In brief:

- Accounts payable automation ranks as CFOs’ top digitization priority for the third year in a row.

- Process and technical complexity, lack of talent, and siloed initiatives are cited as the biggest factors behind automation projects that fail to deliver expected value.

- Understanding common challenges and leveraging these best practices can help you maximize AP automation results.

Leading transformation efforts is the most critical priority for 79% of CFOs in 2024, states Gartner’s “Top 5 Priorities for CFOs” e-book. And accounts payable (AP) automation tops that list – ranking as CFOs’ top digitization priority for the third consecutive year on the 2023 State of AP report.

But despite the tremendous potential, it’s no secret that most digital transformation initiatives fall short of potential outcomes. Nearly 90% of CFOs say they struggle to capture value from their technology investments (PwC What’s Important to CFOs in 2024?).

The biggest factors when automation projects fail: process and technical complexity, lack of talent, and siloed initiatives (Deloitte 2023 Global Shared Services & Outsourcing Survey).

To navigate the complexities and demands of a modern accounts payable department, a strategic approach to AP automation is crucial. Let’s examine AP automation best practices that can help you reap the full benefits of this transformative technology for your organization.

What is AP automation?

Automation stands as the linchpin for modernizing AP operations. It’s not merely about digitizing; it’s about comprehensive process automation that streamlines workflows from invoice receipt to payment – minimizing common pain points like lost paper invoices, manual data entry, approval delays, and the risk of human error that lead to late payments.

The potential cost savings and efficiency improvements are significant and emphasize the transformative power of technology. Powered by advancing innovation like AI, machine learning, and optical character recognition (OCR), AP automation can deliver real-time visibility into cash flow, touchless payments, faster processing, a streamlined approval process, a better ability to catch fraud, fewer errors, standardized workflows, and decreased time and expense.

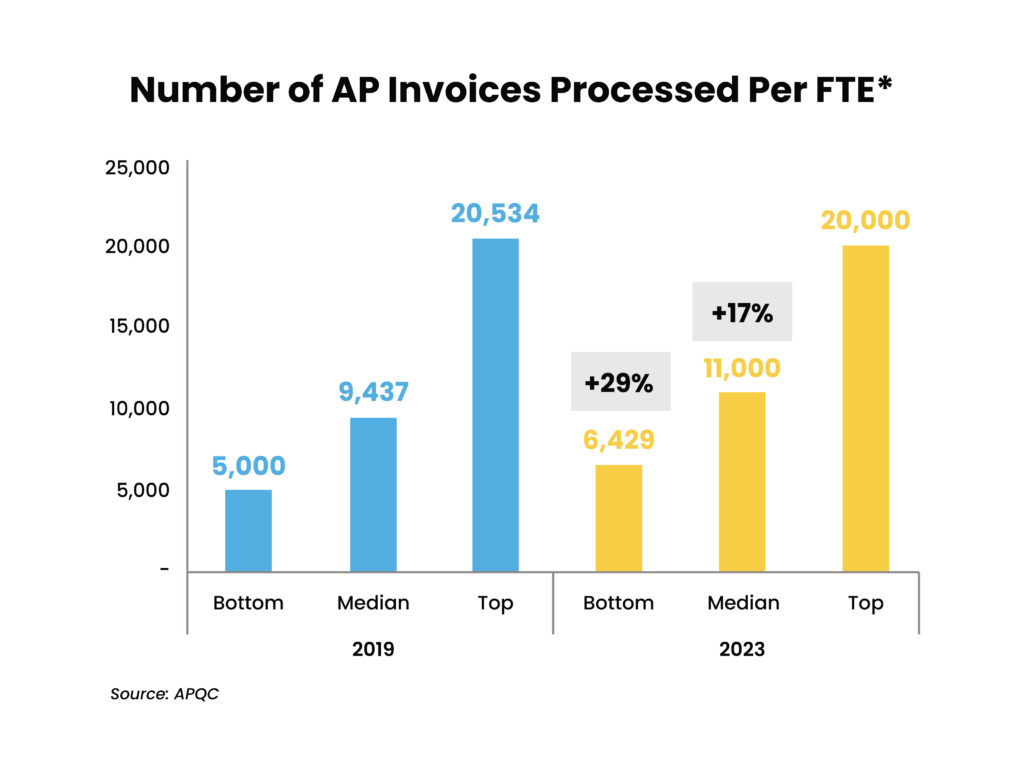

Nearly 90% of AP teams report efficiency gains and 64% report a faster, more timely payment process with AP automation, according to the State of AP report. As automation became increasingly embedded in accounts payable, the number of invoices processed per FTE increased by an average of 17% between 2019 and 2023, according to American Productivity & Quality Center (APQC) data.

