As most of our readers are aware by now, during the past three years Robotics Process Automation (RPA) has emerged as one of the leading technologies in the market for organizations of all industries and sizes.

Despite all the hype, while there were multiple industry reports out there about RPA as a growing trend, these studies were very high level and did not provide much in the way of operational insights on how the technology was truly being used, and the specific benefits that organizations had been able to achieve.

In order to narrow this information gap and get beyond the hype, Auxis recently surveyed over 100 organizations across all revenue sizes and industries to truly qualify where they were in their RPA journey, and provide a more detailed understanding of the most pressing questions that executives have about the technology, including:

- What is the current level of adoption for companies of my size?

- Which are the primary functions where RPA is being utilized?

- What strategies are companies using to get started? – Build vs. Buy

- What are the “real” benefits that I can expect to get from RPA?

- What are the main implementation challenges?

This article tries to summarize the key findings from the Auxis 2018 Survey Report: Where Are We With RPA, which you can download any time by clicking here.

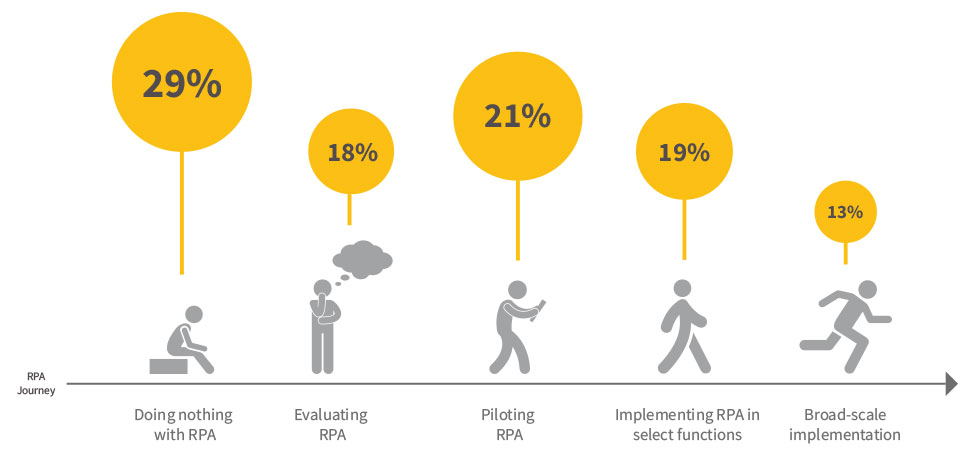

Level of RPA Adoption

Most organizations are still in the early stages, but it’s coming fast:

- 71% of organizations have at least started to evaluate or pilot RPA.

- Only 32% of respondents have gone beyond the piloting phase, and are either implementing RPA in select functions (19%), or at a broader scale (13%).

- 67% of organizations that have implemented RPA have been using the tool for less than 2 years.

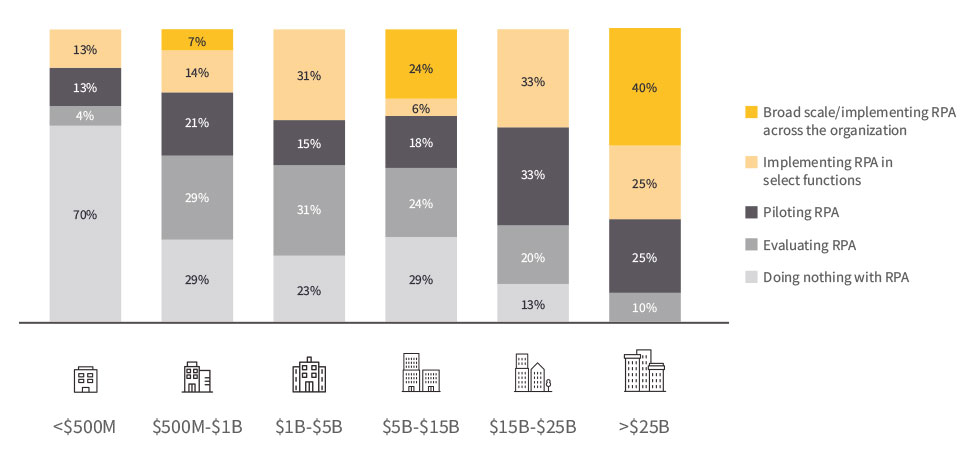

RPA Adoption by Company Size

Automation is penetrating organizations across all revenue sizes, but the level of adoption is higher for larger enterprises. The percentage of companies that have at least started to evaluate RPA varies as follows based on size:

