In brief:

- Maintaining cash flow has become an even greater priority for CFOs as late payments increase, credit is more expensive, and companies brace for economic unknowns.

- Many accounts receivable (AR) and accounts payable (AP) departments are running behind as companies grapple with invoice complexity, fraud, and resource issues.

- Learn 6 strategies to improve working capital that focus on optimizing AR and AP, including determining adequate staffing, implementing process best practices, and leveraging advanced technology.

Improving cash flow is a top priority for CFOs navigating today’s economic uncertainty. Companies are looking for ways to optimize their financial positions and deploy working capital efficiently to maintain organizational resilience, investments, and growth.

Fears of an imminent recession may have faded somewhat, but these efforts still face significant challenges as inflation headwinds persist, some sectors struggle, and many organizations grapple with limited resources, overly complex invoicing processes, and accounting backlogs.

Improving the efficiency of accounts receivable (AR) and accounts payable (AP) functions is the foundation of ensuring steady cash flow. Read on to learn about common financial management hurdles and six strategies for working capital optimization that focus on improving AR and AP.

The state of payments and cash flow challenges

CFOs and other company leaders are all too familiar with the cash flow problems caused by inefficient AR and AP.

A lagging accounts receivable department risks a company entering a cash crunch when bills come due. This, in turn, may require an organization to realize high debt costs to cover gaps or delay the payment of its bills, straining vendor relationships and contributing to a cycle of delayed payments and potential defaults.

One estimate citing Tally Street research states, “27.5% of companies that receive late payments pay their suppliers late too.”

A “Payment Practices Barometer” survey conducted by insurance provider Atradius found that U.S. companies experienced an upward trend in late payments and bad debts in 2023, with 55% of all B2B invoiced sales overdue. Atradius cited customer liquidity issues as a primary driver for late payments, partially reflecting a high interest rate environment.

However, other influences have less to do with macroeconomic factors. Many AR departments are inefficient, overburdened, and running behind.

A 2023 survey by Versapay and Wakefield Research revealed that 77% of accounts receivable (AR) teams are behind on collections. Nearly 37% are weeks or months behind, and 2.33% reported they “will never fully catch up.”

A lagging accounts payable process may seem like a better problem to have than slow AR, but it also creates significant issues. Inefficient AP makes it difficult for businesses to establish good relationships with vendors, accurately determine their cash position, make projections for managing liquidity, and predict whether there is enough cash on hand to meet financial obligations.

The bright side of some of these challenges is that there is something companies can do about them—and many have plans to do just that. The American Productivity & Quality Center (APQC)’s “Finance in Focus” report revealed that 55% of organizations focused on “finance function process improvement” in 2023, while 52% cited “cash flow management” as a top priority.

Finance Transformation Trends: Why Hybrid & Nearshoring Are The New Normal

6 strategies for improving working capital

Here are six working capital improvement techniques to help get AP and AR functions on track and achieve working capital optimization.

1. ‘Right-size’ AR and AP staffing

A CFO Dive report cites missing information on invoices and fraudulent digital invoices as factors that cause AR departments to fall behind. However, a primary driver is the high number of invoices processed by AR departments, many of which have limited resources to handle them.

About 10% of teams process 10,000 invoices or more in a given month, while 28% process between 2,500 and 10,000.

It’s vital to have the right number of personnel in collections and AR departments based on the active number of customers and billing schedules. Many organizations have a poor ratio of staff to active customers, and that’s why they are behind—no matter how much automation or other process efficiencies they bring on board.

