In recent years, Auxis’ business process outsourcing business has grown 2 times faster than our competitors’. Here’s why.

The business process outsourcing (BPO) industry was on track to grow 19% between 2019 and 2023 as organizations look for new ways to solve the talent and productivity challenges they have been experiencing (Deloitte 2019-2023 Outsourcing and Shared Services report).

But here’s a little secret: Auxis’ BPO services averaged more than 40% business growth year-over-year during the same period.

Why are clients turning more and more to Auxis’ type of outsourcing model? What differentiates Auxis from other BPO service providers?

There are three main reasons clients generally cite as to why Auxis stands out from other top business outsourcing companies:

- The detailed, consultative approach we take in custom-designing BPO solutions for our clients, built on decades of experience as advisors and implementers of shared services operations for global businesses.

- The nearshore platform we pioneered as a complement/alternative to Asia-based operations, based on 25+ years operating in the Latin American market.

- The flexibility and cultural fit of our talent, based on our “extension of your team” mentality.

Building customized, optimized BPO solutions

Outsourcing demand is surging amid ongoing labor shortages, greater comfort with remote work models, and a need to ensure stability and productivity in business operations.

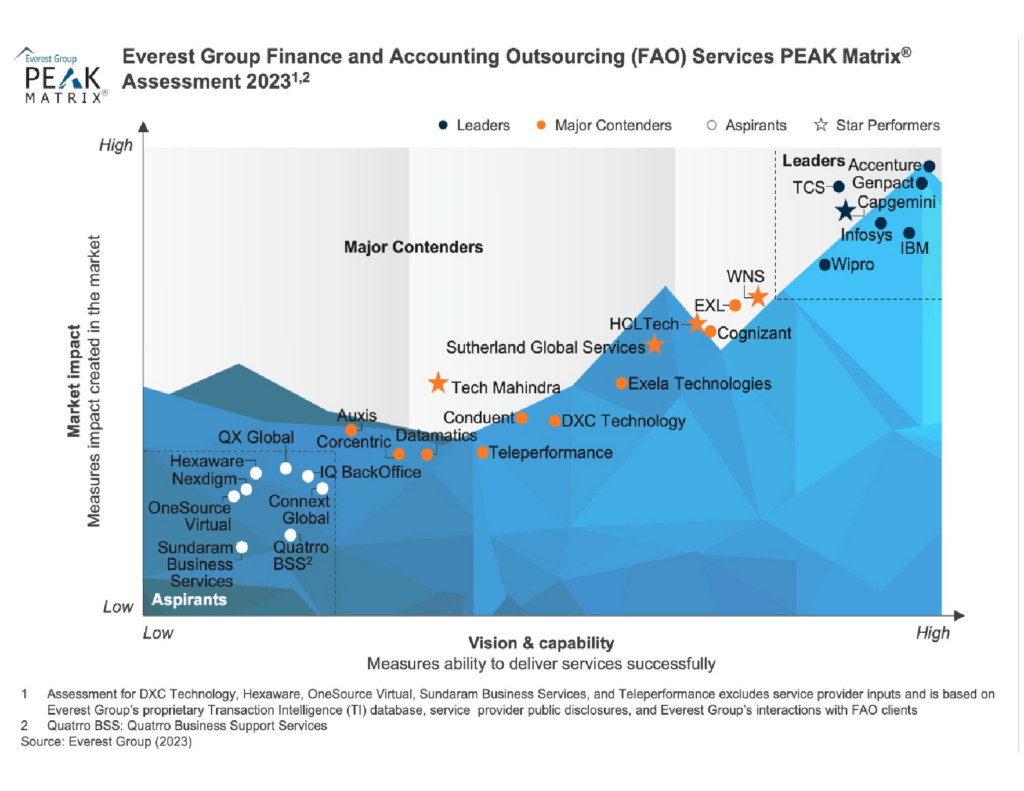

Everest Group PEAK Matrix® for Finance & Accounting Outsourcing (FAO) Services 2024 Assessment

However, a high-level shift is happening in outsourcing. While 55% of outsourcing deals are still traditional (driven by cheaper labor and economies of scale), a growing 25% are next-gen solutions that drive digital transformation – delivering value beyond labor arbitrage by offering strategic BPO partnerships focused on innovation, customer experiences, and business outcomes (KPMG The Future of Outsourcing).

What we have seen is that Auxis customers are attracted to our tech-enabled, two-staged business process outsourcing delivery approach:

- Immediate labor cost savings typically range from 25-50%, depending upon the roles outsourced and the markets in which they are currently residing.

- A second wave of savings averaging 15-30% from digital transformation after the initial transition and stabilization, gained from operational efficiencies (process redesign, automation, data analytics, and other enabling technologies).

But why does your business need both?