- 100% or organizations with $25B+ in revenue

- 87% of organizations in the range of $15-$25B

- 71% of organization in the range of $5B-$15B

- 77% or organizations in the range of $1B to $5B

- 46% of the smaller firms (<$1B)

The relatively low investment required to get started with RPA (compared to traditional IT projects) has allowed mid-market organizations to take advantage of its benefits at a much faster pace compared to other new, disruptive technologies. RPA is being leveraged as a powerful alternative to drive innovation and scalability to enable these organizations to better compete with the larger players.

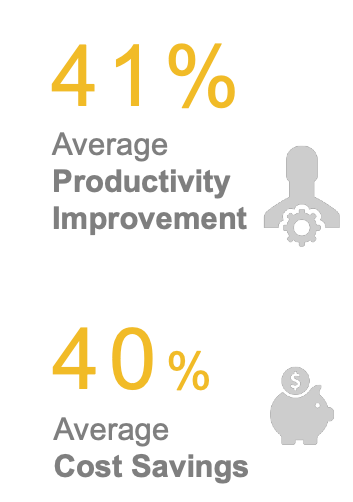

Benefits Delivered

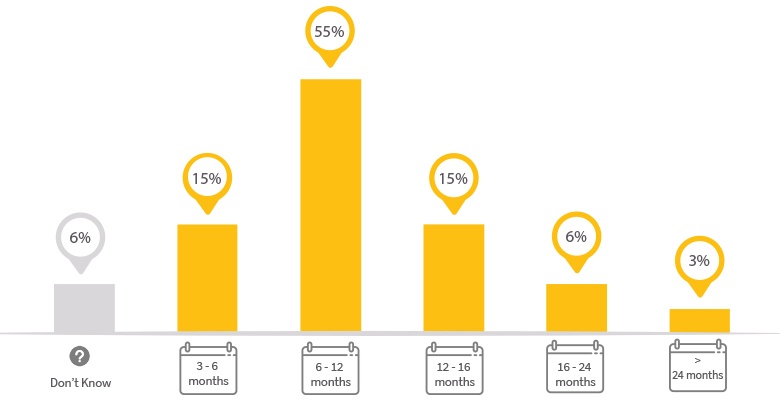

RPA initiatives typically deliver a high ROI with a payback period of less than one year:

- RPA provides a quick ROI compared to traditional IT projects – 70% of survey respondents recovered their investment during the first year

- On average, organizations reported cost savings of 40% and productivity gains of 41%.

- Organizations that have implemented RPA expressed high levels of satisfaction (76%), with only 7% expressing to be “somewhat dissatisfied”. The remaining 17% were not ready to answer the question as it was “too soon to tell.”

RPA initiatives are driven by more than cost reduction. Based on the survey, the top two drivers for implementing RPA are process efficiency (94%) and better accuracy (85%.

Cost reduction is important (84%) but not the main driver. The ability to increase the focus of the organization on more strategic activities obtained the same level of relevance (84%).

Other secondary drivers include:

- Improved customer service (69%)

- Better controls and operational visibility (67%)

- Revenue-generation (54%)

Most Automated Functions

- Finance & Accounting (F&A) is the early “pioneer” of Robotics Process Automation and the top penetrated function with 79% of organizations having at least started to evaluate automation opportunities within F&A.

- The top two F&A processes are: Purchase To Pay (70%) and Order To Cash (70%).

- After F&A, the next top penetrated functions are: HR (57%) and Customer Service (55%).

- On average, each company has started to evaluate at least four different functions (e.g. F&A, HR, Customer Service and IT).

Is the Most Common Approach

64% of organizations “start small” by evaluating or assessing RPA automation opportunities within a select function, versus performing a “broad” assessment across the organization (36%).

