In brief:

- Traditional Asia-based outsourcing models generally offer the lowest pricing, but Latin America’s labor arbitrage is not far behind – and brings greater value that translates into extra savings.

- As organizations seek solutions that can optimize cost and performance, top nearshore locations in Latin America like Costa Rica, Colombia, and Mexico are becoming the strategic destination of choice for North America.

- Productivity gains from nearshoring can increase savings by 10-20% or more, with tech adoption rates at Latin America shared services organizations averaging higher than other regions.

Ask any company why they choose to outsource their operations, and a key reason will likely be to gain outsourcing cost savings. It’s no secret that labor costs are less when talent outside the U.S. is utilized due to lower wages supported by a lower overall cost of living.

But what exactly are you getting in return when you achieve cost savings? And are there costs below the surface that chip away at the savings you expect?

Traditional Asia-based outsourcing models generally offer cheap labor, but this bottom-of-the-barrel price tag brings challenges along with it such as faraway time zones, cultural and language barriers, high turnover, and less success in delivering more complex work. Many executives are rethinking outsourcing to the other side of the world – looking beyond the lowest cost to achieve the highest efficiency and performance.

In fact, “spend optimization” dropped to third place on the list of top outsourcing drivers on Deloitte’s Global Outsourcing Survey 2024, trailing “access to talent” and “increasing customer demands.” Only 34% of enterprises ranked cost reduction as a primary factor, down from 70% in 2020.

A growing number of enterprises are also diversifying their outsourcing locations to mitigate risk, expanding into top markets closer to home where highly skilled talent with strong English proficiency, cultural affinity, and proven remote work models are readily available.

In a market overview, Everest Group predicts finance and accounting outsourcing demand in Latin America will surge by 17% through 2026, as demand shifts from pure transactional support to strategic outsourcing partnerships. And Tholons’ 2025 Top 10 GCC/GBS Trends Report predicts 50% of companies will have adopted a hybrid sourcing model by 2026 that includes nearshoring, driven by the need for greater agility and resilience.

Nearshore vs. Offshore: Navigating the Hidden Hassles of Outsourcing to Asia

Businesses can still achieve significant cost savings through nearshoring – and its value is increased by inherent advantages, highly skilled talent, and robust digital capabilities that drive productivity gains and successful delivery of more judgment-intensive processes.

A new global labor market report by Shared Services & Outsourcing Network (SSON) Research & Analytics and Auxis, “2024 State of the GBS and Outsourcing Industry in Latin America,” delves into the key reasons why more companies are looking to nearshore locations like Costa Rica, Colombia, and Mexico for their outsourcing needs as opposed to India and the Philippines.

Using that data, we explore the real value of nearshoring in terms of what is gained, not just what is spent.

What labor arbitrage can you expect?