While digital transformation can deliver process efficiencies which ultimately may result in cost savings, it is often not enough to provide the full benefit organizations desire. Digital transformation efforts have helped drive a 20% improvement in enterprise productivity over the past four years, according to American Productivity & Quality Center (APQC) data.

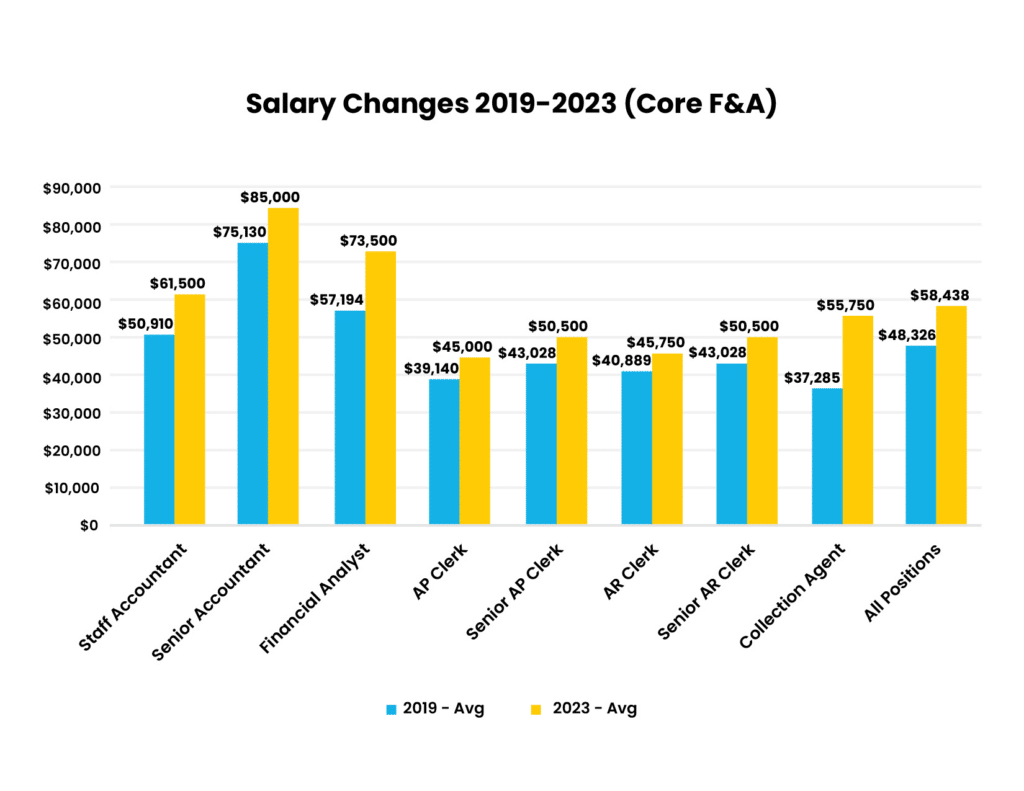

However, during that same period, finance and accounting (F&A) salaries outpaced inflation by an average of 10% across the board – and even with improving macroeconomic conditions, the F&A labor shortage continues to drive up salaries.

According to Robert Half data, salaries for “core” F&A roles jumped almost 21% between 2019 and 2023 – and 31% in larger markets – eating up the cost benefits gained from increased productivity.

And that’s assuming you achieve the hoped-for benefits from your digital initiatives, since nearly 90% of CFOs say they struggle to capture value from their technology investments (PwC What’s Important to CFOs in 2024?).

Here’s what to expect from strategic, tech-enabled business process outsourcing companies like Auxis:

- Auxis customizes outsourcing solutions for our clients’ current operations, while cataloguing opportunities for improvement and optimization.

- Working with the client to create a process improvement roadmap, we align on priorities, timing, and potential benefits.

- Using a “lift and tweak” approach, we capture current processes and make subtle revisions in organizational structure, roles, and activities to bring initial improvements and cost savings without making major changes to the operation.

- After completing a stabilization period to ensure a strong operation, we begin executing the agreed-upon process improvement roadmap, delivering efficiencies and additional cost savings.

Nearshore as a complement/alternative to offshore operations

While the Asia region remains the leading destination for outsourcing, many of the conversations we are having with business executives show that changes are coming. Asian-based outsourcing generally provides a lower-cost model for organizations when compared to nearshore markets, but it comes at a price.

Common concerns expressed by business executives when working with a business process outsourcing company offshore include communication and collaboration challenges caused by time zone differences and hurdles presented by geographic distance.

Talent concerns have emerged as well, as “bottom-of-the-barrel” pricing and overnight shifts needed to align with U.S. business hours leave many providers struggling to attract and retain skilled and experienced resources. This has resulted in inconsistent performance and quality concerns with some Asia-based BPO and knowledge process outsourcing operations.

