Finance outsourcing is exploding in the wake of the pandemic – and Accounts Payable (AP) is often the first function CFOs shift to a trusted BPO partner. But with so many possible paths, many finance leaders struggle to understand how to successfully migrate the AP function.

Even before COVID, the drumbeat had started to modernize Finance Departments by offloading transactional, low-value work. But the pandemic accelerated the pace – creating mounting pressure for CFOs to minimize costs, maximize productivity, adjust to a remote workforce, and increase their team’s focus on more strategic activities.

At many enterprises, the AP function is ripe for improvement: dominated by manual, paper-based processes, a lack of standardization that drives high exception rates, and poor operational visibility that makes upgrading performance a challenge.

In bottom-performing departments, late payments are all too common as invoice approvals drag for 30-90 days and AP staff waste about a quarter of their time chasing down missing or inaccurate information. Finance & Accounting unemployment levels have also reached record lows in the U.S. – increasing wages and driving high turnover that impacts consistency and errors.

Outsourcing your accounts payable function resolves these challenges and more, with Deloitte reporting that 65% of successful organizations include outsourcers in their delivery model. A reputable provider delivers instant access to accounts payable best practices, best-in-class talent, and automation tools that maximize AP performance while giving internal teams the bandwidth to become true business partners.

AP outsourcing is a proven path to modernizing operations and accelerating digital transformation – when it’s executed properly. Here’s how to outsource your accounts payable function for long-term success:

Outsourcing the Accounts Payable Function: 5 Simple Steps

1. Start with a clear vision.

Too many outsourcing projects fall apart because they lack a clear vision. Identifying your biggest business drivers at the start – and aligning your leadership team and BPO provider behind them – ensures the greatest value.

While cost reduction can be important, it’s rarely the sole motivation for outsourcing AP. In fact, Deloitte reports that COVID challenges have most organizations focused on “standardization and process efficiency” as their top strategic objective in 2021 – downgrading “reducing costs” to the #2 priority.

Benchmarking your AP organization to your peers can help you identify the greatest opportunities for improvement and ROI. For instance, top-performing AP teams process nearly four times the number of invoices than bottom performers, according to American Productivity & Quality Center (APQC) benchmarking data.

Improving quality and automation, cutting costs, gaining access to a more stable pool of qualified talent, and freeing up internal teams for higher-value activities are common drivers. But no matter your focus, clearly defining your end goal is essential to measuring your outsourcer’s performance and setting the right expectations for your business.

2. Determine the best location strategy: nearshore, offshore, or onshore.

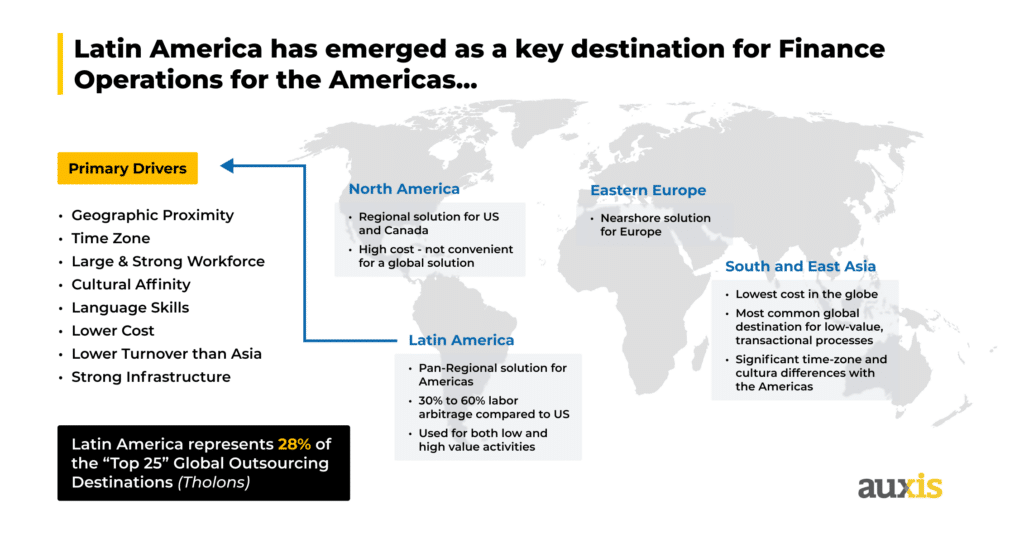

Labor arbitrage is a given in an AP outsourcing project. But organizations also need to look beyond the lowest cost to ensure their partner provides significant cost savings while also driving the highest productivity and performance.

Nearshoring from Latin America has emerged as a leading solution for North American organizations over the last decade. Executives realize that choosing an outsourcer in the same region of the world maximizes opportunities for collaboration, communication, innovation, and continuous improvement by minimizing difficulties caused by faraway times zones and cultural or language barriers.