As with any new technology, companies usually prefer to first prove that RPA works within a narrow scope of processes – and with a limited investment – and then expand from there.

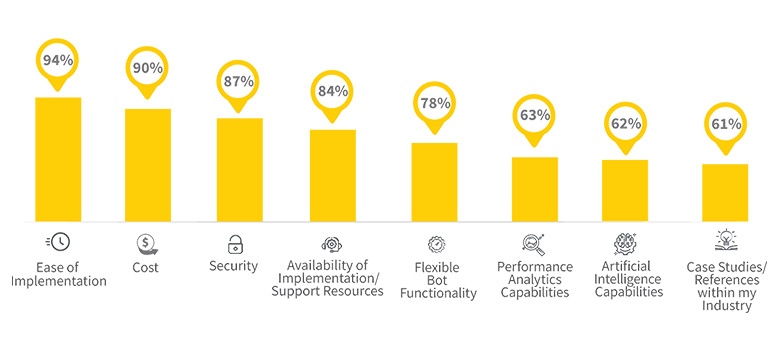

Evaluation Criteria for RPA Software Selection

Ease of implementation, cost and security are the top criteria when selecting the right RPA platform. These three factors were considered to be “very important” or “important” by 94%, 90% and 87% of the respondents respectively.

What was the level of importance of the following drivers in selecting your RPA software platform?

As RPA continues to penetrate the smaller and medium-sized organizations, the ability to access the technology at a low cost of entry is becoming more and more important.

Companies tend to focus on selecting the most manageable and cost-effective platform to get automation up and running quickly, prove ROI in the first year, and then make the case for automating more functions down the line.

Availability of implementation resources was also identified as a key factor (84%). In our experience, this factor is crucial. If organizations are implementing a solution for which they cannot provide the right level of expertise to implement it or the support to operate it, the initiative will not succeed. In general, most RPA software companies are conscious of this and have put a lot of effort into developing a strong network of implementation partners.

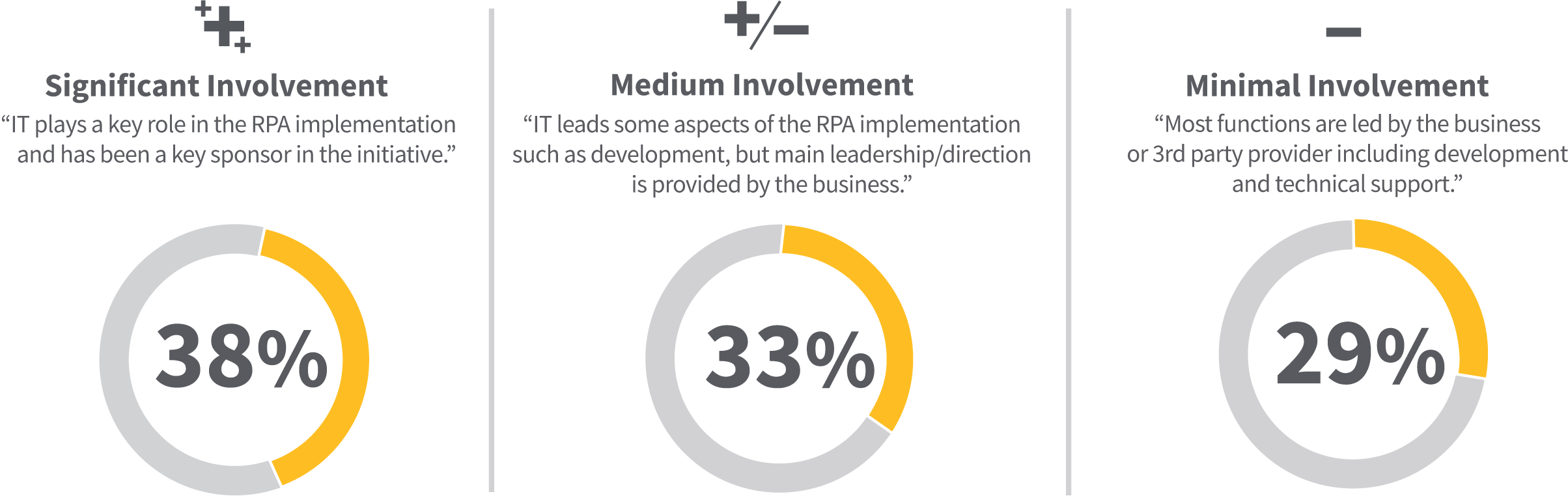

The Role of IT

For 62% of respondents, IT plays a secondary role in their Robotics Process Automation initiatives, with the business being the main driver.

