With 62% of CFOs planning to make significant SG&A cuts this year as a result of the coronavirus crisis, it’s important to take a step back and assess “how lean is too lean?”

According to extensive research performed by Gartner, CFOs adopting aggressive short-term and unsustainable cost-cutting measures during the pandemic risk missing the opportunity to fundamentally reshape their competitive standing over the long-term. This means that organizations need to be smart and cautious about protecting the long-term investments that will drive future profitability.

These “long-term investments” apply to every area of the organization, from Information Technology to Marketing and Supply Chain. However, one of the areas that is often neglected during times of cost-containment is the back office, and more specifically, the Finance back office. But the reality is that in today’s world, the role of the Finance Department has evolved from a cost center, “gatekeeper” type function to a key enabler of business growth through real-time reporting and a forward-looking mentality.

However, not every Finance Department has yet transformed into this higher-value function, and these difficult times could be the turning point for traditional, dated finance organizations to make the change.

As part of this transformation in times of intense cost-cutting needs, every CFO should be asking themselves three key questions:

- How do I Streamline Operations and Remove Inefficiencies to Get the Work Done Faster and with Less People?

- How do I Establish Real-Time Reporting and Analytics to Increase Visibility of a Remote Workforce While Enabling Faster, More Frequent Decision-Making?

- How do I Become More Agile and Flexible to Quickly Scale Up or Down as the Business Evolves?

In the search for responses to these key necessities, Auxis recently facilitated a virtual CFO webinar with the CFO Leadership Council (you can watch the recap here), and gathered some interesting insights from the polling questions answered live by the CFO audience:

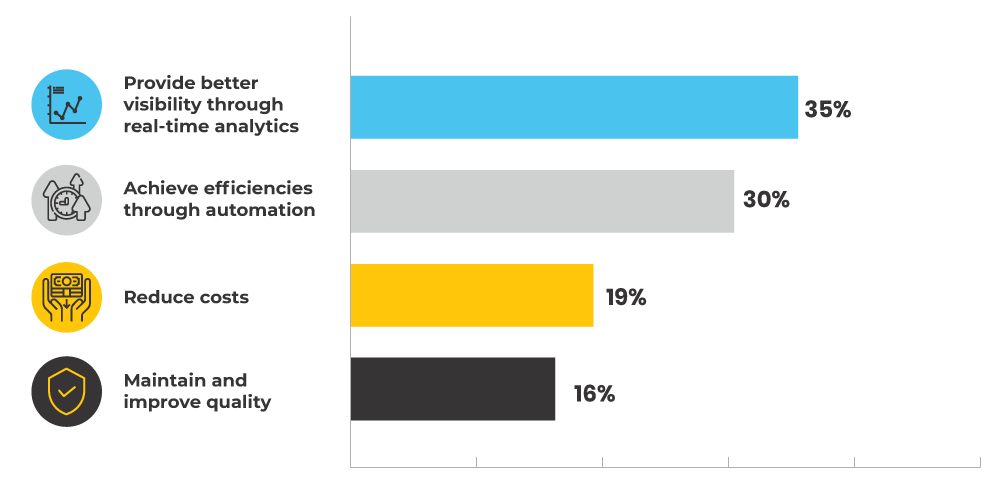

Reducing costs is important, but the need to provide real-time analytics to the business is even greater

When asked for the biggest priority when it comes to running their finance operations, the top urgency for CFOs is to provide better visibility through real-time analytics (35%), followed by the need to achieve efficiencies through automation (30%). Though cost reduction seems to be top of mind as a response to the pandemic, it was only selected as the number one priority for 19% of the CFOs.

What is your biggest priority right now when it comes to running your finance operations?

In reality, these priorities are not mutually exclusive, and in order for Finance Departments to get better at analytics, they will need to first get away from being a transactional processing shop by either automating or outsourcing the bulk of the manual activities they’re still performing. Until finance organizations solve that fundamental problem, it will be hard to make analytics a focus area for their teams.