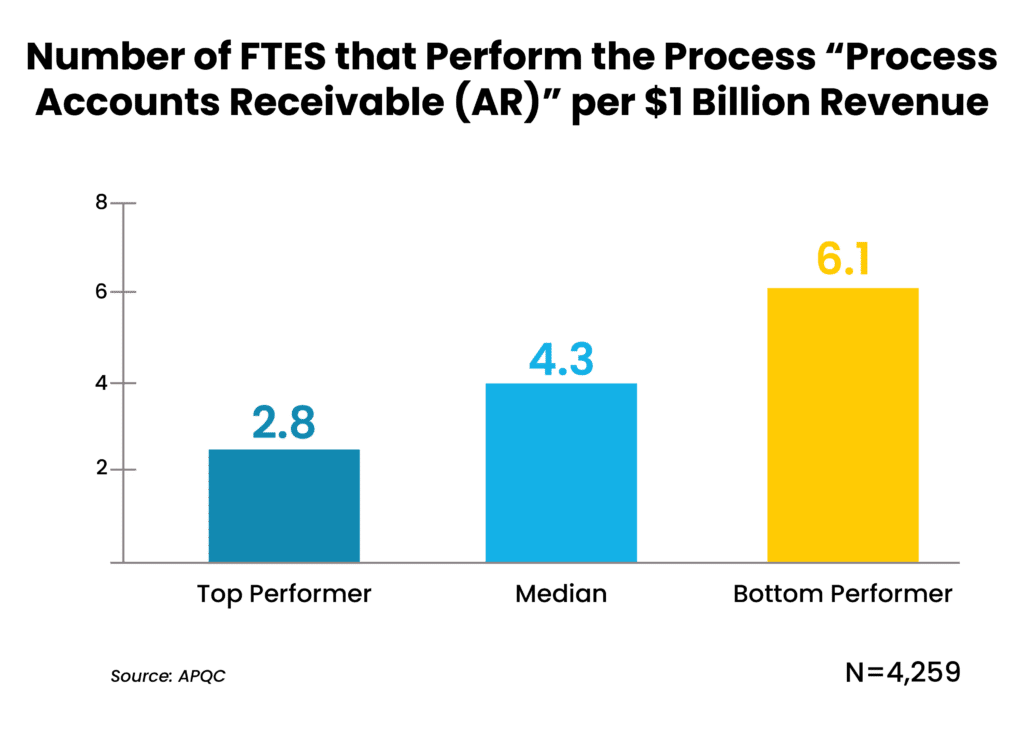

Right-sizing AR departments varies by the industry, the complexity of billing, and the performance of individuals and departments. However, a good cross-industry benchmark comes from APQC’s “Finance in Focus” report. The median number of full-time equivalents (FTEs) representing an employee’s workload is 4.3 FTEs per billion dollars in revenue.

The same holds true for accounts payable; short-staffed teams wind up with a large backlog of invoices, often leading to nasty surprises. A lack of visibility into pending invoices means finance teams can’t accurately predict their cash position and how much they need on hand to pay expenses, and expenses aren’t reported in the period they occur.

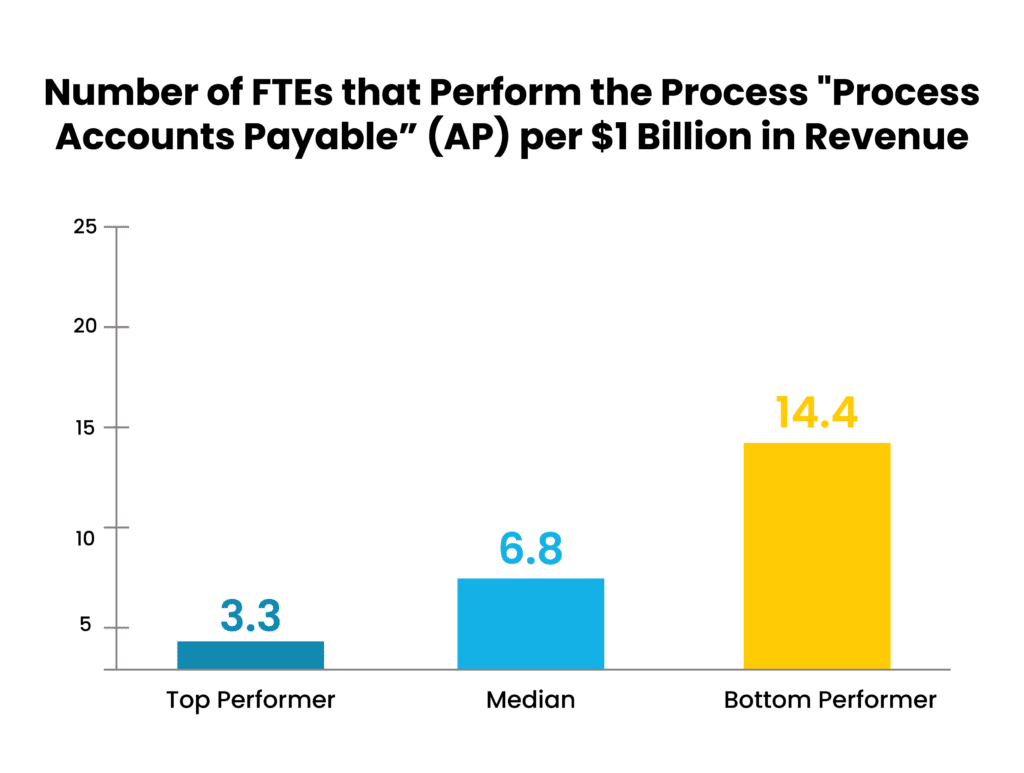

The median number of AP FTEs representing an employee’s workload is 6.8 FTEs per billion dollars in revenue – although once again those numbers can increase or decrease dramatically based on performance and invoice volumes across industries.

2. Invoice promptly to reduce Days Sales Outstanding

Deemed the top metric for evaluating AR performance, Days Sales Outstanding (DSO) tracks how quickly customers pay their bills. This key performance indicator (KPI) is closely linked to cash reserves and liquidity—making it an essential metric to track amid a volatile economy.

After all, the faster a company is paid what it’s owed, the more breathing room it has.

The first step in reducing DSO is to send invoices as soon as the sale is made, the renewal is due, or a contract is signed. Every day that an invoice waits delays payment arrival.

Also, ensure all payment information is accurate and complete to avoid additional holdups and closely track aging invoices to spur customer follow-up. While your business may offer clients 30- to 60-day payment terms, it may need the money sooner to pay bills, order inventory, service debt, or meet other obligations.

