The ability of finance leaders and their teams to act with flexibility, agility, and innovation has never been more important than it is today.

Whether working virtually or navigating unprecedented business challenges, post-COVID Finance & Accounting (F&A) Departments require more than an aptitude for crunching numbers from their staff. And organizations still face stiff competition for the best talent; in February, the financial activities sector reported an unemployment rate of 3.7% – significantly less than the overall unemployment rate of 6.2%, according to the U.S. Bureau of Labor Statistics.

Understanding the latest F&A talent trends helps CFOs think strategically about the future of the finance function. It helps them move past their traditional “scorekeeping” role to build a Modern Finance Organization, capable of crafting insight-driven strategies that deliver the sustainable competitive edge the business is demanding.

Using data from the 2021 Robert Half Accounting & Finance Salary Guide, here are the top 10 talent trends in finance and accounting that are emerging after COVID:

1. Remote work is now the norm.

The pandemic proved that remote teams could deliver exceptional work – and CFO magazine predicts the future of finance is “irrevocably altered.”

The data-intensive nature of finance and increasing use of technology to digitize and automate processes renders physical location irrelevant for many F&A functions.

Bolstered by Work-From-Home (WFH) success, Robert Half found that 74% of F&A staff wants to continue working remotely at least three days a week once offices reopen. And after pandemic lockdowns, a whopping 1 in 2 workers say they won’t return to jobs that don’t offer remote work.

In line with these new expectations, Gartner reports that 90% of HR leaders plan to allow employees to work remotely at least part of the time, even after the COVID-19 vaccine is widely adopted.

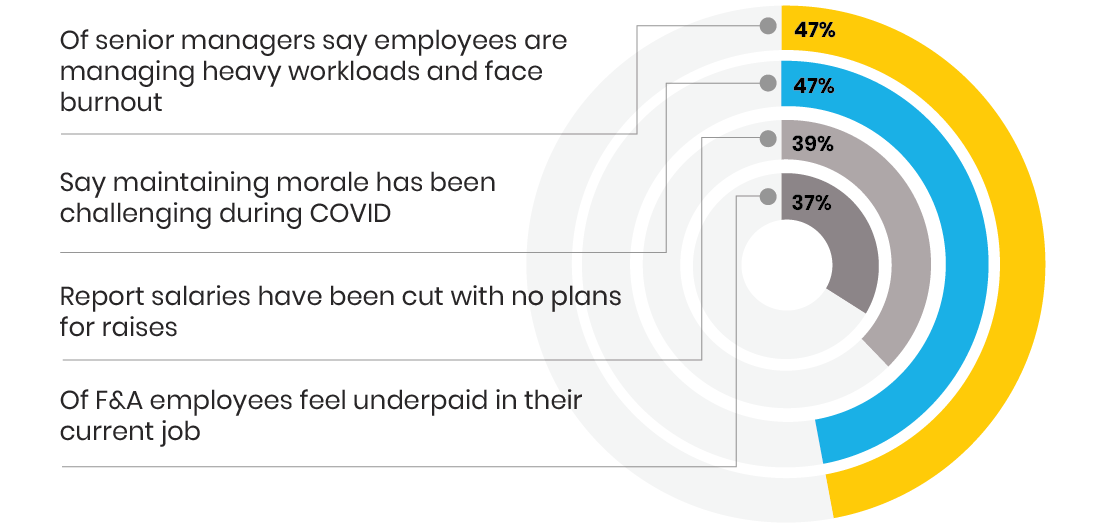

2. Retaining valued employees a top concern.

As F&A Departments help companies regain their footing after the chaos of COVID-19, retaining valued employees is a top-of-mind concern. More than 8 in 10 F&A managers worry about employee retention in the current market, according to the Robert Half report.

For departments operating at lean staffing levels, even the loss of a single team member could spell serious trouble. Robert Half’s report shows real cause for concern:

Turnover of key talent is costly. Companies spend an average of nearly $16,000 to replace a single accounting clerk and more than $20,000 to replace a senior accountant, according to Parker + Lynch.

Of course, that’s assuming you can find quality talent to hire. Before the pandemic, more than 90% of North American CFOs struggled to find qualified staff to fill transactional jobs that U.S. workers consider beneath them. Often, companies wound up significantly overpaying for low-value work – a trend that’s expected to continue as the economy settles.