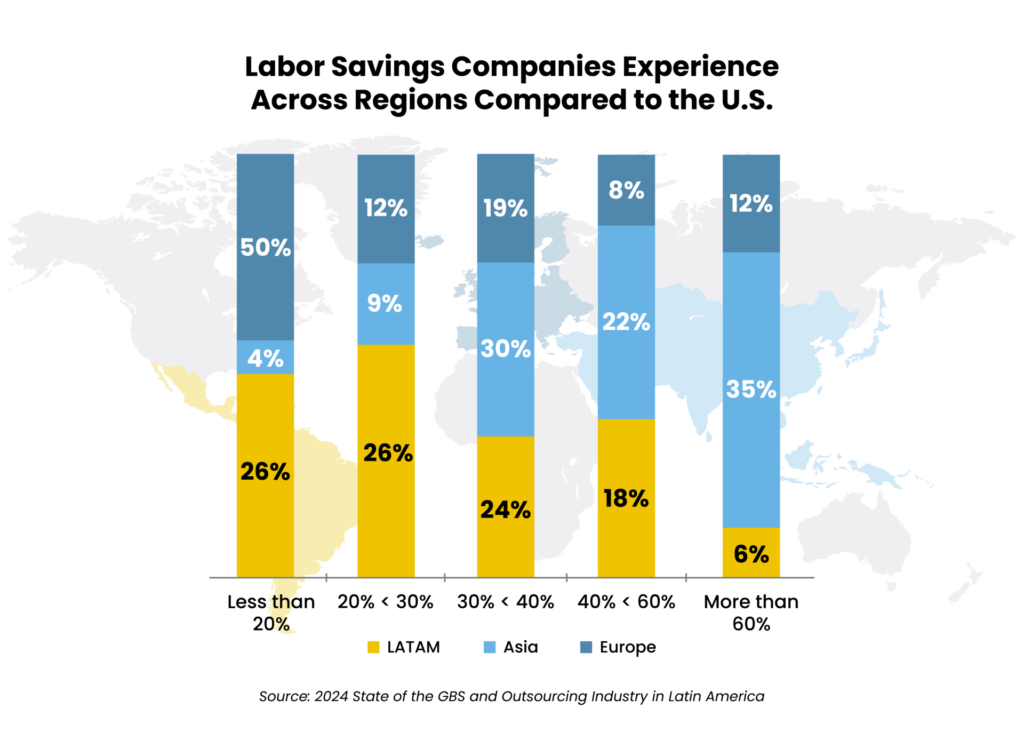

Latin America provides significant cost savings relative to North America. While labor arbitrage varies by country (Colombia will typically yield higher cost savings than Costa Rica, for example), organizations realize an average labor arbitrage cost saving of 30-50% from nearshoring, compared to hiring employees in the U.S. (See “Labor arbitrage in action” below.)

But here’s the thing: While Asia-based models in India and the Philippines tend to fall at the top of this savings range or even higher, companies are realizing a bigger bang for their buck in Latin America.

There’s more to outsourcing cost savings than labor arbitrage: the overall savings opportunity is a combination of labor savings plus efficiencies that come from automation, process improvements, and best practices. This is where Latin America beats Asia – yielding an additional 10-20% or more of savings.

As organizations seek solutions that can optimize cost and performance, top nearshore locations in Latin America like Costa Rica, Colombia, and Mexico are becoming the strategic destinations of choice for North America.

In fact, physical proximity ranks as the #1 factor for choosing an outsourcing provider on the 2023 IT Outsourcing Statistics report by Computer Economics – even if lower labor costs could be realized in a more distant location.

Latin America’s proximity to North America means reduced travel time/expenses and real-time communication, thanks to shared or similar time zones. This adds to cost savings by reducing the need for overnight shifts or significant schedule adjustments that increase turnover and decrease performance in Asia-based locations.

Nearshoring offers a wealth of well-educated professionals, particularly in the tech and business sectors, who deliver high-quality work at significantly lower rates compared to the U.S. and Europe – and not much higher than Asia. And while Asia’s solutions that are solely based on global labor arbitrage practices require cookie-cutter, volume-driven models for success, nearshoring drives greater value with the flexibility to tailor services to a company’s unique business needs.

While Asian locations rank highest for financial attractiveness on Kearney’s “2023 Global Services Location Index,” the labor arbitrage from nearshoring is not far behind. For example, Colombia’s financial attractiveness score is only about a tenth of a point different from the Philippines.

India’s business process outsourcing (BPO) industry has also been chipping away at the labor arbitrage outsourcing delivers there. The median salary increase in India is forecast to rise by 9.5% in 2025, on top of a 9.5% increase in 2024, to combat turnover that’s alarming high compared to other Indian industries, states WTW’s latest Salary Budget Planning Report.

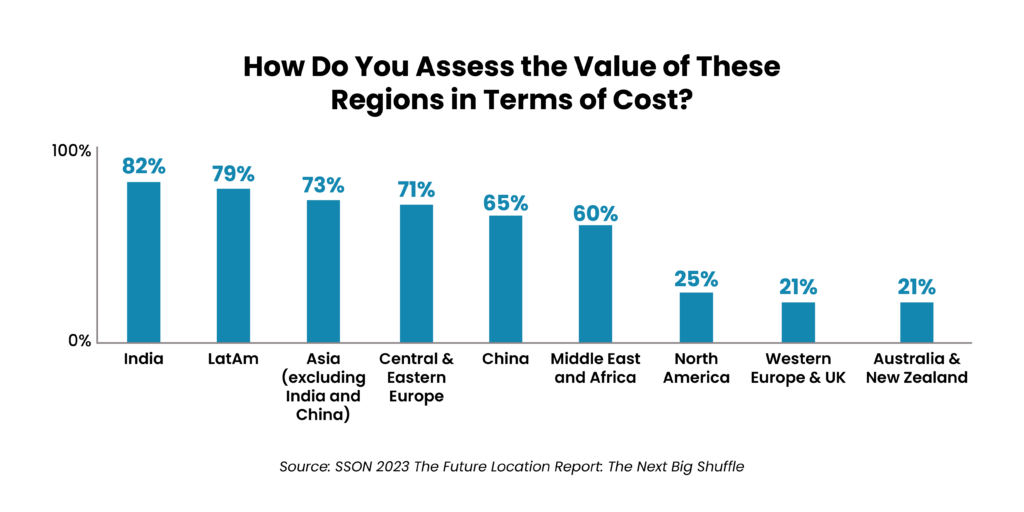

In SSON’s “2023 The Future Location Report,” shared services leaders assessed the value provided by Latin American markets as very similar to India – and ahead of other Asian locations like the Philippines.