In our experience, organizations typically want to move their RPA implementations faster than what IT can internally support.

This doesn’t mean that IT doesn’t play a role. IT needs to definitely understand the technology and what the business is trying to do with it. IT will need, at minimum, to provide robots and their operators with administrative access to systems and ensure effective security controls are in place. In addition, they will ultimately be integral in the ongoing support of the RPA environment.

How would you describe the role of your IT Department in your RPA initiatives?

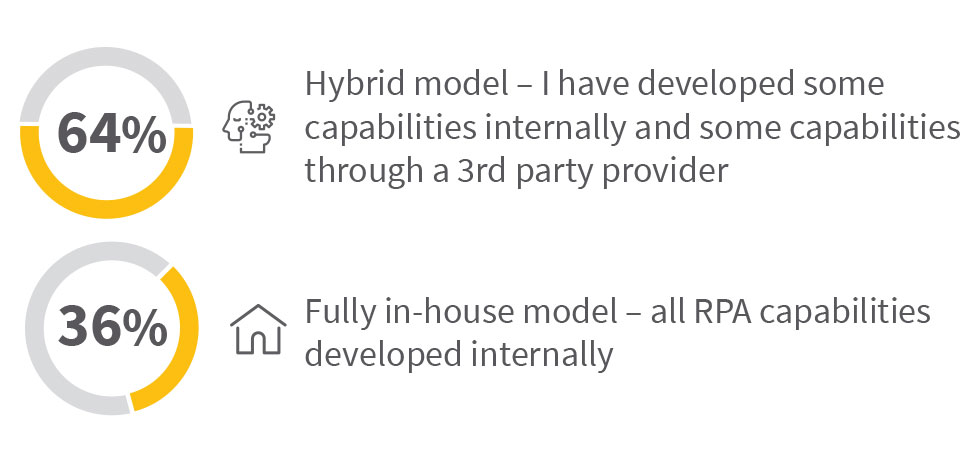

Leveraging Third Party Support

According to the survey, 70% of respondents leveraged a 3rd party to get started, and 64% continues using external support as part of their ongoing operating model, opting for a “hybrid” model.

The business should understand that IT should not be a roadblock to the initiative and that there are multiple options out there (like Auxis) to obtain the required capabilities in a more flexible and timely manner.

At the early stage that most companies are in today, deciding whether you need to establish and retain your RPA capabilities in-house is secondary to getting the robots intro production, and a majority of organizations are choosing to get their expertise from third parties rather than building it internally.

Which of the following best describes the deployment model you are using for implementing RPA?

Main Implementation Challenges

When surveyed organizations were asked what were the most difficult steps during their RPA journey, the biggest challenges have occurred after organizations have implemented RPA rather than in the early stages of evaluation or technology selection.

The following steps in the RPA journey were considered to be more difficult than expected:

The top cited challenges were “redefining roles and redistributing workload” and “quantifying the benefits achieved”, which were considered to be more difficult than expected by 40% and 38% of the respondents respectively.

Getting employees on board with Robotics Process Automation was not reported as a major obstacle (23%). Other early steps in the journey such as understanding capabilities (16%) and evaluating vendor solutions (19%) were found to be less challenging.

Many times we have seen how organizations get caught up in the technology conversation and tend to overlook the organizational realignment and change management aspect. As shown in the survey results, these operational challenges are more difficult to overcome and therefore deserve a higher focus.

The RPA journey can be challenging, but the road will become less “bumpy” the more you work with it. The benefits are there but you will need to find your path.

Want More Real-World Trends and Statistics?

Download our Full Report!

We hope you’ve enjoyed reading through this summary of our report and that you can take back some actionable insights for your automation initiatives.

To get access to the full survey report containing more detailed statistics and insights, you can download your free copy here: 2018 Auxis RPA Survey Report.