Cost benefits attained from the Asia model have also been diluted as offshore providers were forced to pay 10%+ salary increases in 2023 to combat high attrition (WTW’s 2023 Salary Budget Planning report), which is passed through to their customers.

As a result, many business executives are seeking alternative markets for outsourcing their operations, either as a complement to an already-established Asia footprint or, in some cases, in lieu of offshore locations. The European market presents its own set of concerns, given recent geo-political uncertainty.

This has led to an increased interest in the Latin American region for outsourcing.

Latin America offers a strong base of business and technology talent, augmented by enhanced physical and telecommunications infrastructure and the benefits of time zone and cultural overlap with North America. There are many statistics available to highlight the strength of the Latin American region, but here is one that stands out: the talent gap between Latin America and India is widening.

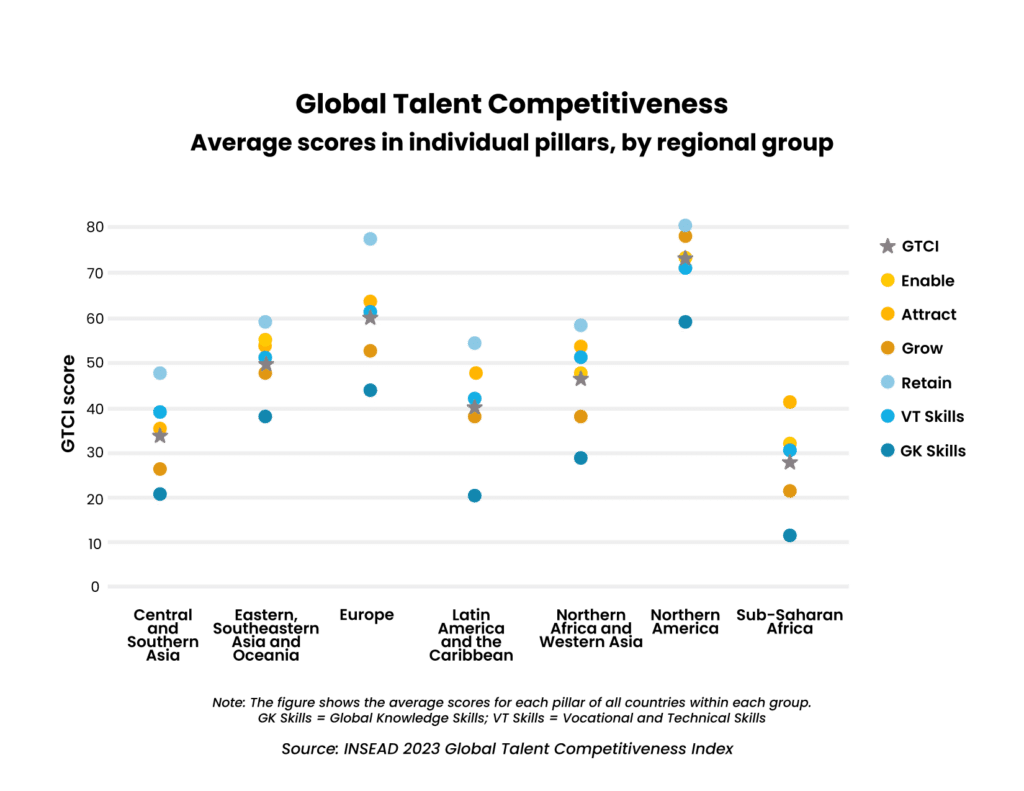

India’s talent competitiveness has decreased every year since 2020 on the World Economic Forum-endorsed Global Talent Competitiveness Index, as growing difficulty attracting talent creates an increased skills mismatch for employers. India ranks 103rd globally on the 2023 report, while top nearshore markets like Costa Rica, Colombia, and Mexico score significantly higher at 47, 72, and 74, respectively.

The chart below illustrates how Latin America’s talent competitiveness outpaces Central and Southern Asia in every area:

Pioneering the nearshore outsourcing model

Auxis was founded more than 25 years ago as a firm that was expert in helping companies establish and optimize business operations in Latin America. Not all nearshore locations are created equal though, and three countries stand out with sufficient size, talent, and infrastructure to meet the criteria of “true nearshore destinations:” Costa Rica, Colombia, and Mexico.

Costa Rica and Mexico currently rank among the 10 most preferred shared services destinations globally (Deloitte 2023 Global Shared Services & Outsourcing Survey). Colombia has emerged as a leader on the Offshore BPO Confidence Index and Kearney’s Global Services Location Index.

All three markets are home to hundreds of multinational companies, providing a pool of talent specifically experienced at working with U.S. operations, work schedules, regulatory requirements, etc.

Auxis launched our first service center in Costa Rica in 2010, becoming one of the most robust nearshore outsourcing companies in the region when we expanded into Colombia in 2021. By the end of 2024, we will add operations in Mexico – capitalizing on the strengths of LATAM’s top markets for our customers.

