The “Great Resignation” has been a phenomenon of the COVID-19 era, with talent shortages consistently being cited by Finance executives as a key risk factor to their operations.

As recently as Q4 2021, 60.7% CFOs highlighted this point, stating that “Talent/Labor” was their No.1 priority in 2022, according to Deloitte’s CFO Signals survey from that period. The most recent Deloitte survey reinforces this topic, with CFOs stating that talent is their number one internal risk to achieving their objectives. Indeed, projected hiring levels remain flat compared to 2021, not because of lack of need, but primarily because of the perceived talent shortages in the market according to the Deloitte survey.

Further, the tightening of the labor market has driven up labor costs, with the most recent data from the Bureau of Labor Statistics (BLS) showing a surge of 5.3% on a year-over-year basis for the period June 2021 to June 2022, the largest rise since 2001.

At the same time, CEOs are pushing for three things: growth, digitization and efficiency. And they view all three as directly connected.

This demand, coupled with the impact of the pandemic on business operations, has sped up the overall adoption of digital technologies by three-to-seven years, according to a recent study from McKinsey, with funding and resource allocation increasing by 65% in this area during recent years, when most other spending was being curtailed.

Here are accounts payable trends of 2023 that we have observed and the best solutions to help you prepare your AP team for their longer-term impact.

1. Paperless processing takeover

AP has long-been an area ripe for digital transformation, with many daily activities requiring manual work, and paper documents still flowing through many organizations and departments. But that is finally starting to change.

According to a recent study from the benchmarking organization APQC, approximately half of organizations surveyed are using Optical Character Recognition (OCR) technology to “read” documents queued up for processing, and more than half leverage electronic invoice matching systems to support AP processes. While these statistics are encouraging, it also shows that half of the organizations out there are still “pushing paper”!

APQC’s study further shows that the Finance function is heavily invested in process automation:

- 15% of organizations use artificial intelligence-based cognitive automation

- 30% use knowledge-based automation for unstructured data and judgment-related tasks with simple rules

- 36% use rules-based robotic process automation (RPA) for structured data-related tasks

- 17% use desktop automation for simple transactional tasks

- Only 1% of organizations state that they do not use any automation to a significant degree, and only 3% state that they have no plans to adopt RPA

Clearly, the two trends of Talent Shortages and Digitalization are impacting Finance & Accounting operations, and Accounts Payable in particular.

2. Significant productivity and cost changes

Is process efficiency significantly increasing in AP? Are these efficiencies driving down the cost of operations, or is this being offset by rising labor costs and talent shortages? A look at recent benchmark data provides some interesting insights .

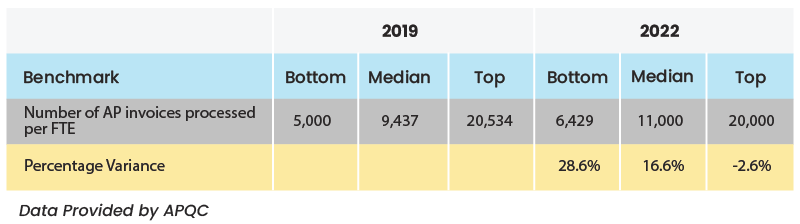

A comparison of invoice processing efficiency from 2019 to 2022 shows that productivity has increased over the past three years by an average of 7%, but the impact has been significantly higher in the low and median-performing organizations:

As you can see, invoice processing efficiency increased 28.6% and 16.6% in the Bottom and Median performer levels respectively, while it remained static at the Top performer level, likely because many of the changes that drove efficiency for the Bottom and Median performers were already in place at the Top performer level.