In fact, the nearshore P2P outsourcing segment alone is expected to grow 26% over the next five years. Countries like Costa Rica have over 300 multinationals with Finance Shared Services Operations supporting North America, The Americas, or in some cases the globe. Accounts Payable is part of the scope of these shared services, in addition to Accounts Receivable and General Accounting that are also very common to find.

In contrast, onshore solutions (US-based) bring the highest costs and typically high turnover from workers who generally often see transactional tasks as beneath them. But many U.S. companies initially lured to offshore locations like India and the Philippines by bottom-of-the-barrel pricing are also rethinking their strategy.

Unfortunately, Asia’s low costs bring significant risks, including unforeseen cultural differences, language difficulties, alarmingly high turnover, an abundance of “black box” operating models that provide little control or visibility. The, significant time zone differences also negatively impact communication and responsiveness, with internal and BPO teams often working opposite hours. And if they are working the same hours, then you will likely be experiencing higher turnover and lesser performance, as work schedules that are aligned to the US translate to overnight shifts in the offshore markets, impacting the talent pool that is willing to work those shifts.

The pandemic further spotlighted the inadequate infrastructure and poor healthcare systems that impact service delivery in many offshore locations.

In contrast, nearshoring to Latin America enables agile, real-time collaboration with U.S. teams through shared or similar time zones, a westernized culture, direct flights from most major cities, and strong, American-flavored English fluency. And with many North American organizations having established operations in the region, there is a large talent pool that is familiar with US operational requirements, schedules and pace.

Nearshoring also delivers significant cost savings without sacrificing quality. For instance, Costa Rica – consistently ranked as the top nearshore destination in Latin America – offers a deep pool of highly skilled talent at a labor arbitrage that averages between 30-50% for North American organizations.

Costa Rica also mitigates outsourcing risk with a modernized infrastructure and world-class pandemic response that earned United Nations recognition.

3. Choose an AP outsourcing partner who defines what’s most important to you.

Having a clear vision of what you hope to achieve helps define criteria for choosing your AP partner. Basic expectations are obvious, demanding proven processes that ensure invoices are paid accurately and on time.

But an exceptional partner should also have the tools and expertise to help you work smarter in a post-pandemic world. AP automation solutions like Intelligent Data Capture, Workflow, and Robotic Process Automation (RPA) are essential to optimizing operations, reducing manual efforts, and improving processing cycles across the end-to-end function.

Besides an innovation agenda, your outsourcer should also demonstrate deep finance subject matter expertise and a robust approach to process documentation. The best partners can readily identify challenges in the full AP lifecycle and are experts at implementing process improvements and best-in-class tools to resolve them. They are also able to take the end-to-end AP process and not just the most basic activities of invoice coding and processing. For example, at Auxis, our AP outsourcing teams are able to perform many other AP functions including vendor master maintenance, vendor communication and inquiries, payment proposal preparation, reconciliations and more.

Look for an outsourcer who wants to develop a long-term partnership with your organization. Priorities should include a commitment to continuous improvement, tangible business outcomes, and a proactive approach to resolving issues enabled by real-time analytics.

An “extension of your team” mentality is important as well, prioritizing regular communication and transparency.

You should also pick partners used to working with similarly sized organizations. With less scale, smaller enterprises need more flexibility from outsourcing partners than multinational corporations. Larger outsourcers are less willing and able to customize solutions because their operations are structured to handle large volumes.

4. Establish a robust transition plan.

Too many outsourcers treat transition as an afterthought, but it sets the foundation for long-term success. Properly transferring knowledge from one team to the next – and bringing documentation up-to-date – is critical to avoiding gaps in service.

Building transparency with your team and other key stakeholders that a change is taking place is also vital for success.

Challenge potential partners to detail a robust transition process that includes documentation, effective training, change management, and a structured solution for deploying automation tools. Make sure you understand how the transition will occur, how you will know it’s completed, and how the outsourcer measures success.

5. Define and track SLAs based on what’s important for your business.

The most effective SLAs measure an outsourcer’s performance through one or two carefully chosen metrics for every function in a contract. That way, the areas you care about most remain the top priority.

The most common AP SLAs zero in on efficiency and effectiveness. How these broader categories are addressed is determined by business priorities.

To ensure a high quality of work, exceptional providers will also track a broader scope of AP key performance indicators (KPIs) like cycle time and number of invoices processed per FTE. While failing to meet KPIs isn’t a breach of contract, these measurements are navigational tools that provide insight into operations, uncover bottlenecks, and keep outsourcers on track to meeting SLA objectives.

The best outsourcers regularly hold monthly service level reviews, ensuring stakeholders get to the bottom of issues and resolve them quickly.

Knowing how to outsource your Accounts Payable lets you focus on strategic priorities

The global F&A outsourcing market is projected to grow more than 40% by 2027, as the pandemic has made it more important than ever for finance teams to shed their traditional number-crunching role and shape insight-driven strategies that provide growth.

AP processes are essential to “keeping the lights on” but generally add little strategic value to a business. Outsourcing your accounts payable function is a key step to eliminating the mundane, time-consuming tasks that distract your team from what matters most.