The number of disbursements processed improved by an average of 21%.

Amid rising F&A labor costs and severe F&A labor shortages in the U.S., automation also enables the AP department to do more with less. Finance teams that implemented automation report 24% lower staffing levels than organizations that have not, APQC reports.

3 key benefits of AP automation

While faster payments and lower costs offer tremendous value, they are not the only benefits your organization can achieve from accounts payable automation. Other key advantages include:

1. Real-time visibility and control

A robust automated accounting system doesn’t just streamline processes; it provides real-time visibility into the entire AP lifecycle. Quality solutions allow for seamless tracking of invoice status – identifying bottlenecks and taking timely actions to mitigate risks while providing control and transparency throughout the process.

Nearly 90% of finance leaders expect their AP automation solution to improve visibility, avoiding errors that prompt late payments, duplicate payments, or missed opportunities to take advantage of early payment discounts.

2. Fraud detection and prevention

The power of AP automation extends beyond efficiency gains; it serves as a critical ally for fraud detection and prevention, a vital component in the AP realm. Some 65% of organizations were victims of payment fraud in 2022 – and the majority recover less than 10% of their funds, according to the 2023 AFP Payments Fraud and Control Survey.

AI-powered automation employs sophisticated algorithms to identify irregularities, discrepancies, and patterns indicative of fraudulent behavior in real-time, thus significantly reducing the risk of fraudulent activities such as duplicate payments, vendor impersonation, or invoice tampering that could slip through manual oversight.

3. Stronger vendor relationships

Vendor portals integrated within AP automation systems significantly reduce distractions and streamline communication. Nearly half of AP teams spend six or more hours fielding vendor inquiries monthly, according to the State of AP report.

An automated vendor portal can alleviate this burden by offering real-time updates and messaging capabilities. This centralized platform not only enhances efficiency but also strengthens vendor relationships at a time that nearly 70% of AP teams say supply chain disruptions make vendor goodwill more important than ever, the report states.

5 AP automation best practices

So, how do you achieve the right results? Whether you are customizing solutions from intelligent automation platforms like UiPath or taking advantage of automation capabilities embedded in your enterprise resource planning (ERP) system, following these best practices can help you realize the full potential of your AP automation initiatives:

1. Assess your workflows

Standardizing AP processes forms the bedrock of efficient automation. Establishing uniform guidelines for invoice processing, approvals, and payments reduces errors, enhances compliance, and achieves greater transparency.

Gaining visibility into process exceptions – as well as their root causes – is a critical part of this process, ensuring constant interruptions don’t prevent your automation from delivering expected ROI.

Prioritize fixing process failures that drive the most exceptions so your automation initiatives achieve the biggest impact. You can also use automation to improve exception resolution, auto-assigning to respective stakeholders to speed cross-functional collaboration and resolution.

2. Address the full Procure-to-Pay process

In the rush to implement AP automation, here’s what many finance leaders overlook: Exceptions to AP processes often stem from process or control weaknesses outside of AP that also need addressing. Assessing the full P2P process is vital to achieving the full potential of the technology.

In many organizations, information is siloed and different departments follow different processes, leading to invoice discrepancies, missed approvals, duplicate payments, and other issues as well.

Creating a clear, well-documented P2P policy is an important AP automation best practice, implementing parameters and guidelines that facilitate smoother operations. A well-crafted policy establishes authorization requirements for purchases, purchase order requests, vendor criteria, spending limits, role-based guidelines, and more – helping you simplify the P2P process and leverage automation effectively.

End-to-end automation can also foster simple, seamless cohesion between accounts payable and procurement systems that increases visibility, streamlines data flow, enables real-time access to financial information, and reduces processing time and human error. You can further guard against errors by setting automation rules that ensure every step of a process is completed before proceeding to the next step.

3. Get your data house in order

Cleaning and standardizing invoice and vendor data is key to a successful accounts payable automation program, minimizing exceptions and errors that lead to payment delays. AP automation software can’t function properly if your data isn’t clean – struggling to automatically locate, validate, and utilize vendor information or match invoices to purchase orders and receipts.

Unfortunately, proper management of the master vendor data file stands as a common AP challenge: 67% of respondents in a CFO & Controller poll admitted their master vendor data file “could use a little cleaning.” Nearly 20% called it “a total mess.”