One popular solution for speeding up the payment cycle is offering clients early payment discounts. A survey by APQC found that 52% of companies were more likely to provide incentives for early invoice payments last year.

3. Optimize accounts payable strategies

For every lagging AR department, there is often an equally inefficient accounts payable department. A 2023 report by Ardent Partners states that 49% of accounts payable teams still struggle with lengthy invoice cycles, with 47% of executives saying that invoice exceptions routinely gum up the process.

AP must be efficient to accurately assess a company’s cash position and ability to meet its obligations. And late payments can result in direct costs, of course, in addition to the indirect or lagging costs of strained vendor relationships and less favorable payment terms.

Here are some optimization tips for your current liabilities:

- Optimizing AP starts with streamlining processes to avoid late payments that incur fees. Take advantage of electronic payments, replace manual actions with automation where possible, and leverage robust, recurring metrics to catch bottlenecks and drive continuous improvement.

- Review your vendor list to find providers offering duplicate services and focus on the one (or a select few) that generates the most benefit. Then, renegotiate with key partners for better terms or ask for volume discounts—assuming your relationship and standing with them provides this leverage. Many will also agree to a significant discount for paying upfront.

- Set defined days/weeks for payment release to help better manage cash flow. Paying too early can be just as harmful as paying too late if you can’t recover the reduced cash flow; it’s critical to strike a balance between timely payment and adequate reserves.

- Extending the payment cycle of your suppliers is a common way to obtain cheap financing. Instead of simply choosing to pay certain bills past their due date, potentially impacting credit and sullying relationships, try negotiating a slightly revised due date—one on which you are confident you can pay. Some service providers will also allow for annual or semi-annual payments instead of monthly.

4. Increase productivity, cost optimization, and standardization with automation

APQC’s survey states that 81% of organizations are more likely to invest in technology to automate the process for quicker payments to vendors. Companies can also use automation to significantly lower operating costs. This technology helps standardize processes, maximizing productivity by minimizing exceptions that cause delays in sending invoices, following up on them, and making payments.

In addition, automation creates strong internal controls, flagging duplicate payments and fraud that drain cash flow. Teams can automate collection emails, tailoring collection strategies by customer categories. Many of these solutions incorporate artificial intelligence (AI) with robotic process automation (RPA) to accomplish these aims.

Modern accounts receivable tools can use AI to predict the dates when a customer pays, enabling companies to customize collection strategies and forecast cash more accurately. AI can also vastly improve the process of discovering areas in need of improvement.

For example, UiPath’s white paper “Enabling finance-driven digital transformation with AI-powered automation” highlights the use of AI as a continuous discovery tool. Instead of manually identifying bottlenecks and challenges, the technology automatically documents existing workflows, iteratively identifies issues, and highlights the most impactful automation opportunities.

Here’s one case study illustrating the impact of this technology:

A leading beverage company used continuous discovery to uncover automation opportunities across its Order-to-Cash processes. It found high DSO was causing downstream cash flow problems. The company introduced a combination of automation and AI for invoice processing. By doing so, it improved cash flow cycle times by 20% and saved 30,000 annual working hours in one country.

5. Use advanced analytics to keep a close eye on cash

An accurate view of AP and AR functions is essential for understanding their impact on the organization’s financials. So, another vital working capital optimization strategy is to implement advanced analytics and reporting to keep a close eye on metrics like expenses, past-due invoices, aging bills sent to customers, and operating cash flow.

Generating and tracking daily cash reports can help planning immensely, as you’ll see real-time fluctuations that you can use to inform critical decisions.

If your organization is seasonal or cash flow tends to follow another business cycle, you’ll need to save money from the high-revenue months to cover overhead during lower-revenue months. An accurate monthly cash flow forecast reveals potential shortfalls and gives the organization time to seek extra resources if needed.

Advanced analytics work hand-in-hand with automation. Key benefits realized in this reporting relationship include real-time integration of AP data with the organization’s enterprise resource planning system and greater visibility into the company’s current assets, payments, and liabilities.

6. Leverage experts for working capital optimization

Some of the steps mentioned above are fairly straightforward, even if not all of them—like hiring additional qualified staff—are easy. However, other optimization approaches may require specialized experience and help getting started to improve net working capital.

If your company needs assistance with finance transformation, outsourcing specific automation and process implementations can have exceptional ROI. A quality outsourcing provider can be an invaluable partner that helps you optimize working capital, leveraging automation technology and best practices to streamline AP and AR processes.

Fortune 1000 companies across industries have relied on Auxis for more than 25 years for finance transformation success. We offer expert guidance and help keep your business operations running smoothly, so you have time to focus on strategy and growth.

Our nearshoring services provide advanced technology, proven best practices, and skilled finance personnel that can up your game while achieving cost efficiencies vs. entirely in-house implementations.

If you’d like to learn more about AP and AR working capital management and optimization strategies, schedule a consultation today! You can also read more about our accounts receivable, accounts payable, and finance transformation services.