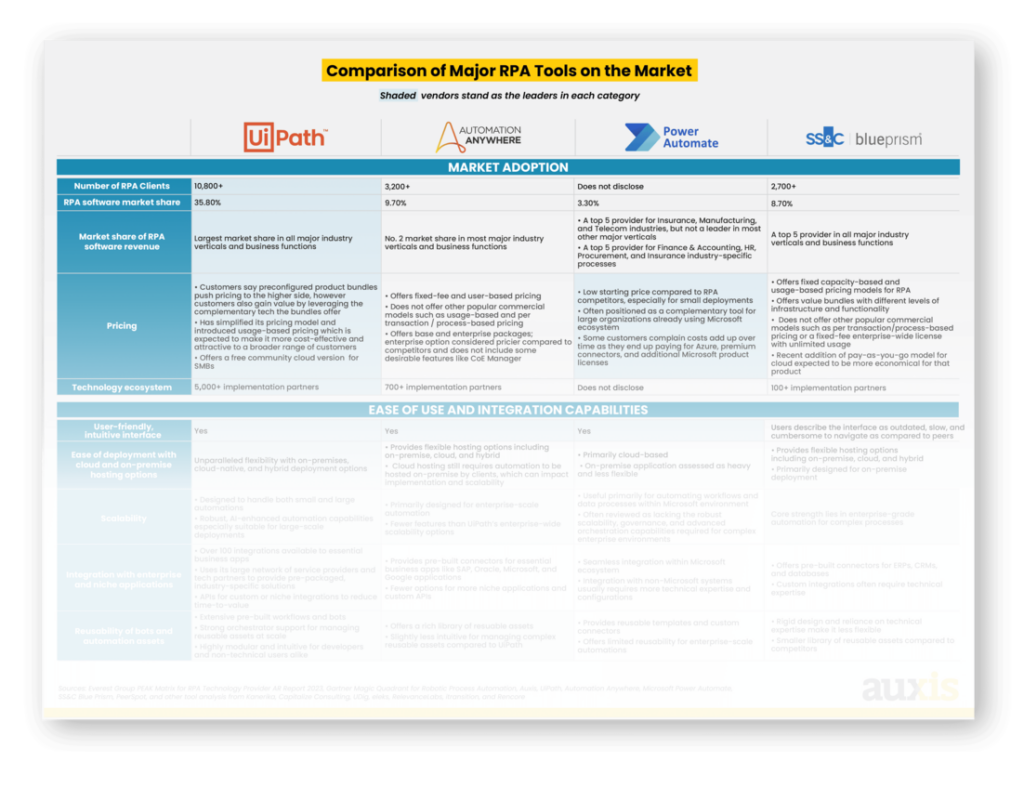

Our world-class AI and automation capabilities are reinforced by our exceptional status as a Platinum Partner and Foundational Americas Partner of the Year for UiPath, the world’s leading intelligent automation platform. We also stand among the top 1% of UiPath Partners worldwide who have achieved both of its elite Platinum Partner and Certified Professional Services accreditations. Leveraging these capabilities gives us an edge over out-of-the-box solutions – harnessing one of the most effective platforms for achieving sustainable AP automation success.

While many AP automation partners are just technical experts, we bring nearly three decades of finance transformation experience to create impactful, scalable change that aligns with your organization’s greater goals. With extensive experience as industry veterans, finance shared services operators, and trusted advisors for nearly 30 years, we bring unparalleled insights into the best practices and operational strategy for achieving breakthrough accounts payable performance faster and more cost-effectively. Auxis has been recognized as a top finance and accounting outsourcing company by multiple research firms including Everest Group and ISG.

Our AP automation solutions average 80+% touchless invoice processing for clients across industries, with some achieving 95%. But we also go beyond AP invoice automation – tailoring end-to-end solutions to your unique business needs. With Auxis, you’ll gain real-time visibility into cash flow, faster processing, fewer errors, a better ability to catch fraud, streamlined approvals, standardized workflows, and decreased time and expense that let you focus on the high-value work that matters most. It’s no surprise 90% of our automation customers choose to expand their initial engagements into long-term partnerships.

