The “war for talent” has become top of mind for business executives, and with no sign of the current labor shortage easing, there will be no ceasefire in 2022!

The Talent Shortage Phenomenon had been going on even before the pandemic, but since COVID-19 entered our lives, it has become, well, an epidemic. In his featured topic Korn Ferry recently reported that almost a third (31%) of professionals surveyed said they were thinking of leaving their jobs even though they didn’t have another one lined up. In July 2021, U.S. employers reported the highest level ever of unfilled positions, and 74% of professionals surveyed said that employee turnover will only increase in the coming year (that’s now!)

The most recent CFO Signals Survey from Deloitte highlighted this point, as 60.7% of CFOs indicated that “Talent/Labor” Was their No.1 priority in 2022. Specifically, CFOs stated that hiring, retention, attrition, employee burnout and well-being, and staff development were all key concerns. An incredible 97% of CFOs agree that talent/labor costs will substantially increase in 2022.

CFOs cite turnover and lack of digital skills as key challenges of talent acquisition

Another survey from PwC doubles down on these concerns. An astonishing 8 out of 9 executives say they’re experiencing higher-than-normal turnover right now, and 81% of CFOs are concerned that high turnover and labor shortages will impact their company’s revenue growth.

61% of Finance executives believe this is being driven by higher wages, but re-establishing a strong corporate culture after a pandemic that has changed the way people work is also top-of-mind. 63% of CFOs say their company is going to emphasize leadership and culture and company purpose and values (61%) to differentiate from their competitors.

But the impact of turnover goes beyond differentiating yourself from other companies. 77% of CFOs say that staffing shortages are impacting their ability to get work done. And 74% think it will impact their ability to take on new business.

Finally, as CFOs recognize that technology investments are critical elements of their future-state operations, with Digital Transformation topping the list of investment plans (68%), another survey from Gartner states that only one-third of Finance leaders believe their teams have the sufficient skills required to work effectively as a digital finance function. And trying to acquire these digital skills will put you right in the middle of the “war on talent” battlefield – increasing your wage levels, challenging your retention strategies, and potentially developing your team with the skills they need to get that higher- paying job elsewhere.

And achieving a successful digital transformation is no easy task. According to McKinsey, less than 30% of technology transformations are successful. And digital transformations are even more challenging: only 16% of organizations said DT has successfully improved performance in a sustainable fashion.

Outsourcing: the secret to navigating the current labor shortage

This is all a lot to consider as Finance executives look to navigate the turbulent waters of 2022 and beyond. But there is a potential solution: outsourcing. Many successful Finance organizations have leveraged outsourcing as part of their operating models to help steer their ships through these rough seas.