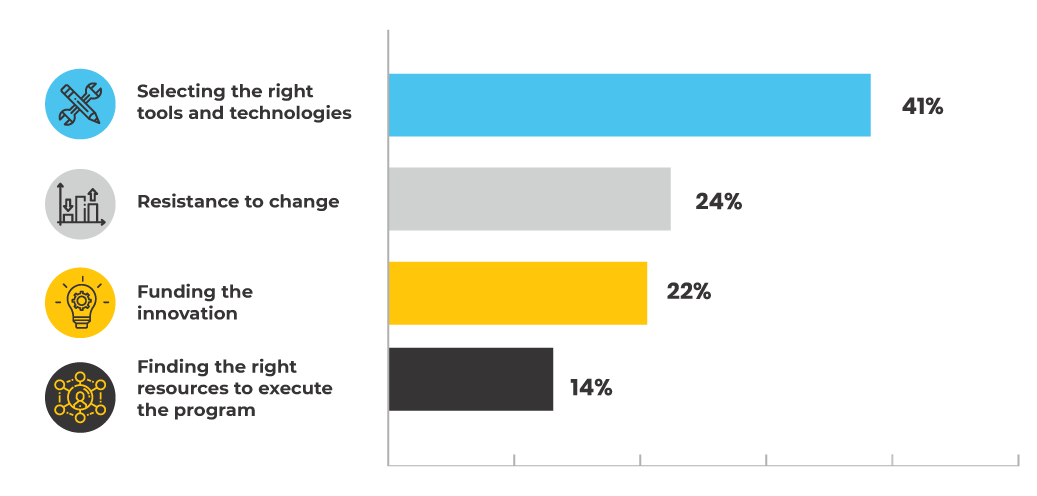

The ability to select the right tools and technologies is holding back the digital transformation programs of many organizations

While 85% of finance organizations are in the midst of a finance transformation initiative, 70% of them still fail according to Gartner. The reasons behind the high percentage of failure include a combination of unrealistic expectations, a lack of skilled resources, and limited organizational adoption.

When asked for the primary challenge that is impacting their ability to achieve their digital transformation outcomes, CFOs attending the webinar reported: “selecting the right tools and technologies” (41%) as the top issue, followed by “resistance to change” (24%), “funding the innovation” (22%), and “finding the right resources” (14%).

The proliferation of all kinds of technologies and finance automation software (e.g. RPA, workflow, AP solutions, content management, AI, Machine Learning, Financial Close Management tools, etc.) has created significant confusion among Finance Departments as to which tools are the right solutions for their organization and why. On the surface, many of these tools seem to do the same thing (e.g. AP automation), but the reality is that there could be huge differences in capabilities, implementation effort and ongoing cost to operate.

Because of this growing complexity of the finance automation space, partnering with a 3rd party expert that can quickly help you identify your gaps and select the best solution for you shortcuts your automation journey and ensures that you are going in the right direction. Ideally, this partner can also help you with the design and implementation of the technology and future-state processes, and in some cases even with the ongoing maintenance and support of the solution.

What is the primary challenge that is impacting your ability to achieve your digital transformation outcomes?

Finance Outsourcing as a tool to reduce costs and improve flexibility is growing in acceptance

The global BPO market size was valued at $221.5B in 2019 and is expected to reach $405.6B by 2027 (at an 8% CAGR) according to a recent BPO Market Analysis Report from Grand View Research. Finance & Accounting represents roughly 15% of the BPO market and is growing at the same pace.

However, many organizations, especially those in the midmarket space, were still reluctant to consider the use of outsourcing within their Finance function for multiple reasons. One frequently cited by Finance executives is a fear of losing control. But after COVID-19, CFOs are now realizing that having your accounting staff “down the hall” may no longer be possible in this new “work from home” era, and many of the objections against outsourcing are starting to fade…

When CFOS were asked their perspective about outsourcing in our recent webinar, 54% of them reported that they were open to considering outsourcing as a tool to reduce costs and improve the flexibility of their finance operation, while another 24% was already outsourcing or actively looking to outsource.

Are you planning to increase your use of outsourcing as a tool to reduce costs and improve flexibility in your finance back office operations?

For organizations that are looking to run lean and agile without sacrificing their digital transformation investments, outsourcing can represent a great alternative. Typical labor savings of outsourcing can range from 30% to 50% (under a nearshore model), allowing companies to “self-fund” the innovation while also improving business continuity and the ability to quickly scale up or down as the business evolves. In addition, your outsourcing partner should be able to do the “heavy lifting” on the process automation efforts for the functions that they’re taking over, reducing the burden of your internal team so they can focus on the transformation of the functions that are core to your business.

Doing nothing is not an option

Keeping the status quo is no longer an option for organizations that want to survive and thrive in this new era. But when it comes to how to execute the transformation, there’s not a “one size fits all” solution. In the end, each Finance organization is dealing with its own challenges and priorities, and as such, will need to define its unique path to modernization.

If you would like to discuss how Auxis can help you assess your current capabilities in your finance department and provide real-world recommendations to achieve a high performance operation, you can schedule your consultation here.

.png)