Labor arbitrage in action

To illustrate the actual amount of cost savings achieved through labor arbitrage between Latin America and the U.S., consider the following chart:

The roles of AP Clerk and AR Clerk, for example, command a salary that is approximately 50% higher in the U.S. than in Colombia. Even for a higher paying tech role, like Senior Network Engineer, the cost savings between Latin America and the U.S. is still significant, at just over 36%. The amount of labor arbitrage achieved for these six common roles is anywhere from $24,220 to $62,270.

LATAM’s labor cost arbitrage is significant. But there’s more to the story.

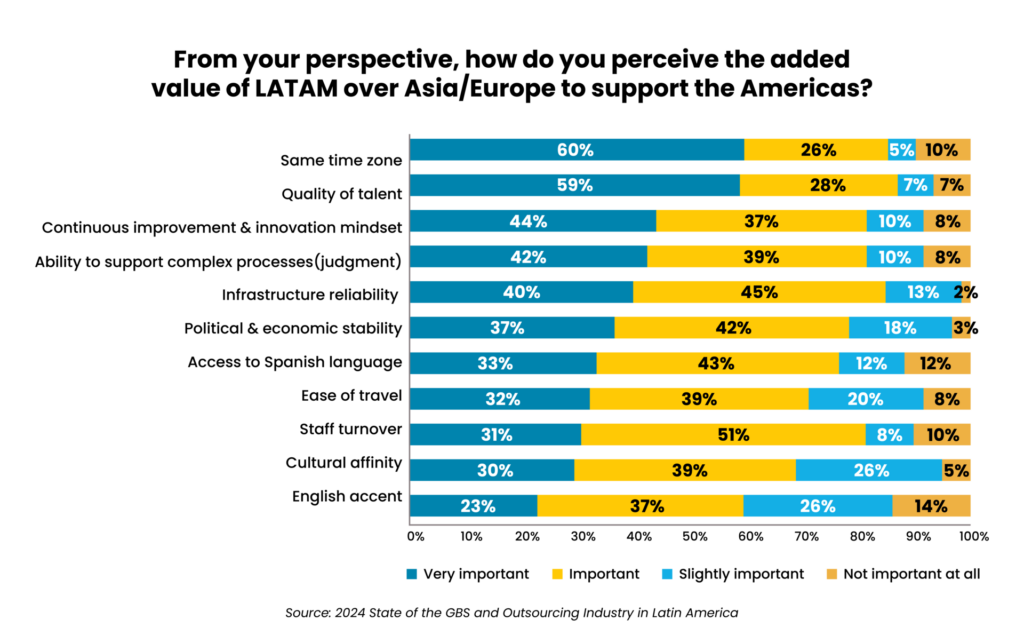

LATAM offers a real ability to lower costs without sacrificing quality. In the SSON/Auxis survey, companies already operating in the region deemed multiple factors as “important” or “very important” to Latin America’s value over Asia and Europe, with at least 60% prioritizing each category.

Three out of the top five factors on the “very important” list speak to the high quality of LATAM’s talent – and all of them contribute to greater productivity and performance.

Consider this example: One of our clients, a major healthcare provider, outsourced some transactional, back-office functions to Asia. But its leadership team was concerned that this solution lacked the right skillsets, geographic proximity, communication, and cultural alignment to successfully deliver a more advanced, judgment-intensive tier of key healthcare provider services.

The bottom-of-the-barrel pricing and overnight shifts needed to align with U.S. business hours in India makes it difficult to attract higher-level resources who can support complex healthcare processes. The organization was also struggling with traditional offshore challenges, including language, cultural, and time zone barriers.

By leveraging Auxis’ nearshore platform to tap into a top Latin American market with a highly educated population, the client was able to access the critical-thinking skills, outstanding English proficiency, and real-time communication needed to deliver complex, time-sensitive processes without constant support from its internal teams. With operations in both India and Latin America, this client found that the productivity of 1 LATAM team member was equal to 1.4 FTEs in India.

The takeaway: Nearshore salaries may start slightly higher than some Asia-based locations, but the total cost savings of nearshoring to Latin America can be lower once you consider its additional value – as well as Asia’s hidden costs like greater travel expenses, lower productivity, issues with quality control, and high turnover.

Productivity gains increase the cost benefits of nearshoring to Latin America

In today’s macroeconomic climate, business leaders face intense pressure to boost productivity while streamlining operations and reducing costs. In addition to labor arbitrage, nearshoring’s focus on driving strategic efficiencies through automation, process improvement, and best practices delivers additional average savings of 10-20% and sometimes more – depending on how much room for improvement and automation existed before the outsourcer took over.