Before you automate, implement a structured process for maintaining a clean database – standardizing how vendors are added to your system, creating consistent naming conventions for invoices, cleansing your data regularly, and more.

Getting your data house in order ensures consistent historical data that makes it easier to analyze vendor performance, track spending patterns, and negotiate better payment terms. It further enhances your reporting capabilities, enabling more strategic decision-making.

4. Don’t automate everything at once

Automation is a journey, not a sprint. While there’s a lot in AP that can be improved with automation, that doesn’t mean you have to do it all at once.

Setting realistic expectations is also important. For example, 100% touchless automation is an intimidating goal that can stop your organization from getting started.

While top-quality automation providers can come close to that number, the percentage of AP invoices that become “touchless” typically averages between 60-80%, depending upon an organization’s unique circumstances and process exceptions. Read our case study to learn how Auxis’ tech-enabled outsourcing solution achieved 95% touchless invoice processing for an e-commerce retail client.

Rolling out automation in phases is another AP automation best practice, creating momentum with quick wins that spread enthusiasm enterprise-wide. This strategy supports change management – giving your team time to adjust to new processes while providing early, concrete evidence of how automation can directly improve their work lives.

Restructuring large-scale automation initiatives into a series of smaller, faster projects supports cost management as well – achieving quicker returns with less upfront spend.

5. Pick the right accounts payable automation tools for your situation

As demand for AP automation grows, the number of technology choices have become daunting.

Whether your goal is streamlining workflows, reducing approval times, speeding payments, minimizing errors, or something else, determining your biggest driver for implementing automation is the first step to choosing the right tool for your organization.

But with so many diverse technology options marketing different strengths and capabilities – from machine-learning powered Intelligent Document Processing to Robotic Process Automation to Electronic Data Interchange (EDI) solutions – many AP leaders still struggle to make selections that avoid buyer’s remorse.

For example, some automation options are truly payment solutions with AP automation as an add-on feature. Others rely on a matrix-only system for approvals that don’t consider when someone is out sick or leaves the company.

A quality accounts payable partner can help you narrow down the overwhelming number of choices and implement the right solution for your unique needs. The best partners combine business and technical knowledge to help you identify the best automation opportunities, prioritize your roadmap, and achieve sustainable success.

They will also drive continuous improvement, leveraging analytics and performance metrics to identify bottlenecks and enhance workflows to ensure you achieve desired results.

4 common challenges for implementing AP automation

What stops AP organizations from getting automation right?

1. Resistance to change

Organizational resistance can hinder AP automation initiatives. More than 40% of IT leaders rank change management as their biggest digital transformation challenge. Fostering a culture of change through comprehensive training programs and transparent communication can drive adoption.

2. System integration complexity

Integrating a new AP automation system with existing infrastructure is essential to maximizing the value of your initiative, but it can also pose significant challenges. Deploying phased integration approaches can facilitate a smooth transition.

3. Accounts payable data security and compliance

AP automation can significantly improve data security, adding rigorous controls, detecting fraudulent patterns, verifying vendor and invoice authenticity, and minimizing interactions between financial documents and human staff. However, stringent security measures and compliance adherence are key to safeguarding financial data integrity. Best practices include continuous monitoring to detect and prevent unauthorized access and file encryption during transmission and storage.

4. Cost and resource allocation

Initial investments in technology and resources for accounts payable automation solutions require a business case to calculate ROI and get leadership approval to manage costs effectively. A quality automation partner can help you prepare your business case and align leadership behind a strategic vision for your journey.

Why Auxis: Maximize the value of your AP automation journey

Automation is a critical step toward transforming AP organizations into a strategic business asset – creating a streamlined, digital department that enables staff to shift their focus from transactional tasks to high-value work. But most finance teams lack the time or digital expertise to drive a successful automation journey.

A quality accounts payable partner like Auxis is key to ensuring a smooth transition to automated processes. Auxis plays a pivotal role in helping organizations harness the complete advantages of AP automation – combining more than 25 years of finance transformation experience with a proven track record supporting end-to-end automation journeys as a UiPath Platinum Business Partner, the platform’s highest partnership level.

By the end of 2023, 65% of finance leaders aimed to have half their duties automated, according to a 2023 CFO magazine report. With expert guidance and strategic approaches, Auxis brings the tools, talent, and best practices to overcome AP automation challenges and augment the efficiency and accuracy of your payment processes.

Want to learn more about AP outsourcing and AP automation solutions? Schedule a consultation with our accounts payable team today! Or visit our resource center for more AP tips, strategies, and success stories.