F&A turnover also hurts productivity at a time when speed is essential for success. It takes an average of 1-2 years for new hires to match their predecessor’s productivity, Parker + Lynch reports. Problems take longer to solve as new employees learn the company culture as well.

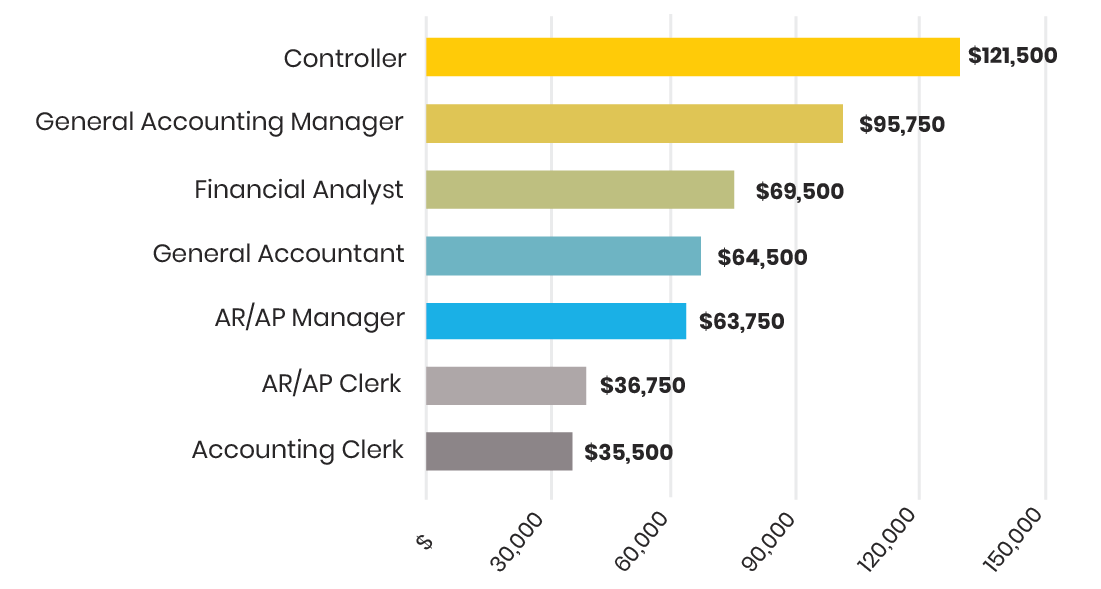

3. F&A salaries expected to stay steady.

COVID cost-containment strategies prompted many industries to slash salaries. But permanent wage cuts aren’t sustainable in F&A Departments that hope to retain their top performers.

While there may be slightly more talent in the labor pool for now, in-demand or hard-to-fill F&A positions can still command substantial compensation.

Robert Half expects F&A salaries to remain stable in 2021. Here’s a look at average midpoint starting salaries for key F&A hires in the U.S. with average experience, not including bonuses, benefits, and other forms of compensation:

Of course, factors like cost of living and availability of talent will cause salaries to vary by market. Employers should bump these numbers more than 40% in markets such as San Francisco and New York City, but can decrease them by 11% in Boise, Idaho.

Use the Robert Half Salary Calculator to uncover average starting salaries in your area.

4. The hottest F&A roles.

Despite the economic downturn, hiring competition remains fierce for many F&A roles. As just some examples, LinkedIn ranks loan and mortgage experts as the second most in-demand positions nationwide in 2021, and Accounting Today reported a 10% increase last August alone in online job postings for accountants and auditors.

Finance Benchmarks: Prophecy or Pretense?

Although employment is still slightly down from pre-pandemic levels overall, it is expected to grow 10% by 2026 for financial occupations overall, introducing more than 773,800 new jobs to the marketplace.

Robert Half lists the most in-demand F&A positions heading into 2021:

- Accounting Manager

- AR/AP Roles

- Controller

- Financial Analyst

- Internal Auditor

- Loan Administrator

- Payroll Manager

- Staff and Senior Accountants

The reasons behind the high demand are easy to decipher, as Robert Half explains. Companies are recognizing that attracting and keeping capable accountants, analysts and auditors is critical in helping them regain their footing. These roles can help stabilize a business’ balance sheet by finding inefficiencies and making accurate forecasts.

CPAs, risk analysts, and internal auditors can play a vital role in helping companies improve cash flow and navigate an uncertain future. Payroll staff ensures employees are paid on time and new regulatory guidelines are met.