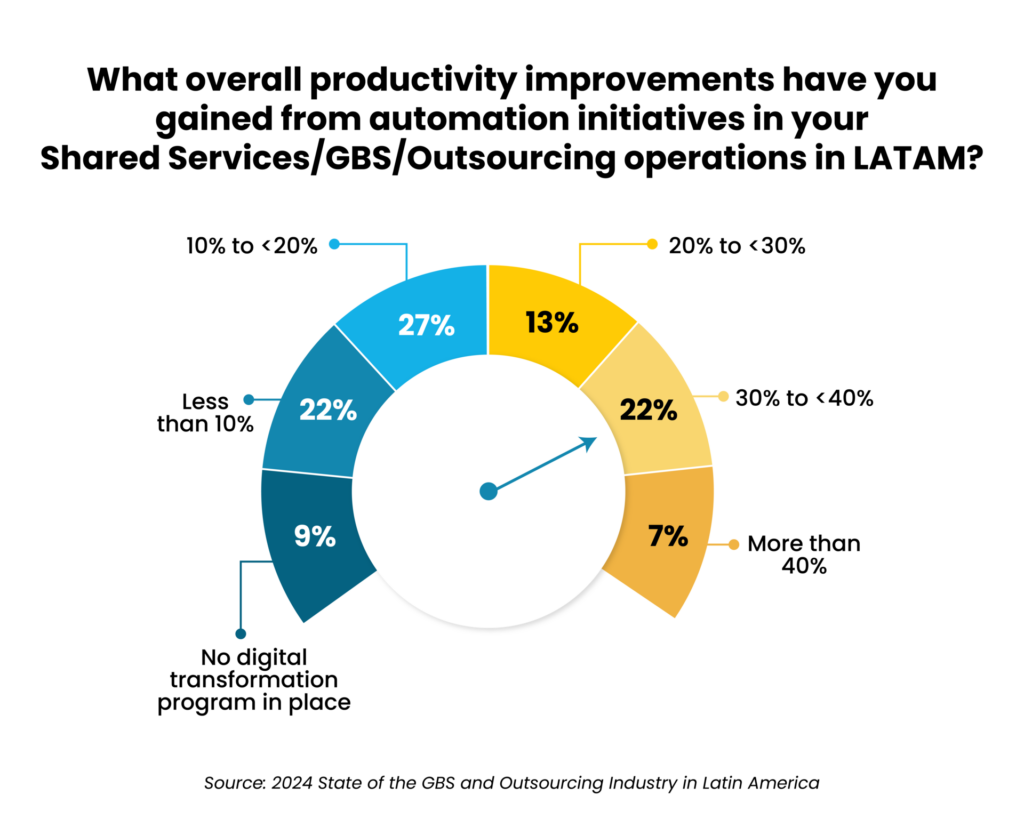

When asked about productivity improvements from automation in the SSON/Auxis survey, 69% of respondents report gains of more than 10% from LATAM shared services organizations (SSOs), and 42% report improvements of 20%-plus.

It’s also interesting to note that tech adoption rates at LATAM SSOs for critical technology like automation averages 9% higher than other regions on the SSON/Auxis survey. LATAM’s ability to offer plenty of talent, accelerate digital transformation, and drive continuous improvement, productivity, and operational efficiency provides a compelling value proposition for nearshoring.

Why Auxis: Maximize the value of Latin America with the nearshore leader

Cost optimization remains a top priority in the C-suite as macroeconomic uncertainty continues and hiring challenges in critical areas like IT, customer service, HR, and finance and accounting raise salaries in the U.S. – outpacing savings gained by productivity tools like automation. But as business leaders confront today’s challenges, outsourcing models solely focused on labor arbitrage no longer provide enough value.

By leveraging the strategic advantages inherent to the proximity, capabilities, and favorable economic conditions of the top outsourcing markets in Latin America, Auxis’ nearshore platform delivers substantial cost savings while solving the challenges that complicate offshoring to Asia. In addition, Auxis helps clients use their cost savings to accelerate digital transformation that drives additional cost optimization and value.

As a nearshore pioneer recognized as a leader in Latin America shared services by top research firms and industry associations like Everest Group, ISG, and IAOP, Auxis offers its clients a cost-effective alternative to traditional outsourcing models, while maintaining high service standards and mitigating risks associated with distant offshore operations.

Want to learn more about the benefits of shared services consulting and nearshore outsourcing solutions? Schedule a consultation with our nearshore experts today! Or, visit our resource center to learn more nearshoring trends, strategies, and success stories.