We are true “nearshore pioneers,” having built our business in the region well before many other companies recognized the talent, cost, and operational benefits available there.

Auxis is firmly entrenched as an established brand and “employer of choice” in these markets. This allows us to attract and retain the best talent available, and our operational expertise and innovation-driven approach provides the best use of this talent for our clients and the best opportunities for our employees.

An “extension of your team” approach

One of the complaints many companies have regarding outsourcing is the inflexibility of their business “partners.” Note the word “partner” in quotation marks. The real complaint is the partnership stops once the sales cycle is over and the operations commence.

Many BPO providers want to establish a “cookie cutter” approach, bending your processes to their operational model and drawing lines around what they will and won’t do within the defined scope.

Consider this recent example provided by a client:

The company manufactured highly engineered control devices and customer orders required very specific instructions on design specifications. Often, orders required follow-up discussions with customers, suppliers, and internal departments to ensure proper configuration.

The company’s outsourcing partner, one of the largest Asian-based firms, would only process orders that were easily configurable and did not require follow-up discussions. Everything else was forwarded to the client as a process exception.

According to the outsourcer, the defined scope in the contract did not include outreach to customers or suppliers, therefore refusing to engage with them.

What was the real reason for the outsourcer’s unwillingness to perform this extra step? Since the provider brought on a team of very junior resources with limited English after “low-balling” its pricing, its team simply did not have the necessary skills to perform the job.

As a result, the client was forced to retain most of its original order processing team to ensure timeliness and accuracy. Not only did the client not achieve its expected labor arbitrage savings, outsourcing ended up costing more as the client had an in-house team AND an outsourced team handling the work!

While this is an extreme case, there are many examples clients have cited where outsourcing firms attempt to cram them into a box and limit the scope of work.

But as we all know, operations do not fit well inside a box. Operations are dynamic and things come at you fast and furious, and teams need to respond, react, and employ judgment to handle situations.

Auxis’ BPO approach is different:

- We build an organization based on your business requirements and functional scope, layering various experience levels with a span of control that has proven to work for similar-sized organizations. This approach ensures the team structure has the depth of knowledge, specialized services, and experience required to support assigned tasks.

- We break down silos before they are built. We do not operate in a “black box” – instead, constant communication and interaction is the norm. Our team is available to clients as if they’re down the hall, directly engaging with team members as a true “extension of your team.”

- Tasks that “pop up” are performed by our team as required. We understand operational exceptions and variances are not always identified and included in process flows and service catalogs.

Why Auxis BPO Services?

Clients have told us they select Auxis over bigger firms because they appreciate our operational depth and innovative mindset. We are “process people,” meaning we understand business processes and how to break them down. We can identify operational gaps and roadblocks, and provide practical, “real-world” solutions.

And we do it “in the room.” We have been told our sales meetings are more like workshops, partnering together to design an approach and flush it out. We help our clients visualize the outcome and feel comfortable.

We are also willing to start smaller and prove ourselves, rather than setting limits on the size of the deal. Combine these factors with our access to top-tier talent from our well-established nearshore platform, and we have become the provider of choice for many organizations seeking an alternative to an Asia-based model.

Clients have also told us they select Auxis over smaller (read: cheaper) firms because they appreciate our sophistication, accompanying our digital transformation expertise and detailed operational knowledge. They are willing to pay more for a solution that presents less risk, more capabilities, and a broader spectrum of functions we can support.

You don’t have to just take our word for it. Auxis has been recognized as one of the world’s top outsourcing companies since 2015 on the International Association of Outsourcing Professionals’ (IAOP) Global Outsourcing 100 list – considered the definitive guide for evaluating service providers and advisors. We earned honors once again as an “All Star” company in 2024, receiving top scores across every judging category. To view the Global Outsourcing 100, click here.

Auxis was also named a Major Contender on the 2023 Everest Group Finance & Accounting Outsourcing (FAO) Services PEAK Matrix Assessment – the #1 source for evaluating finance and accounting outsourcing companies. We stand out as the only true nearshore player on the list – and the only firm to achieve Major Contender status the first time it appeared in the matrix, according to Everest Group. For a complimentary copy of Everest’s 2023 FAO PEAK Matrix Assessment, click here.

I have been preaching the same message for the past 15 years: A top-quality nearshore BPO company provides an effective solution for helping enterprises acquire the talent and skills needed to improve their operational performance and refocus their internal teams on core business activities. At the same time, nearshoring companies solve many operational challenges that come with offshore outsourcing models.

In recent years, it appears that message has traveled through time and space and been heard!

Want to learn more about Auxis business process outsourcing services? Schedule a consultation with our BPO experts today! Or visit our resource center for BPO tips, strategies, and success stories.