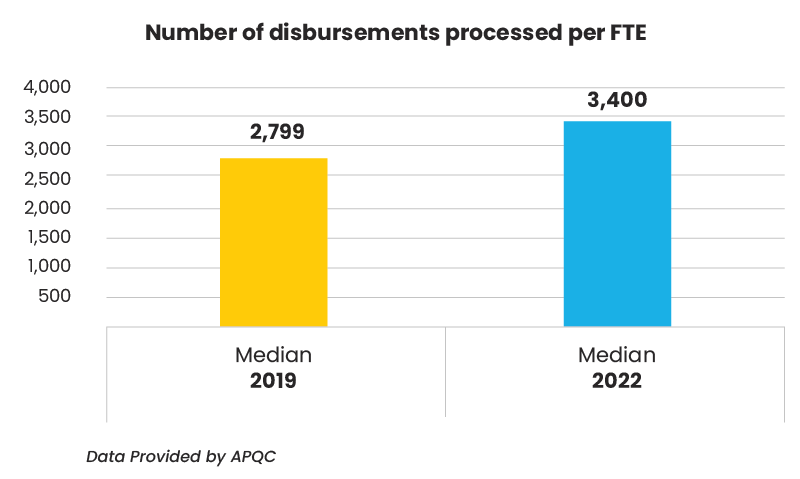

Similar results have been achieved with the processing of disbursements:

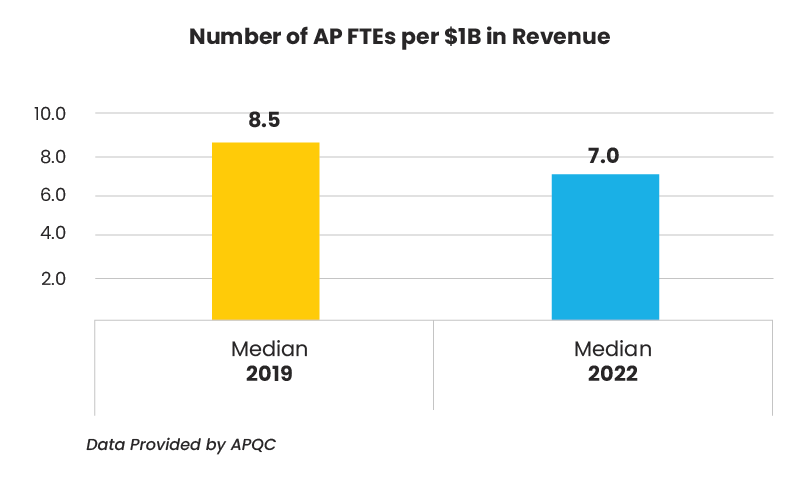

This change represents a 21.5% increase in productivity over that 3-year time period at the Median performer level, allowing organizations to use less staff to perform related transactional activity:

Staffing levels for AP processing have decreased by 17.6% over the three-year time period at the Median performer level.

Clearly, the benchmark data is showing that organizations have gotten more efficient and productive over the past three years, almost certainly due to the digital transformation initiatives that have been implemented. Digital transformation has truly become a “democratizing” event for organizations, as this technology has become accessible and affordable for companies of all sizes.

This has been a huge “sea change” for businesses, but how has it translated into the cost to perform the AP function?

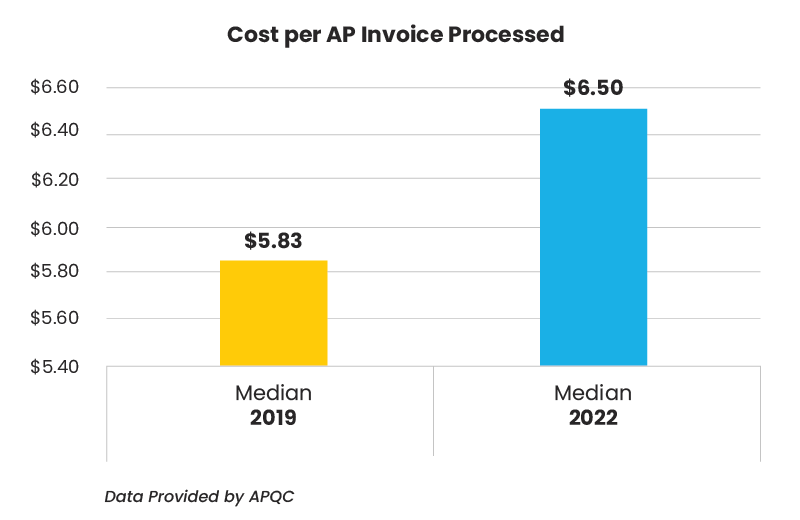

Let’s examine another key industry benchmark, the cost per invoice processed:

Over the same three-year period, the cost per invoice processed has increased by 11.5%. Is this a surprising result? Not when you consider the increase in labor costs, driven by the talent shortages and retention issues that have occurred over the same three-year period.