The Auxis Center of Excellence (CoE) is structured to provide our clients with the AP automation tools, talent, and best practices they need to embed innovation throughout their end-to-end AP automation journey. That includes AP automation consulting strategy, implementation, and ongoing 24×7 maintenance and support.

Unlike rigid off-the-shelf solutions, our AP automation is tailored to meet your unique business rules and industry demands. With extensive experience realizing targeted outcomes for our clients and for ourselves at our shared services operations, we understand the challenges that cause AP automation projects to fail and we offer a proven methodology for mitigating risk, protecting sensitive data, and designing solutions that deliver. The result: greater efficiency, improved productivity and resource allocation, cost savings, and improved decision-making.

AI and automation jobs are among the most sought after and highest-paid jobs today. Avoid the labor shortage and talent war in the U.S. by leveraging our award-winning, UiPath-certified nearshore team in Latin America, benefiting from cultural alignment, outstanding English proficiency, and seamless collaboration in your time zone.

Our AP automation team can enhance your current capabilities while suggesting additional cutting-edge solutions to drive higher levels of efficiency, productivity, and real-time insights. Our partnership with UiPath helps you access all the leading GenAI tools in the marketplace including:

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Report

Webinar on demand

Whitepaper

Webinar on demand

Report

Webinar on demand

Report

Webinar on demand

Webinar on demand

Whitepaper

Webinar on demand

Accounts payable (AP) automation refers to the use of technology and software to streamline and enhance the AP process. It replaces many manual tasks like data entry, invoice approvals, and payment processing by automating these workflows, resulting in greater accuracy and efficiency. Powered by advancing innovation like AI, machine learning, and optical character recognition (OCR), AP automation can deliver real-time visibility into cash flow, touchless payments, faster processing, a streamlined approval process, a better ability to catch fraud, fewer errors, standardized workflows, and decreased time and expense.

Automating accounts payable helps organizations save time, reduce errors, and lower operational costs. It also improves visibility into cash flow, accelerates invoice processing times, enhances compliance, and reduces the risk of fraud by implementing strong controls. Additionally, automation reduces the workload for AP teams, allowing them to focus on strategic financial tasks.

AI is transforming AP automation by introducing advanced tools and technologies that enhance efficiency and accuracy. Through machine learning algorithms, AI can streamline manual data entry processes by continuously improving the automatic extraction and validation of information from unstructured and structured documents. This reduces manual intervention, minimizes errors, and accelerates processing times. AI-powered systems also enable predictive analytics, offering insights into payment trends and cash flow management. AI enhances fraud detection by identifying anomalies and flagging suspicious transactions in real-time. These innovations not only optimize AP workflows but also empower organizations to make data-driven decisions with greater confidence and precision.

A successful AP automation solution must integrate seamlessly with popular enterprise resource planning (ERP) or accounting systems to ensure the smooth flow of data and avoid duplication, providing a unified financial process. While out-of-the-box solutions can struggle to seamlessly integrate with some legacy systems, customizable platforms like UiPath offer a rich catalog of prebuilt connectors and the ability to easily create custom integrations with connection building tools.

Businesses of all sizes, from small enterprises to large corporations, can benefit from AP automation. It is especially useful for organizations that deal with high volumes of invoices and payments or face challenges with manual AP processes.

Accounts payable automation can address a wide range of use cases across various industries and business operations, including:

While AP automation offers numerous advantages, multiple challenges can stand in the way of success, including cost, system integration issues, data quality and security concerns, and employee resistance to change. A top-quality nearshore AP automation partner can help you overcome these challenges with careful planning, strategic opportunity identification and analysis, proven implementation success, cost-effective talent, change management strategies, and the ability to help you select the right AP automation solution for your specific needs.

Want to work smarter, leaner, and faster? Auxis can help.

"*" indicates required fields

"*" indicates required fields