5. Industries with exploding F&A talent needs.

Despite pandemic uncertainties, Robert Half reports that many industries are ramping up recruitment of F&A talent in 2021:

- Government F&A departments are scaling up quickly to address unprecedented financial aid packages, new tax strategies to address revenue shortfalls, and booming public infrastructure projects.

- Trucking, shipping, and logistics companies are scrambling to keep up with increasing e-commerce demand.

- While many public accounting firms furloughed staff at the height of the pandemic, they face rising demand from clients trying to navigate unpredictable cashflows, changing compliance requirements, and consumer assistance programs.

- Financial services firms – including banking, lending, and investment institutions – are hiring employees skilled at helping clients secure credit and reorganize liabilities. Low mortgage rates triggered an increase in loan originations and refinance activity. Staff is also needed to help borrowers with mortgage and loan modifications, as well as specialists in risk, compliance, audit, fraud, and forensics.

- Healthcare companies are experiencing a surge in billing, reconciliations, and new payment processes as patients reschedule non-emergency procedures and routine care canceled during COVID.

- Construction firms are undergoing growth prompted by fast-growing cities and infrastructure projects funded before and after the pandemic.

- Non-profit organizations require F&A talent as communities rally to help individuals and businesses in need.

In addition to these industries, any role that involve improving cash flow – billing, AR and collections – remain strong and a top recruiting priority for many organizations.

6. Soaring demand for tech-savvy talent.

COVID challenges brought new urgency to the need for finance organizations to accelerate digital transformation efforts like automation, machine learning, cloud computing, and predictive analytics. Gartner reports that 67% of finance leaders believe their department must become “significantly more digitalized” to build resiliency, scalability, and cost efficiencies into critical business processes.

Gartner also reports that finance leaders consider 89% of accounting activities highly automatable – and nearly 75% plan to use Robotic Process Automation (RPA) to tackle their top priorities this year. But a third of CFOs also worry that digital investments will be wasted because their organizations lack the skills and competencies to fully leverage technology and automation.

Addressing the digital finance skills gap through upskilling and recruitment is a top CFO priority in 2021. Finance leaders are revising job competencies and desired skillsets – looking beyond traditional accounting skills for knowledge and proficiency in data science, automation, cloud-based systems, digital communication tools, business management, operations, and more.

In this new era, F&A Departments need talent who can draw actionable insights from financial data, analyzing it in different ways and applying it to a broader business context. Demand for expertise in predictive modeling and scenario planning is especially high, as well as experience identifying and managing risk.

New hires must also be tech-savvy enough to learn new systems with minimal or no in-person training.

7. Soft skills needed to manage unprecedented change.

As Finance teams adjust to the scale and urgency of change in the post-pandemic economy, finding talent with critical soft skills can be just as important as technical expertise.

For instance, F&A staff must be equipped to operate remotely, innovate, and adapt to the fast-changing business environment. Strong critical-thinking and collaboration skills become vitally important for virtual teams. And challenging times call for managers who are empathetic, supportive, approachable, and reassuring.

As new ways of business become the norm, forward-thinking F&A organizations are prioritizing soft skills in their talent strategies. Robert Half lists these critical soft skills for F&A talent in 2021:

- The Ability to Work Independently in Virtual Teams

- Attention to Detail

- Comfortable with Change

- Commitment to Continual Learning

- Creativity and Innovation

- Customer Service Capabilities

- Problem-solving

- Writing and Verbal Skills

8. Reinventing the workplace through better leadership, communication and collaboration

The global pandemic changed the way we work virtually overnight. Resilient Finance organizations are seizing the opportunity to learn from COVID challenges and emerge stronger than ever before.