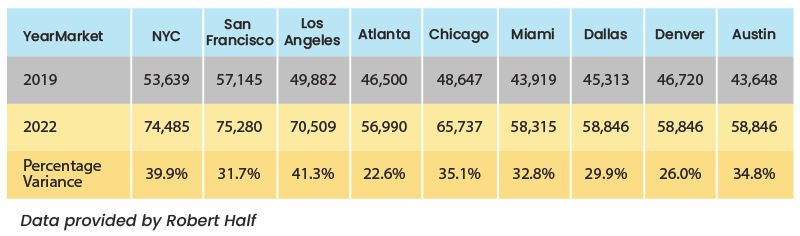

And the “Great Resignation” has had a specific impact on AP personnel cost. The average cost of a Senior AP Clerk has risen by 20% of the three-year period from 2019-2022, from $42,000 to more than $53,000 (not including benefits and taxes), according to data taken from Robert Half’s Salary Guide for Finance Professionals for those periods.

But these metrics don’t really tell the full story, as the impact has been felt much more significantly in the larger employment markets, where labor is always at a premium. Consider these numbers:

Overall, in these larger employment markets, the labor costs for AP processing roles have increased by 34.7%, with certain markets (New York, Los Angeles, Chicago and Austin) showing increases of 37% or higher). Even markets once-considered “low cost” are feeling the pinch, such as in Miami (up 34.7%), Dallas (31.8%) and Denver (27.8%).

A lot has changed over the past three years, and organizations have had to do a lot of things to “keep up.” A basic function such as Accounts Payable has seen tremendous changes, both in terms of cost and in the way of processing transactions. AP is considered one of those “keeping the lights on” kind of processes; it needs to work effectively, but it is typically not strategic nor value-added to the organization. But when it doesn’t work well, everyone knows it!

Implementing digital transformation initiatives can be challenging, and many companies, frankly, don’t get it right. According to a study by McKinsey, less than 30% of technology transformations are successful; and digital transformations are even more challenging: only 16% of organizations said that they have successfully improved performance in a sustainable fashion.

If you are trying to make these changes to your operations, and you “miss the mark,” the cost and impact to your business can be painful.

3. The increase in nearshore business process outsourcing.

Many successful Finance organizations have leveraged outsourcing as part of their operating models, and it is on the rise. In the Q4 2021 Deloitte CFO Signals survey, 34% of Finance executives indicated that they expect to increase the use of outsourcing in their operations. In addition to the typical drivers for outsourcing, cost reductions and process improvements, accelerating the digital agenda and access to talent have been cited by CFOs as drivers for outsourcing, according to the Deloitte survey.

A top-notch outsourcing firm does transactional work “for a living.” They should be able to do more than just provide the talent and perform the tasks. They should be experts at optimizing processes to achieve the highest levels of productivity and efficiency. They should be adept at implementing digital technologies, taking the risk out of these initiatives. And they should guarantee the outcomes, assuring the delivery of the expected cost savings and ROI.

By using the capabilities of an outsourcing provider for transactional activities, besides lowering your costs, you can improve your operational efficiency and focus on those digital transformation projects that are more core to your enterprise – allocating those same resources that were previously swallowed up by administrative tasks.

And by working with a nearshore provider, you eliminate many of the operational issues of traditional outsourcing that have impacted the effectiveness of the program, such as time zone and geographic proximity challenges, language and cultural mismatches, and collaboration/communication concerns. Nearshore outsourcing is another current trend that Finance & Accounting departments are seeking to take advantage of.

Digital Transformation and The Great Resignation are continuing to impact the operational world as we know it. Savvy Finance executives are overcoming these issues by incorporating nearshore outsourcing into their operating model to solve the talent (and labor cost) challenge and improve operational performance and productivity.

And that will help you to start a new Account Payable trend: achieving the mission of growth, digitization and efficiency.