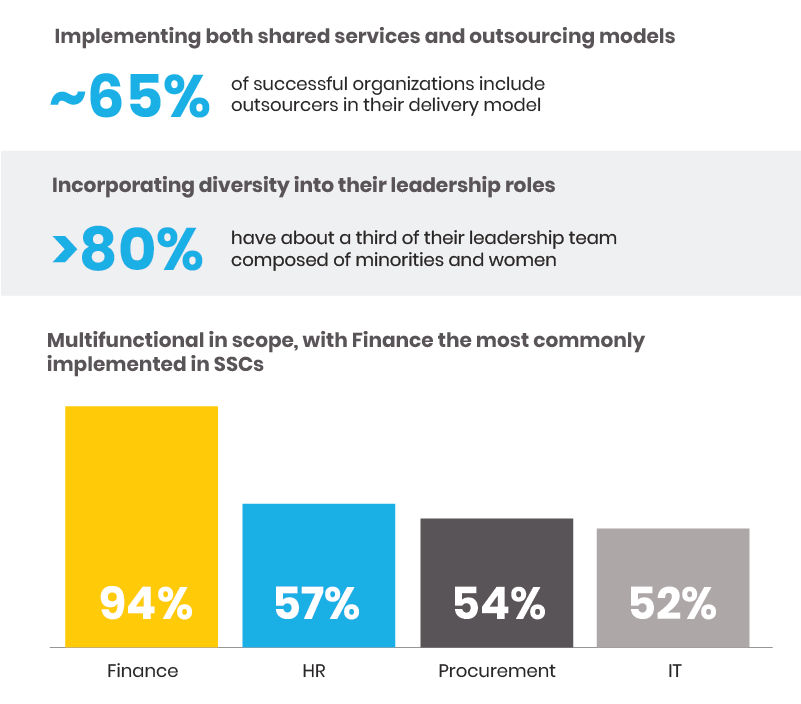

Deloitte’s 2021 Global Shared Services and Outsourcing Survey reported that 65% of successful global organizations incorporate both shared services and outsourcing into their operating models. And within these organizations, IT (54%) and Finance (44%) represent the top two functions where outsourcing is being employed.

Outsourcing remains top of mind in 2022. In the Deloitte CFO Signals survey, 34% of Finance executives indicated that they expect to increase the use of outsourcing in their operations.

While cost improvements have always been a key objective of this hybrid operating strategy (84% of executives stated this), it was not the No.1 objective: standardization and efficiency of processes (88%) was the top objective of business executives surveyed. Other key drivers included driving business value (73%) and accelerating the digital agenda (61%).

Now, you can add access to talent to overcome the current labor shortage as a reason to incorporate outsourcing into your business operating model.

Key benefits of outsourcing transactional finance work

Actually, access to talent has always been a reason for outsourcing, it was just intertwined with cost reduction. But a company wouldn’t want to have lower skilled/poorly performing workers handling their administrative work just to receive lower costs.

Outsourcing firms actually have to prove that they perform effectively. Service-Level Agreements (SLAs) are a key element of outsourcing agreements and they establish baseline performance standards against which they are regularly measured.

Most in-house or captive organizations do not issue monthly reports of performance at the functional and individual performer level. Outsourcing firms do.

Transitioning non-core, transactional work to an outsourcing provider allows you to not only reduce the cost of these (lower-value) tasks, but it also enables you to shift the focus on your retained organization to higher-value, more strategic activities. Typically, our experience has shown that anywhere from 75%-90% of an organization’s resources and focus are spent on transactional tasks.

Right behind overcoming the challenges of talent acquisition as a key priority for Finance executives in the Deloitte CFO Signals survey was Financial Performance (42.7%) and Growth (31.6%). Outsourcing gives you another talented labor pool to draw from, enabling you to fill administrative jobs faster (and at a lower cost) and allows you to focus your hiring on the key roles that will support the Finance and Growth agenda.

The Deloitte Global Shared Services and Outsourcing Survey highlighted the need to drive efficiency and accelerate the digital transformation of the business. So, how do you accelerate these risk-heavy initiatives and get the benefits you are looking for?

Beat the challenges of talent acquisition with the right outsourcing partner

A top-notch outsourcing firm does transactional work “for a living.” They are experts at not just performing these tasks, but also optimizing processes to achieve the highest levels of productivity and efficiency.

The outsourcing firm should also be an expert at implementing these solutions, taking the risk out of the initiatives. And they should guarantee the outcomes, ensuring the delivery of the expected cost savings and ROI.

By using the capabilities of an outsourcing provider for transactional activities, besides lowering your costs, you can improve your operational efficiency and focus on those DT projects that are more core to your enterprise – allocating those same resources that were previously swallowed up by administrative tasks.

What does this do for your Talent Challenge? Well, if Finance executives truly want to emphasize leadership and culture and values within their organization, imagine changing the purpose of your best people, giving them more meaningful and rewarding roles, enhancing their skills and abilities – rather than having them pay bills, apply cash, and perform reconciliations.

Also, by lowering your cost to perform the transactional work, you can free up funds to address the wage concerns that may force you to lose key staff members, without impacting your overall operational costs.

All of this will go a long way towards building the culture and the values that you are trying to establish. And that should truly differentiate your organization from your competitors.