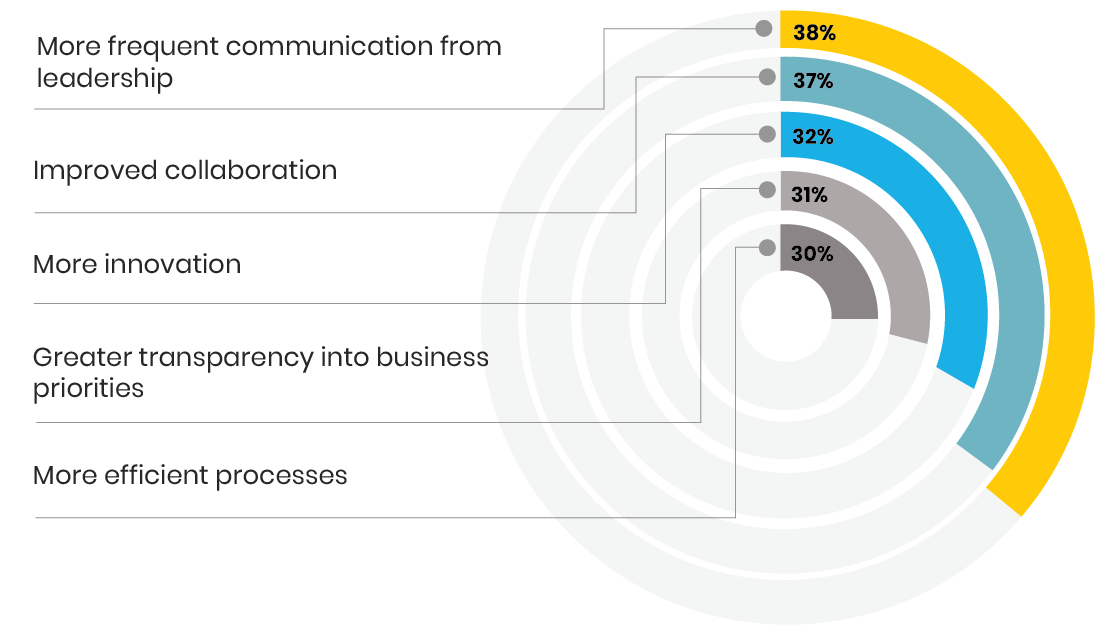

Robert Half shows how the chaos of 2020 is changing some Finance organizations for the better. Instead of returning to old ways of doing business, progressive Finance leaders are re-engaging with their workforce and reinventing their workplace in the following ways:

9. Companies offer pricey perks to compete for F&A talent.

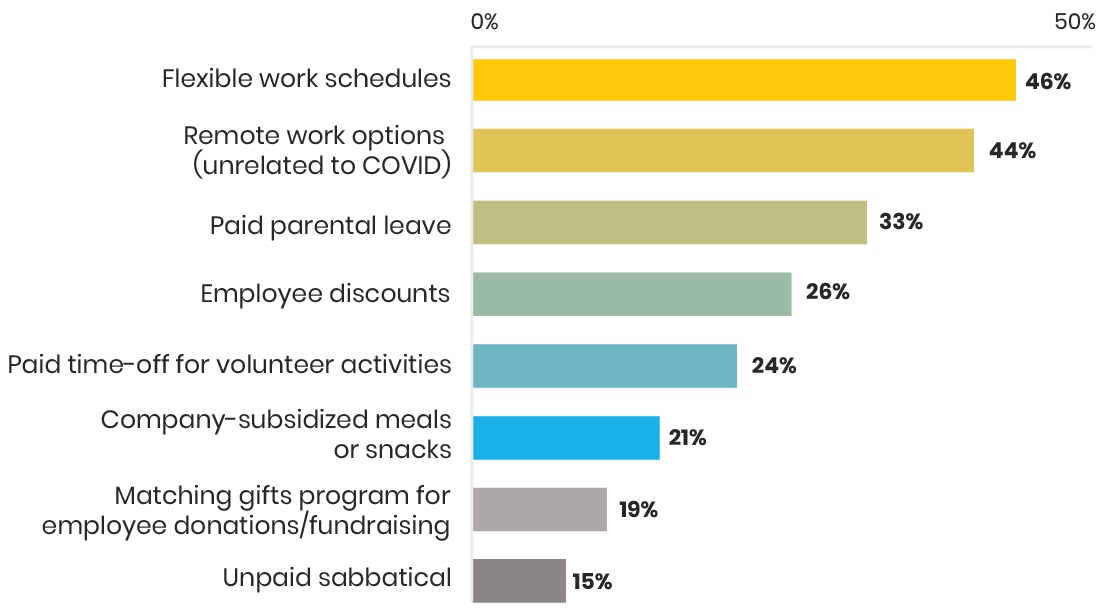

After a tough 2020, F&A talent are demanding workplace benefits and perks that promote flexibility and wellness in the coming year. COVID made work-life balance an even more critical component of employment – and potential and current employees are considering companies on a holistic scale.

It’s a trend organizations can’t ignore if they want to retain or attract top talent: 52% of workers say they would leave their current jobs for one with the “right” benefits.

Here are the perks F&A talent values most in 2021, according to Robert Half:

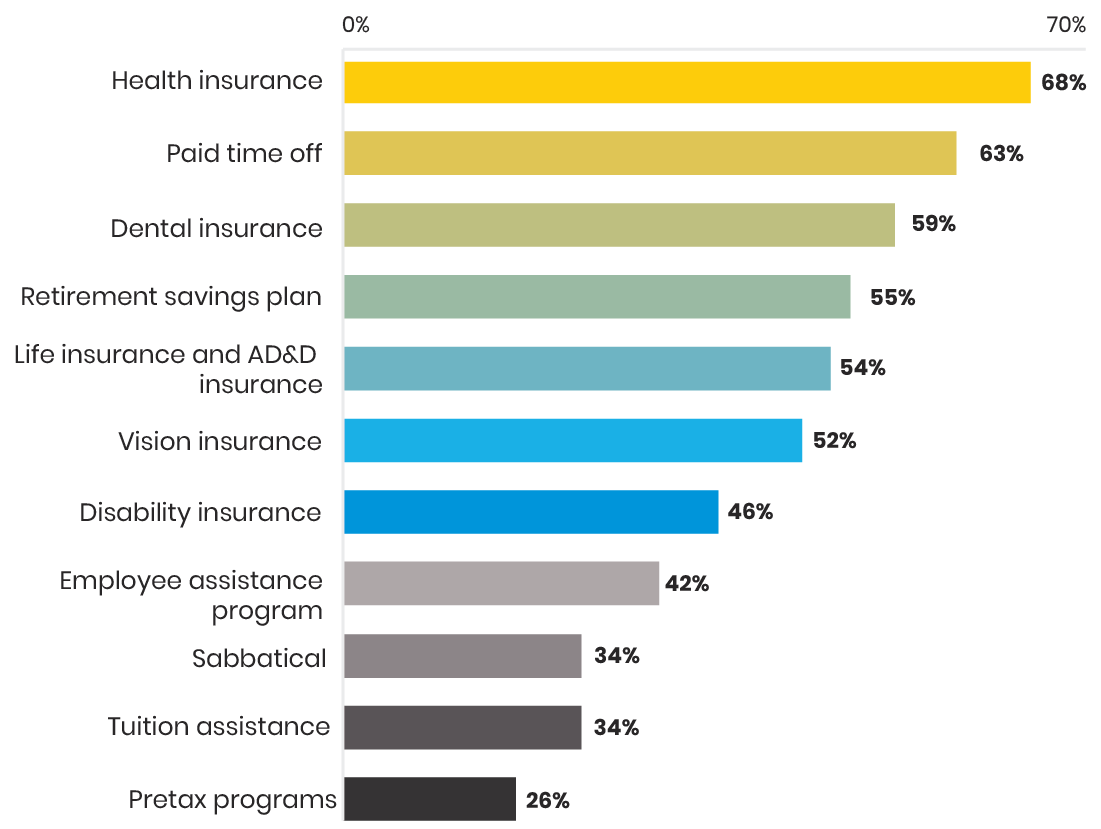

Here are the most-valued benefits:

10. Flexible staffing and outsourcing build resiliency in post-pandemic economy.

In the post-pandemic economy, Finance teams face tremendous pressure to transform into strategic partners for their companies. Executives teams want F&A organizations that can provide clarity amidst uncertainty with real-time data and facts, and help them thoroughly consider the short and long-term consequences of strategic decisions.

But F&A Departments that laid off staff during COVID lack the resources to meet more than routine business needs. To make sure they can still accomplish all of their goals, organizations are increasingly turning to flexible staffing, interim professionals and BPO outsourcing. Some of the functions where CFOs are leveraging these more flexible models include accounts receivable, collections, accounts payable, and special projects demanding a rapid response.

Here are the top reasons F&A organizations are turning to flexible staffing solutions this year, according to Robert Half:

COVID-19 unleased a tsunami wave of change on the business world – and 2021 is a great time for CFOs to re-evaluate their current F&A Organization. More than ever, Finance leaders should feel encouraged to look for opportunities to streamline existing operations – as well as the potential to move certain functions to reputable BPO providers that operate in the same U.S. time zone from proven nearshore countries like Costa Rica.